Analysts Have Been Trimming Their Hainan Meilan International Airport Company Limited (HKG:357) Price Target After Its Latest Report

Analysts Have Been Trimming Their Hainan Meilan International Airport Company Limited (HKG:357) Price Target After Its Latest Report

Shareholders might have noticed that Hainan Meilan International Airport Company Limited (HKG:357) filed its half-yearly result this time last week. The early response was not positive, with shares down 5.0% to HK$7.40 in the past week. It was a pretty bad result overall; while revenues were in line with expectations at CN¥1.1b, statutory losses exploded to CN¥0.11 per share. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

股东们可能已经注意到了 海南美兰国际机场股份有限公司 (HKG: 357) 上周这个时候公布了半年度业绩。早期的反应并不乐观,过去一周股价下跌5.0%,至7.40港元。总体而言,这是一个相当糟糕的结果;虽然收入符合预期,为11亿元人民币,但法定亏损激增至每股0.11元人民币。对于投资者来说,收益是一个重要的时刻,因为他们可以追踪公司的业绩,看看分析师对明年的预测,看看人们对公司的情绪是否发生了变化。我们认为,读者会发现看到分析师对明年的最新(法定)财报后预测很有趣。

See our latest analysis for Hainan Meilan International Airport

查看我们对海南美兰国际机场的最新分析

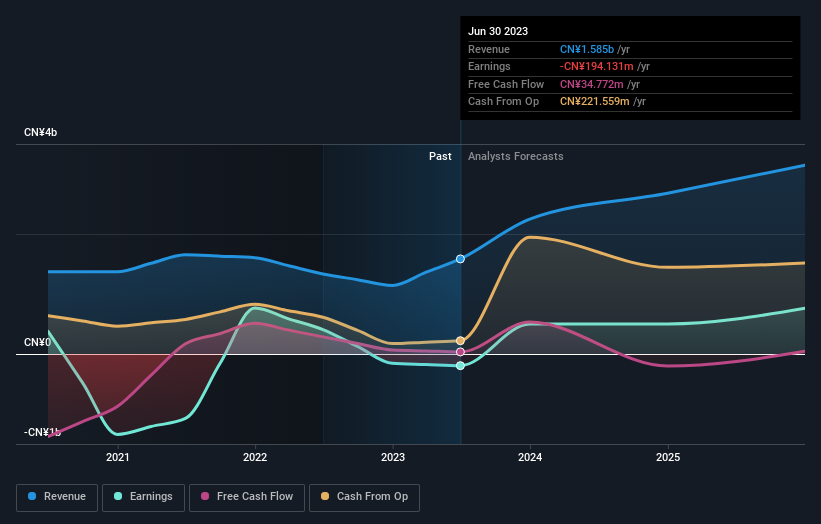

Taking into account the latest results, the most recent consensus for Hainan Meilan International Airport from nine analysts is for revenues of CN¥2.25b in 2023. If met, it would imply a huge 42% increase on its revenue over the past 12 months. Hainan Meilan International Airport is also expected to turn profitable, with statutory earnings of CN¥1.06 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of CN¥2.21b and earnings per share (EPS) of CN¥0.93 in 2023. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the substantial gain in earnings per share expectations following these results.

考虑到最新业绩,九位分析师对海南美兰国际机场的最新共识是,2023年收入为22.5亿元人民币。如果得到满足,这将意味着其收入在过去12个月中大幅增长42%。预计海南美兰国际机场也将实现盈利,每股法定收益为1.06元人民币。然而,在最新财报公布之前,分析师预计2023年收入为22.1亿元人民币,每股收益(EPS)为0.93元人民币。收入预期没有实际变化,但鉴于这些业绩公布后每股收益预期大幅增长,分析师似乎更看好收益。

The consensus price target fell 17% to HK$16.20, suggesting the increase in earnings forecasts was not enough to offset other the analysts concerns. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Hainan Meilan International Airport, with the most bullish analyst valuing it at HK$29.87 and the most bearish at HK$7.70 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

共识目标股价下跌17%,至16.20港元,这表明收益预期的上调不足以抵消分析师的其他担忧。但是,这并不是我们可以从这些数据中得出的唯一结论,因为一些投资者在评估分析师目标股价时也喜欢考虑估值中的利差。对海南美兰国际机场的看法各不相同,最看涨的分析师将其估值为29.87港元,最看跌的分析师为每股7.70港元。因此,在这种情况下,我们不会对分析师的价格目标给予太多的可信度,因为对于这项业务可以产生什么样的业绩,显然存在一些截然不同的看法。考虑到这一点,我们不会过于依赖共识目标价,因为它只是一个平均水平,分析师显然对该业务有一些截然不同的看法。

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Hainan Meilan International Airport's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 101% growth to the end of 2023 on an annualised basis. That is well above its historical decline of 4.1% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 6.2% annually. So it looks like Hainan Meilan International Airport is expected to grow faster than its competitors, at least for a while.

当然,另一种看待这些预测的方法是将它们置于行业本身的背景下。例如,我们注意到,海南美兰国际机场的增长率预计将大幅加快,预计到2023年底,收入按年计算将增长101%。这远高于过去五年中每年4.1%的历史跌幅。将其与分析师对整个行业的估计进行比较,后者表明(总计)行业收入预计每年将增长6.2%。因此,预计海南美兰国际机场的增长速度将超过竞争对手,至少在一段时间内是如此。

The Bottom Line

底线

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Hainan Meilan International Airport following these results. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Hainan Meilan International Airport's future valuation.

这里最重要的是,分析师上调了对每股收益的预期,这表明在这些业绩公布之后,人们对海南美兰国际机场的乐观情绪明显上升。令人高兴的是,收入预测没有重大变化,预计该业务的增长速度仍将超过整个行业。共识目标价大幅下跌,分析师似乎没有对最新业绩感到放心,导致对海南美兰国际机场未来估值的估计下调。

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Hainan Meilan International Airport going out to 2025, and you can see them free on our platform here.

考虑到这一点,我们仍然认为该业务的长期发展轨迹对投资者来说更为重要。我们预测海南美兰国际机场将在2025年投入使用,你可以在我们的平台上免费查看。

You should always think about risks though. Case in point, we've spotted 1 warning sign for Hainan Meilan International Airport you should be aware of.

不过,你应该时刻考虑风险。一个很好的例子,我们已经发现了 1 个海南美兰国际机场警告标志 你应该知道。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

The consensus price target fell 17% to HK$16.20, suggesting the increase in earnings forecasts was not enough to offset other the analysts concerns. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Hainan Meilan International Airport, with the most bullish analyst valuing it at HK$29.87 and the most bearish at HK$7.70 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

The consensus price target fell 17% to HK$16.20, suggesting the increase in earnings forecasts was not enough to offset other the analysts concerns. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Hainan Meilan International Airport, with the most bullish analyst valuing it at HK$29.87 and the most bearish at HK$7.70 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.