Geotech Holdings Ltd. (HKG:1707) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

Geotech Holdings Ltd. (HKG:1707) Shares May Have Slumped 27% But Getting In Cheap Is Still Unlikely

The Geotech Holdings Ltd. (HKG:1707) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

这个岩土科技控股有限公司(HKG:1707)股价在过去一个月表现非常糟糕,大幅下跌27%。过去30天的下跌为股东们艰难的一年画上了句号,股价在此期间下跌了28%。

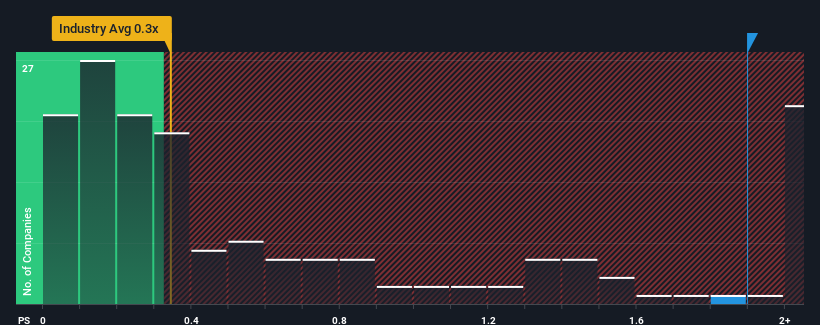

In spite of the heavy fall in price, given close to half the companies operating in Hong Kong's Construction industry have price-to-sales ratios (or "P/S") below 0.3x, you may still consider Geotech Holdings as a stock to potentially avoid with its 1.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

尽管股价大幅下跌,但鉴于近一半在香港建筑业运营的公司的市销率(P/S)低于0.3倍,你可能仍会考虑将Geotech Holdings视为一只值得规避的股票,其市盈率为1.9倍。尽管如此,我们还需要更深入地挖掘,以确定P/S升高是否有合理的基础。

See our latest analysis for Geotech Holdings

查看我们对Geotech Holdings的最新分析

How Has Geotech Holdings Performed Recently?

Geotech Holdings最近表现如何?

For instance, Geotech Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

例如,Geotech Holdings最近的营收下滑就值得深思了。或许,市场认为该公司在不久的将来可以做得足够好,跑赢业内其他公司,这使得市盈率和S的市盈率保持在较高水平。然而,如果情况并非如此,投资者可能会被发现为该股支付过高的价格。

What Are Revenue Growth Metrics Telling Us About The High P/S?

收入增长指标告诉我们关于高市盈率的哪些信息?

In order to justify its P/S ratio, Geotech Holdings would need to produce impressive growth in excess of the industry.

为了证明其市盈率与S的比率是合理的,Geotech Holdings需要实现超出行业的令人印象深刻的增长。

Retrospectively, the last year delivered a frustrating 52% decrease to the company's top line. As a result, revenue from three years ago have also fallen 47% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

回顾过去一年,该公司的营收令人沮丧地下降了52%。因此,三年前的整体营收也下降了47%。因此,股东们会对中期营收增长率感到悲观。

In contrast to the company, the rest of the industry is expected to grow by 15% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

与该公司形成鲜明对比的是,该行业其他业务预计明年将增长15%,这确实让人对该公司最近的中期收入下降有了正确的认识。

With this in mind, we find it worrying that Geotech Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

考虑到这一点,我们感到担忧的是,Geotech Holdings的P/S超过了行业同行。显然,该公司的许多投资者比最近的情况所显示的要乐观得多,不愿以任何价格抛售他们的股票。如果市盈率/S指数跌至与近期负增长更为一致的水平,现有股东很有可能正在为未来的失望做准备。

The Key Takeaway

关键的外卖

Despite the recent share price weakness, Geotech Holdings' P/S remains higher than most other companies in the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

尽管最近股价疲软,但Geotech Holdings的市盈率S仍高于行业内大多数其他公司。虽然市销率不应该成为你是否买入一只股票的决定性因素,但它是一个很好的收入预期晴雨表。

Our examination of Geotech Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

我们对Geotech Holdings的调查显示,考虑到该行业将会增长,其中期营收缩水并没有导致市盈率S像我们预期的那样低。由于投资者担心营收下滑,市场情绪恶化的可能性相当高,这可能会使市盈率/S回到我们预期的水平。如果近期的中期营收趋势持续下去,将对现有股东的投资构成重大风险,潜在投资者将很难接受该股的当前价值。

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Geotech Holdings (1 is significant) you should be aware of.

别忘了,可能还有其他风险。例如,我们已经确定Geotech Holdings的2个警告标志(1是重要的)您应该知道。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

当然了,利润丰厚、盈利增长迅速的公司通常是更安全的押注。所以你可能想看看这个免费其他市盈率合理、盈利增长强劲的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

For instance, Geotech Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

For instance, Geotech Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.