Dragon Rise Group Holdings Limited's (HKG:6829) 36% Share Price Plunge Could Signal Some Risk

Dragon Rise Group Holdings Limited's (HKG:6829) 36% Share Price Plunge Could Signal Some Risk

The Dragon Rise Group Holdings Limited (HKG:6829) share price has fared very poorly over the last month, falling by a substantial 36%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

这个龙升集团控股有限公司(HKG:6829)过去一个月,股价表现非常糟糕,大幅下跌36%。在过去12个月里一直持有股票的股东现在坐拥44%的股价下跌,而不是获得回报。

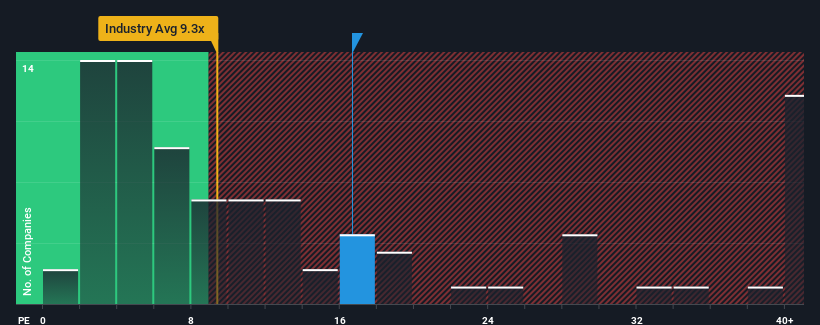

In spite of the heavy fall in price, Dragon Rise Group Holdings' price-to-earnings (or "P/E") ratio of 16.7x might still make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

尽管股价大幅下跌,龙洲国际控股有限公司16.7倍的市盈率(或“市盈率”)仍可能使其目前看起来像是一个强劲的卖盘。在香港市场,大约一半的公司的市盈率低于9倍,甚至市盈率低于4倍的情况也很常见。尽管如此,我们还需要更深入地挖掘,以确定市盈率大幅上升是否有合理的基础。

Earnings have risen at a steady rate over the last year for Dragon Rise Group Holdings, which is generally not a bad outcome. One possibility is that the P/E is high because investors think this good earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

在过去的一年里,龙瑞集团控股的盈利一直在稳步增长,这总体上是一个不错的结果。一种可能性是,市盈率很高,因为投资者认为,这种良好的收益增长将足以在不久的将来跑赢大盘。你真的希望如此,否则你会无缘无故地付出相当大的代价。

View our latest analysis for Dragon Rise Group Holdings

查看我们对龙升集团控股的最新分析

How Is Dragon Rise Group Holdings' Growth Trending?

龙瑞集团控股的增长趋势如何?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Dragon Rise Group Holdings' to be considered reasonable.

有一种固有的假设,即一家公司的市盈率应该远远超过大盘,才能被认为是合理的。

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.6% last year. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

先回过头来看,该公司去年的每股收益轻松增长了6.6%。然而,由于其在此期间之前的表现不太令人印象深刻,在过去三年中,每股收益几乎不存在增长。因此,在我们看来,在这段时间里,该公司在收益增长方面的结果好坏参半。

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

与预计未来12个月将实现24%增长的市场相比,根据最近的中期年化收益结果,该公司的增长势头较弱。

In light of this, it's alarming that Dragon Rise Group Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

有鉴于此,龙瑞集团控股的市盈率高于其他大多数公司,这是令人担忧的。似乎大多数投资者忽视了最近相当有限的增长率,并希望该公司的业务前景有所好转。如果市盈率下降到与最近的增长率更一致的水平,现有股东很可能会让自己未来感到失望。

The Final Word

最后的结论

Dragon Rise Group Holdings' shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Dragon Rise Group Holdings的股价可能有所回落,但其市盈率仍在高涨。通常,在做出投资决策时,我们会告诫不要过度解读市盈率,尽管它可以充分揭示其他市场参与者对该公司的看法。

We've established that Dragon Rise Group Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

我们已经确定,Dragon Rise Group Holdings目前的市盈率远高于预期,因为其最近三年的增长低于更广泛的市场预测。当我们看到盈利疲软、增长慢于市场增长时,我们怀疑股价有下跌的风险,导致高市盈率下降。除非最近的中期状况明显改善,否则要接受这些价格是合理的是非常具有挑战性的。

Before you take the next step, you should know about the 3 warning signs for Dragon Rise Group Holdings (1 can't be ignored!) that we have uncovered.

在您采取下一步之前,您应该了解龙升集团控股的3个警告信号(1不容忽视!)我们已经发现了。

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是确保你寻找的是一家伟大的公司,而不仅仅是你遇到的第一个想法。所以让我们来看看这个免费近期收益增长强劲(市盈率较低)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。