Tesla's Surge Propels 10 ETFs, And Cathie Wood's ARKK Isn't Top Gainer

Tesla's Surge Propels 10 ETFs, And Cathie Wood's ARKK Isn't Top Gainer

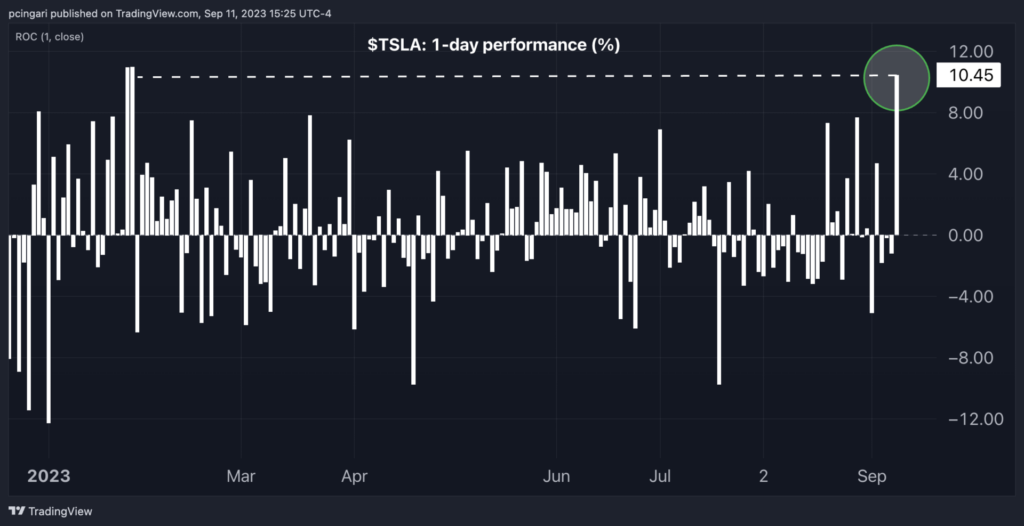

Tesla Inc. (NASDAQ:TSLA) saw its stock soar by over 10% on Monday, marking the largest single-day gain since the close of January 2023.

特斯拉公司(纳斯达克股票代码:TSLA) 周一其股价飙升了10%以上,这是自2023年1月收盘以来的最大单日涨幅。

The price surge increased the EV maker's market cap by $80 billion in just one day. Tesla's valuation hit the $870 billion mark, leaving companies like Warren Buffett's Berkshire Hathaway Inc. (NYSE:BKR) (NYSE:BKR) and Meta Platforms Inc. (NASDAQ:META) in its rearview mirror.

价格飙升使这家电动汽车制造商的市值在短短一天内就增加了800亿美元。特斯拉的估值突破了8,700亿美元大关,这让公司大吃一惊 沃伦·巴菲特的 伯克希尔哈撒韦公司 (纽约证券交易所代码:BKR)(纽约证券交易所代码:BKR)和 元平台公司 (纳斯达克股票代码:META)在后视镜中。

Chart: Tesla Inc Notches One of The Best-Performing Session In 2023

图表:特斯拉公司创下2022年表现最好的交易日之一3

Morgan Stanley Turns Bullish On Tesla

摩根士丹利转为看涨特斯拉

The catalyst: Morgan Stanley's analyst Adam Jonas shifted his stance on Tesla, moving the stock from Equalweight to Overweight. He also hiked the price target from $250 to $400, which is nearly 50% higher than current market prices.

催化剂: 摩根士丹利的分析师亚当·乔纳斯改变了对特斯拉的立场,将该股从同等增持转为增持。他还将目标股价从250美元上调至400美元,比当前市场价格高出近50%。

The reason: Tesla's Dojo supercomputer. Morgan Stanley sees the potential of Dojo adding $500 billion to Tesla's enterprise value. This optimism is rooted in the belief that the supercomputer will expedite adoption rates in mobility, particularly robotaxis, and network services.

原因: 特斯拉的 Dojo 超级计算机。摩根士丹利认为,Dojo有可能为特斯拉的企业价值增加5000亿美元。这种乐观情绪源于这样的信念,即超级计算机将加快出行(尤其是机器人出租车)和网络服务的采用率。

Morgan Stanley emphasized the importance of identifying scalable, high-potential ventures that haven't been fully factored in by the market. The analysts believe Tesla's Dojo fits this bill perfectly.

摩根士丹利强调了识别市场尚未完全考虑的可扩展、高潜力的企业的重要性。分析师认为,特斯拉的Dojo完全符合这一要求。

According to the investment bank, Tesla's groundbreaking supercomputing tech sets new standards. Their custom-designed chip, combined with specialized hardware and software, could offer a sixfold cost reduction per computing power unit, thanks to a highly efficient system.

据该投资银行称,特斯拉开创性的超级计算技术设定了新的标准。得益于高效的系统,他们定制设计的芯片,再加上专门的硬件和软件,可以将每个计算能力单元的成本降低六倍。

Read now: Tesla To Rally Around 61%? Here Are 10 Analyst Forecasts For Monday

立即阅读: 特斯拉将上涨约61%?以下是周一的10位分析师预测

ETFs Soaring On Tesla Rally

特斯拉上涨后,交易所买卖基金飙升

When discussing exchange-traded funds with significant Tesla exposure, many instantly think of Cathie Wood's Ark Innovation ETF (NYSE:ARKK) as the primary Tesla-heavy fund.

在讨论拥有大量特斯拉风险敞口的交易所交易基金时,许多人会立刻想到 凯茜·伍德的方舟创新ETF (纽约证券交易所代码:ARKK)是主要以特斯拉为主的基金。

This perception, however, isn't entirely accurate. While ARKK boasts a notable chunk of its portfolio dedicated to Tesla – being Wood's premier investment – there are ETFs out there with an even heftier Tesla allocation.

但是,这种看法并不完全准确。尽管ARKK的投资组合中有很大一部分专门用于特斯拉——这是伍德的主要投资——但也有一些ETF的特斯拉配置更大。

Leading the pack with the most significant daily gain is The Meet Kevin Pricing Power ETF (NYSE:PP), which surged by 3.2% on Monday. This fund dedicates roughly a quarter of its assets to Tesla.

以最显著的每日增益名列前茅的是 Meet Kevin 定价能力 ETF 纽约证券交易所代码:PP),周一上涨3.2%。该基金将其大约四分之一的资产用于特斯拉。

Hot on its heels is the Consumer Discretionary Select Sector SPDR Fund (NYSE:XLY). With an 18.6% Tesla stake, it witnessed a 2.8% daily uptick.

紧随其后的是 非必需消费品精选行业SPDR基金 (纽约证券交易所代码:XLY)。它持有特斯拉18.6%的股份,每日上涨2.8%。

The Vanguard Consumer Discretionary ETF (NYSE:VCR) clinched the third spot, registering a 2.3% daily ascent.

这个 先锋非必需消费品 ETF 纽约证券交易所代码:VCR)夺得第三名,每日上涨2.3%。

Interestingly, Wood's other offering, the ARK Autonomous Technology & Robotics ETF (NYSE:ARKQ), found itself in the seventh position. It climbed 2.1% for the day, powered by its 13% Tesla allocation.

有趣的是,伍德的另一个产品, ARK 自主技术与机器人 ETF 纽约证券交易所代码:ARKQ)发现自己排在第七位。在特斯拉13%的配置的推动下,它当天上涨了2.1%。

Factoring in the Tesla shares sprinkled across both ARKK and ARKQ, these funds' market valuation swelled by $100 million in just one day.

考虑到分布在ARKK和ARKQ上的特斯拉股票,这些基金的市场估值在短短一天内就飙升了1亿美元。

Table: Tesla-Heavy Exchange Traded Funds

表:以特斯拉为主的交易所交易基金

| ETF Name | ETF Ticker | Fund Style | Fund Focus | Weight% | Shares Held | Market Value |

|---|---|---|---|---|---|---|

| Tidal ETF Trust II – The Meet Kevin Pricing Power ETF | PP | Strategy | Theme | 25.81% | 40,077 | $11.0M |

| The Select Sector SPDR Trust – The Consumer Discretionary | XLY | Sector | Consumer Discretio... | 18.58% | 13,444,761 | $3,683.2M |

| Vanguard World Fund – Vanguard Consumer Discretionary | VCR | Sector | Consumer Discretio... | 15.06% | 3,288,595 | $900.9M |

| ProShares Trust – ProShares Ultra Consumer Discretionary | (NYSE:UCC) | Sector | Consumer Discretio... | 14.71% | 9,722 | $2.7M |

| Fidelity Covington Trust – Fidelity MSCI Consumer Discretionary Index ETF | (NYSE:FDIS) | Sector | Consumer Discretio... | 14.61% | 722,735 | $198.0M |

| Direxion Shares ETF Trust – Direxion Daily Consumer Discretionary ETF | (NYSE:WANT) | Sector | Consumer Discretio... | 13.57% | 19,258 | $5.3M |

| ARK ETF Trust – ARK Autonomous Technology & Robotics ETF | ARKQ | Strategy | Theme | 13.29% | 562,808 | $154.2M |

| Simplify Exchange Traded Funds – Simplify Volt Robocar Disruption And Tech ETF | (NYSE:VCAR) | Strategy | Theme | 11.56% | 1,898 | $0.5M |

| iShares Trust – iShares Global Consumer Discretionary ETF | (NYSE:RXI) | Sector | Consumer Discretio... | 10.82% | 144,369 | $39.6M |

| ARK ETF Trust – ARK Innovation ETF | ARKK | Strategy | Theme | 10.52% | 3,278,033 | $898.3M |

| First Trust Exchange-Traded Fund – First Trust NASDAQ Clean Edge Green Energy Index Fund | (NYSE:QCLN) | Strategy | Theme | 10.31% | 550,514 | $150.9M |

| Tidal ETF Trust – SoFi Social 50 ETF | SFYF | Size and Style | Large Cap | 10.21% | 6,368 | $1.7M |

| ETF 名称 | 交易所买卖基金股票代码 | 基金风格 | 基金焦点 | 重量% | 持有的股份 | 市场价值 |

|---|---|---|---|---|---|---|

| Tidal ETF Trust II — Meet Kevin Pricing | PP | 策略 | 主题 | 25.81% | 40,077 | 110 万美元 |

| 精选行业SPDR信托基金——消费者自由裁量权 | XLY | 行业 | 消费者自由裁量权 | 18.58% | 13,444,761 | 36.832 亿美元 |

| Vanguard 世界基金 — Vanguard 非必 | 录像机 | 行业 | 消费者自由裁量权 | 15.06% | 3,288,595 | 9.009 亿美元 |

| ProShares Trust — ProShares 超级非必需消费品 | (纽约证券交易所代码:UCC) | 行业 | 消费者自由裁量权 | 14.71% | 9,722 | 270 万美元 |

| 富达卡温顿信托基金-富达摩根士丹利资本国际公司非必需消费品指数ETF | (纽约证券交易所代码:FDIS) | 行业 | 消费者自由裁量权 | 14.61% | 722,735 | 1.980 亿美元 |

| Direxion Shares ETF Trust — Direxion 每日非必需消费品交易所买卖基金 | (纽约证券交易所代码:WANT) | 行业 | 消费者自由裁量权 | 13.57% | 19,258 | 530 万美元 |

| 方舟交易所买卖基金信托基金 — 方舟自主科技与机器人ETF | ARKQ | 策略 | 主题 | 13.29% | 562,808 | 1.542 亿美元 |

| 简化交易所交易基金 — 简化 Volt Robocar 颠覆和科技 ETF | (纽约证券交易所代码:VCAR) | 策略 | 主题 | 11.56% | 1,898 | 500 万美元 |

| iShares Trust — iShares 全球非必需消费品交易所买卖基金 | (纽约证券交易所代码:RXI) | 行业 | 消费者自由裁量权 | 10.82% | 144,369 | 3,960 万美元 |

| 方舟ETF信托基金 — 方舟创新ETF | ARKK | 策略 | 主题 | 10.52% | 3,278,033 | 8.983 亿美元 |

| 第一信托交易所交易基金 — 第一信托纳斯达克清洁边缘绿色能源指数基金 | (纽约证券交易所代码:QCLN) | 策略 | 主题 | 10.31% | 550,514 | 1.509 亿美元 |

| Tidal ETF Trust — SoFi Social 50 ETF | SFYF | 尺码和款式 | 大盘股 | 10.21% | 6,368 | 170 万美元 |

Read now: Elon Musk Says Bill Gates 'Doesn't Get Enough Negative Feedback' After Isaacson's Biography Reveals Origins Of Billionaires' Clash

立即阅读: 艾萨克森的传记揭示了亿万富翁冲突的起源后,埃隆·马斯克说,比尔·盖茨 “没有得到足够的负面反馈”

Photo: Shutterstock

照片:Shutterstock