Huayi Brothers Media (SZSE:300027 Shareholders Incur Further Losses as Stock Declines 10% This Week, Taking Three-year Losses to 46%

Huayi Brothers Media (SZSE:300027 Shareholders Incur Further Losses as Stock Declines 10% This Week, Taking Three-year Losses to 46%

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Huayi Brothers Media Corporation (SZSE:300027) shareholders have had that experience, with the share price dropping 46% in three years, versus a market decline of about 7.2%. Unfortunately the share price momentum is still quite negative, with prices down 12% in thirty days.

为了证明挑选个股的努力是合理的,值得努力超越市场指数基金的回报。但几乎可以肯定的是,有时你会买入低于市场平均回报率的股票。我们很遗憾地报告这一长期的华谊兄弟传媒公司(SZSE:300027)股东有过这样的经历,股价在三年内下跌了46%,而市场跌幅约为7.2%。不幸的是,股价势头仍然相当负面,股价在30天内下跌了12%。

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

鉴于该公司股价在过去一周下跌了10%,我们有必要看看公司的业绩,看看是否有什么危险信号。

See our latest analysis for Huayi Brothers Media

查看我们对华谊兄弟传媒的最新分析

Given that Huayi Brothers Media didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

鉴于华谊兄弟传媒在过去12个月中没有盈利,我们将重点关注收入增长,以快速了解其业务发展。一般来说,没有利润的公司预计每年都会有收入增长,而且增长速度很快。一些公司愿意推迟盈利以更快地增长收入,但在这种情况下,人们确实预计营收会有良好的增长。

In the last three years Huayi Brothers Media saw its revenue shrink by 37% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 13% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

在过去的三年里,华谊兄弟传媒的收入每年缩水37%。这意味着与其他亏损的公司相比,它的收入趋势非常疲软。在收入下滑的情况下,股价以每年13%的速度下跌并不是不应该的。现在的关键问题是,在没有更多现金的情况下,该公司是否有能力为自己的盈利提供资金。当然,企业有可能从收入下降中反弹--但我们希望在产生兴趣之前看到这一点。

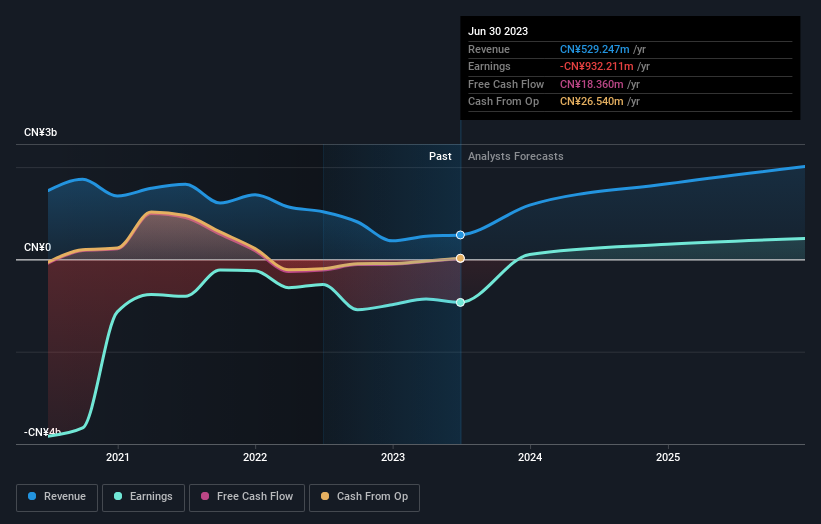

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

您可以在下图中看到收益和收入随时间的变化(单击图表查看确切的值)。

Take a more thorough look at Huayi Brothers Media's financial health with this free report on its balance sheet.

更全面地审视华谊兄弟传媒的财务健康状况免费报告其资产负债表。

A Different Perspective

不同的视角

It's nice to see that Huayi Brothers Media shareholders have received a total shareholder return of 26% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Huayi Brothers Media has 1 warning sign we think you should be aware of.

很高兴看到华谊兄弟传媒的股东在过去一年中获得了26%的总股东回报。值得注意的是,与最近的股价表现相比,TSR每年6%的五年年化亏损非常糟糕。这让我们有点警惕,但这家企业可能已经扭转了命运。我发现,把股价作为衡量企业业绩的长期指标是非常有趣的。但为了真正获得洞察力,我们还需要考虑其他信息。例如,承担风险-华谊兄弟传媒1个警告标志我们认为你应该意识到。

Of course Huayi Brothers Media may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

当然了华谊兄弟传媒可能不是最值得买入的股票。所以你可能想看看这个免费成长型股票的集合。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

请注意,本文引用的市场回报反映了目前在中国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

Given that Huayi Brothers Media didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Given that Huayi Brothers Media didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.