Volatility Bargain Alert: Goldman Sachs Analyst Asserts VIX Is Priced Too Low For Economic Realities

Volatility Bargain Alert: Goldman Sachs Analyst Asserts VIX Is Priced Too Low For Economic Realities

Analysts at Goldman Sachs are highlighting an intriguing disconnect between market conditions and the famed 'fear' gauge.

分析师在 高盛 凸显了市场状况与著名的 “恐惧” 指标之间有趣的脱节。

Goldman Sachs' analyst team, featuring experts such as John Marshall and Spencer Hill, CFA, wrote a note explaining that the CBOE Volatility Index (VIX) is presently trading at price levels considerably beneath what the broader economic context would imply.

高盛的分析师团队由以下专家组成 约翰·马歇尔 和 Spencer Hill,CFA,写了一份说明解释说,芝加哥期权交易所波动率指数(VIX)目前的交易价格水平大大低于更广泛的经济背景所暗示的水平。

"The VIX at 13.8 is about 6 points below the 20.6 level implied by the growth and inflation environment, but only 4 points below levels implied by our year-end-2024 estimates," the analysts wrote.

分析师写道:“VIX指数为13.8,比增长和通货膨胀环境所暗示的20.6水平低约6个百分点,但仅比我们在2024年底的估计所暗示的水平低4个百分点。”

Goldman Sachs Deep Dive

高盛深度探索

Goldman Sachs' analysis examines the historical underpinnings of the VIX. They examined key macroeconomic variables such as unemployment rates, ISM new orders, consumer spending growth, and inflation.

高盛的分析考察了VIX的历史基础。他们研究了关键的宏观经济变量,例如失业率、ISM新订单、消费者支出增长和通货膨胀。

A number of factors typically appear to be correlated with an increase in equity market volatility:

许多因素似乎通常与股票市场波动性的增加相关:

- Weakness in manufacturing new orders

- Dwindling consumer expenditures

- Rising unemployment

- Disparities in inflation between consumers (CPI) and producers (PPI)

- 制造业新订单疲软

- 消费者支出不断减少

- 失业率上升

- 消费者(CPI)和生产者(PPI)之间的通货膨胀差异

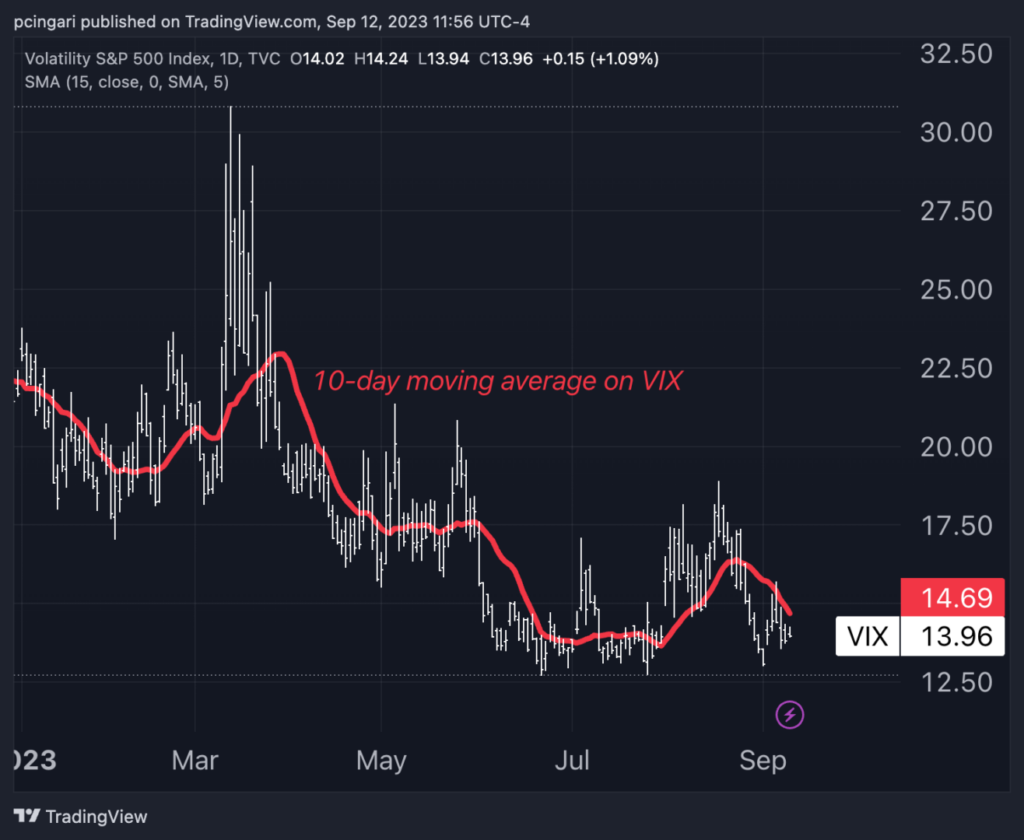

Despite a turbulent period that briefly propelled the VIX to a high of 31 during the regional-bank failures in March, volatility has since taken a nosedive, except for a brief uptick in August, plumbing to 2023 lows as September began.

尽管在3月份地区银行倒闭期间,VIX指数短暂推高至31点的高位,但此后波动率急剧下降,只是8月份短暂上涨,在9月开始时跌至2023年的低点。

Currently resting at a relatively modest 14, the VIX seems to have settled comfortably in the lower range of the post-pandemic era, even dipping below pre-Covid historical averages.

VIX指数目前处于相对温和的14点,似乎已经轻松稳定在后疫情时代的较低区间内,甚至跌至COVID之前的历史平均水平以下。

This year's staggering 35% decline in the VIX is the second-largest annual drop since the 2009 financial crisis, surpassed only by the 46% plunge witnessed in 2019.

今年VIX指数跌幅惊人35%,是自2009年金融危机以来的第二大年度跌幅,仅超过2019年46%的跌幅。

Signs of Turbulence on the Horizon?

地平线上有动荡的迹象?

Is an undervalued VIX an early indicator of turbulence ahead? There are market participants who seem to believe just that, betting on the fear index to skyrocket from here.

被低估的VIX是未来动荡的早期指标吗?有些市场参与者似乎相信这一点,他们押注恐惧指数将从现在开始飙升。

Recently, an unconventional move saw a trader snap up more than 5,000 call options on the VIX, anticipating the fear index to soar to an astonishing 180 levels by February 2024. That's an eye-popping 1,100% leap from its current level.

最近,一位交易员在VIX指数上抢购了5,000多个看涨期权,预计到2024年2月,恐惧指数将飙升至惊人的180水平。这比目前的水平跃升了惊人的1,100%。

It's worth noting that the VIX reached its all-time high of 89 during the September 2008 Lehman Brothers crash when the entire financial world teetered on the brink of collapse.

值得注意的是,在2008年9月的雷曼兄弟崩盘期间,VIX指数创下了历史新高,为89点,当时整个金融界都处于崩溃的边缘。

Exchange-traded funds such as the ProShares Trust VIX Short-Term Futures ETF (NYSE:VIXY), the ProShares Trust VIX Mid-Term Futures ETF (NYSE:VIXM), and the ProShares Trust Ultra VIX Short-Term Futures ETF (NYSE:UVXY) provide opportunities to participate in the VIX's movements.

交易所交易基金,例如 ProShares Trust VIX 短期期货 ETF (纽约证券交易所代码:VIXY), ProShares Trust VIX 中期期货 ET (纽约证券交易所代码:VIXM),以及 ProShares Trust 超VIX短期期货ETF 纽约证券交易所代码:UVXY)为参与VIX的走势提供了机会。

Read now: How To Protect Your Portfolio From The Next Crash With SPY, VIX, GLD, TLT, And UUP

立即阅读:如何使用 SPY、VIX、GLD、TLT 和 UUP 保护您的投资组合免受下一次崩溃的影响

Goldman Sachs' analysis examines the historical underpinnings of the VIX. They examined key macroeconomic variables such as unemployment rates, ISM new orders, consumer spending growth, and inflation.

Goldman Sachs' analysis examines the historical underpinnings of the VIX. They examined key macroeconomic variables such as unemployment rates, ISM new orders, consumer spending growth, and inflation.