Loss-making Blueprint Medicines (NASDAQ:BPMC) Sheds a Further US$118m, Taking Total Shareholder Losses to 53% Over 3 Years

Loss-making Blueprint Medicines (NASDAQ:BPMC) Sheds a Further US$118m, Taking Total Shareholder Losses to 53% Over 3 Years

If you love investing in stocks you're bound to buy some losers. But long term Blueprint Medicines Corporation (NASDAQ:BPMC) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 53% share price collapse, in that time. Shareholders have had an even rougher run lately, with the share price down 16% in the last 90 days.

如果你喜欢投资股票,你一定会买一些失败者。但从长远来看蓝图医药公司纳斯达克(Sequoia Capital:BPMC)股东在过去三年经历了一段特别艰难的时期。因此,他们可能会对那段时间53%的股价暴跌感到情绪激动。股东们最近的表现更加艰难,股价在过去90天里下跌了16%。

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

鉴于过去一周对股东的态度一直很严峻,让我们调查一下基本面,看看我们能学到什么。

See our latest analysis for Blueprint Medicines

查看我们对蓝图药物的最新分析

Blueprint Medicines wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Blueprint Medicines在过去的12个月里没有盈利,我们不太可能看到它的股价和每股收益(EPS)之间有很强的相关性。可以说,收入是我们的下一个最佳选择。当一家公司没有盈利时,我们通常预计会看到良好的收入增长。一些公司愿意推迟盈利以更快地增长收入,但在这种情况下,人们确实预计营收会有良好的增长。

Over the last three years, Blueprint Medicines' revenue dropped 41% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 15% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. It could be a while before the company repays long suffering shareholders with share price gains.

在过去的三年里,Blueprint Medicines的收入每年下降41%。这一结果肯定比大多数盈利前公司报告的要弱。可以说,市场对这种业务表现做出了适当的反应,在同一时间段内,股价下跌了15%(折合成年率)。当收入下降,亏损仍在继续,股价快速下跌时,问一问是不是玩忽职守是公平的。该公司可能需要一段时间才能用股价上涨来回报长期受苦的股东。

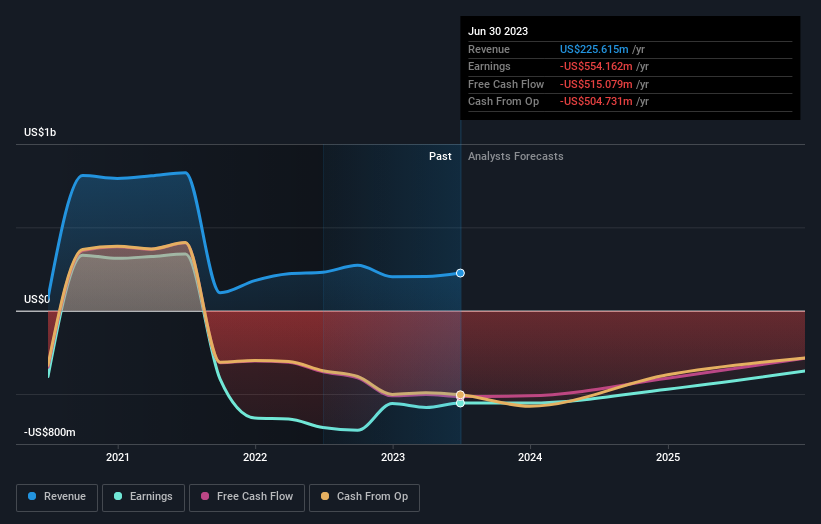

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下图显示了收益和收入随时间的变化情况(如果您点击该图,您可以看到更多详细信息)。

Blueprint Medicines is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Blueprint Medicines in this interactive graph of future profit estimates.

Blueprint Medicines为投资者所熟知,许多聪明的分析师曾试图预测未来的利润水平。您可以在这里看到分析师对Blueprint Medicines的预测互动未来利润预估图表。

A Different Perspective

不同的视角

Investors in Blueprint Medicines had a tough year, with a total loss of 7.4%, against a market gain of about 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Blueprint Medicines has 1 warning sign we think you should be aware of.

Blueprint Medicines的投资者经历了艰难的一年,总亏损7.4%,而市场收益约为18%。即使是好股票的股价有时也会下跌,但我们希望在对企业产生太大兴趣之前,看到企业的基本指标有所改善。不幸的是,去年的表现可能预示着尚未解决的挑战,因为它比过去五年5%的年化损失更糟糕。一般来说,股价长期疲软可能是一个坏信号,尽管反向投资者可能会希望研究这只股票,希望它能好转。我发现,把股价作为衡量企业业绩的长期指标是非常有趣的。但为了真正获得洞察力,我们还需要考虑其他信息。例如,承担风险-Blueprint Medicines1个警告标志我们认为你应该意识到。

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

对于那些想要找到赢得投资这免费最近有内幕收购的不断增长的公司名单可能就是合适的选择。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文引用的市场回报反映了目前在美国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

Blueprint Medicines wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Blueprint Medicines wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.