Revenues Not Telling The Story For CTR Holdings Limited (HKG:1416) After Shares Rise 27%

Revenues Not Telling The Story For CTR Holdings Limited (HKG:1416) After Shares Rise 27%

CTR Holdings Limited (HKG:1416) shareholders have had their patience rewarded with a 27% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

CTR 控股有限公司 (HKG: 1416) 股东的耐心得到了回报,上个月股价上涨了27%。从更广泛的角度来看,尽管没有上个月那么强劲,但全年23%的涨幅也相当合理。

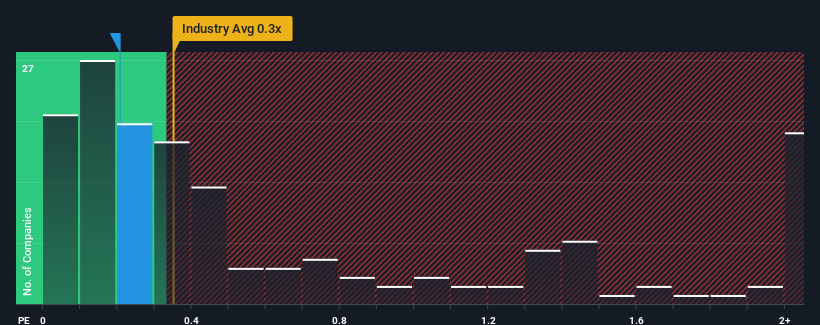

Even after such a large jump in price, you could still be forgiven for feeling indifferent about CTR Holdings' P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Hong Kong is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

即使在价格大幅上涨之后,你对CTR Holdings的0.2倍市盈率漠不关心还是可以原谅的,因为香港建筑业的市盈率(或 “市盈率”)中位数也接近0.3倍。但是,在没有解释的情况下干脆忽略市盈率是不明智的,因为投资者可能忽视了独特的机会或代价高昂的错误。

See our latest analysis for CTR Holdings

查看我们对CTR Holdings的最新分析

What Does CTR Holdings' P/S Mean For Shareholders?

CTR Holdings的市盈率对股东意味着什么?

As an illustration, revenue has deteriorated at CTR Holdings over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

举例来说,去年CTR Holdings的收入有所下降,这根本不理想。一种可能性是,市盈率适中,因为投资者认为该公司在不久的将来仍可能做得足以与整个行业保持一致。如果不是,那么现有股东可能会对股价的可行性感到有些紧张。

How Is CTR Holdings' Revenue Growth Trending?

CTR Holdings的收入增长趋势如何?

In order to justify its P/S ratio, CTR Holdings would need to produce growth that's similar to the industry.

为了证明其市盈率是合理的,CTR Holdings需要实现与行业相似的增长。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Even so, admirably revenue has lifted 37% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

在回顾去年的财务状况时,我们很沮丧地看到该公司的收入下降至15%。即便如此,令人钦佩的是,尽管在过去的12个月中,总收入仍比三年前增长了37%。因此,尽管他们本来希望继续上涨,但股东们肯定会欢迎中期收入增长率。

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

根据最近的中期年化收入业绩,该行业预计将在未来12个月内实现15%的增长,相比之下,该公司的势头较弱。

With this in mind, we find it intriguing that CTR Holdings' P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

考虑到这一点,我们发现有趣的是,CTR Holdings的市盈率与行业同行相当。看来大多数投资者都忽视了近期相当有限的增长率,他们愿意为股票敞口付出代价。如果市盈率降至更符合近期增长率的水平,他们可能会为未来的失望做好准备。

The Final Word

最后一句话

CTR Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

最近,CTR Holdings的股票势头强劲,这使其市盈率与业内其他公司持平。有人认为,在某些行业中,价格与销售比率是衡量价值的次要指标,但它可能是一个有力的商业情绪指标。

We've established that CTR Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我们已经确定,CTR Holdings的平均市盈率有点令人惊讶,因为其最近的三年增长低于整个行业的预测。当我们看到收入疲软,增长低于行业增长时,我们怀疑股价有下跌的风险,从而使市盈率恢复到预期水平。除非最近的中期条件有所改善,否则很难接受当前的股价作为公允价值。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with CTR Holdings (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

始终需要考虑永远存在的投资风险幽灵。 我们已经在CTR Holdings发现了三个警告信号 (至少 1 个有点令人担忧),理解它们应该是你投资过程的一部分。

If you're unsure about the strength of CTR Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不确定CTR Holdings的业务实力,为什么不浏览我们的互动股票清单,为你可能错过的其他一些公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。