Vodatel Networks Holdings Limited's (HKG:8033) Shares Climb 35% But Its Business Is Yet to Catch Up

Vodatel Networks Holdings Limited's (HKG:8033) Shares Climb 35% But Its Business Is Yet to Catch Up

Vodatel Networks Holdings Limited (HKG:8033) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 4.0% isn't as attractive.

沃达尔网络控股有限公司(HKG:8033)股价经历了令人印象深刻的一个月,在经历了一段不稳定的时期后上涨了35%。不幸的是,尽管过去一个月表现强劲,但4.0%的全年涨幅并不具有吸引力。

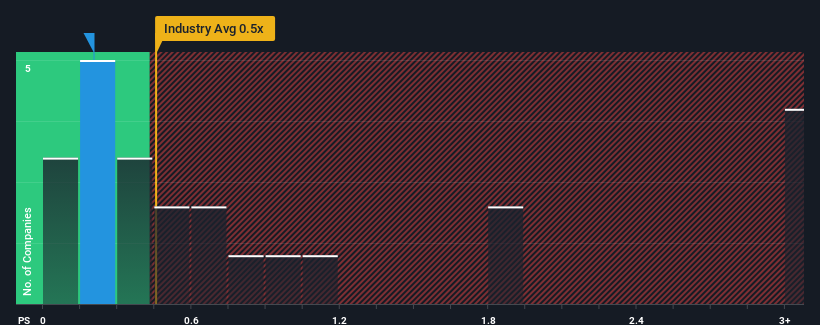

In spite of the firm bounce in price, there still wouldn't be many who think Vodatel Networks Holdings' price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Hong Kong's Communications industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

尽管股价强劲反弹,但当香港通信业的市盈率(P/S)中值约为0.5倍时,仍不会有很多人认为沃达尔网络控股0.2倍的市售比(P/S)值得一提。尽管如此,在没有解释的情况下简单地忽视市盈率S是不明智的,因为投资者可能会忽视一个独特的机会或代价高昂的错误。

Check out our latest analysis for Vodatel Networks Holdings

查看我们对Vodatl Networks Holdings的最新分析

How Has Vodatel Networks Holdings Performed Recently?

Vodatl Networks Holdings最近表现如何?

With revenue growth that's exceedingly strong of late, Vodatel Networks Holdings has been doing very well. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

由于最近收入增长异常强劲,Vodatl Networks Holdings一直表现良好。S的市盈率可能是温和的,因为投资者认为,这种强劲的收入增长可能不足以在不久的将来跑赢整体行业。如果你喜欢这家公司,你会希望情况并非如此,这样你就可以在它不太受欢迎的时候买入一些股票。

Is There Some Revenue Growth Forecasted For Vodatel Networks Holdings?

Vodatl Networks Holdings有没有一些收入增长的预测?

The only time you'd be comfortable seeing a P/S like Vodatel Networks Holdings' is when the company's growth is tracking the industry closely.

唯一能让你放心地看到像沃达尔网络控股公司这样的P/S的时候,就是该公司的增长正在密切跟踪该行业的时候。

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. As a result, it also grew revenue by 5.3% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

首先回顾一下,我们看到该公司去年的收入增长了令人印象深刻的42%。因此,在过去三年中,它的总收入增长了5.3%。因此,股东可能会对中期营收增长率感到满意。

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially higher than the company's recent medium-term annualised growth rates.

这与其他行业形成鲜明对比,预计明年该行业将增长17%,大大高于该公司最近的中期年化增长率。

With this in mind, we find it intriguing that Vodatel Networks Holdings' P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

考虑到这一点,我们发现耐人寻味的是,沃达尔网络控股公司的P/S可以与其行业同行相媲美。显然,该公司的许多投资者并不像最近的情况所显示的那样悲观,他们现在不愿抛售自己的股票。维持这些价格将很难实现,因为最近的收入趋势可能最终会拖累股价。

What Does Vodatel Networks Holdings' P/S Mean For Investors?

沃达尔网络控股公司的P/S对投资者意味着什么?

Vodatel Networks Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

沃达尔网络控股公司的股票最近势头强劲,使其市盈率与S的市盈率达到了行业内的水平。仅仅用市销率来决定你是否应该出售你的股票是不明智的,但它可以成为公司未来前景的实用指南。

We've established that Vodatel Networks Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

我们已经确定,Vodatl Networks Holdings的平均市盈率S有点令人惊讶,因为该公司最近三年的增长低于更广泛的行业预测。目前,我们对市盈率/S感到不舒服,因为这种收入表现不太可能长期支持更积极的情绪。除非近期的中期状况有所改善,否则很难接受当前股价为公允价值。

And what about other risks? Every company has them, and we've spotted 3 warning signs for Vodatel Networks Holdings (of which 1 can't be ignored!) you should know about.

还有其他风险呢?每家公司都有它们,我们已经发现Vodatl Networks Holdings的3个警告标志(其中1个不容忽视!)你应该知道。

If these risks are making you reconsider your opinion on Vodatel Networks Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑你对Vodatl Networks Holdings的看法,探索我们的高质量股票互动列表,以了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。