Universe Printshop Holdings Limited's (HKG:8448) 26% Share Price Plunge Could Signal Some Risk

Universe Printshop Holdings Limited's (HKG:8448) 26% Share Price Plunge Could Signal Some Risk

Universe Printshop Holdings Limited (HKG:8448) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 38% share price drop.

环球印务集团有限公司(HKG:8448)股价经历了可怕的一个月,在经历了一段相对较好的时期后,下跌了26%。在过去12个月里一直持有股票的股东非但没有获得回报,反而坐在股价下跌38%的位置上。

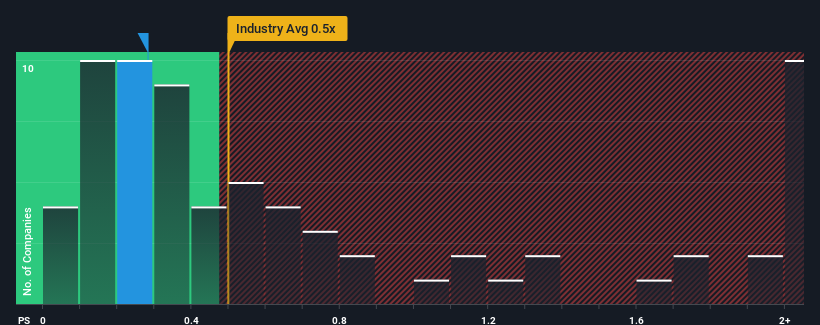

Even after such a large drop in price, it's still not a stretch to say that Universe Printshop Holdings' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Hong Kong, where the median P/S ratio is around 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

即使在价格下跌如此之大之后,可以毫不夸张地说,环球印务控股目前0.3倍的市售比(P/S)与香港商业服务业的P/S比率中值约为0.5倍相比,似乎相当“中间”。尽管如此,在没有解释的情况下简单地忽视市盈率S是不明智的,因为投资者可能会忽视一个独特的机会或代价高昂的错误。

View our latest analysis for Universe Printshop Holdings

查看我们对Universal Printshop Holdings的最新分析

How Universe Printshop Holdings Has Been Performing

Universal Printshop Holdings的表现如何

For instance, Universe Printshop Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

例如,环球印刷品控股公司近期营收下滑的情况就不得不引起一些思考。一种可能性是,S的市盈率是温和的,因为投资者认为,该公司在不久的将来可能仍会采取足够的措施,与更广泛的行业保持一致。如果你喜欢这家公司,你至少会希望情况是这样的,这样你就可以在它不太受欢迎的时候买入一些股票。

Is There Some Revenue Growth Forecasted For Universe Printshop Holdings?

宇宙印刷店控股公司有没有一些收入增长的预测?

In order to justify its P/S ratio, Universe Printshop Holdings would need to produce growth that's similar to the industry.

为了证明其市盈率与S的比率是合理的,环球印刷控股需要实现与该行业类似的增长。

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

回顾过去一年,该公司的营收令人沮丧地下降了21%。这意味着它的长期营收也出现了下滑,因为过去三年的总营收下降了26%。因此,公平地说,最近的收入增长对公司来说是不可取的。

In contrast to the company, the rest of the industry is expected to grow by 14% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

与该公司形成鲜明对比的是,该行业其他业务预计明年将增长14%,这确实让人对该公司最近的中期收入下降有了正确的认识。

With this information, we find it concerning that Universe Printshop Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

有了这些信息,我们发现环球印刷控股的市盈率与行业相当接近S。显然,该公司的许多投资者并不像最近的情况所显示的那样悲观,他们现在不愿抛售自己的股票。如果市盈率/S指数跌至与近期负增长更为一致的水平,现有股东很可能正在为未来的失望做准备。

The Key Takeaway

关键的外卖

Universe Printshop Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

宇宙印刷品控股公司股价暴跌,使其市盈率/S指数回到了与业内其他公司类似的地区。有人认为,在某些行业中,市销率是衡量价值的次要指标,但它可能是一个强大的商业信心指标。

The fact that Universe Printshop Holdings currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

环球印务控股目前的市盈率与业内其他公司持平,这一事实令我们感到惊讶,因为该公司最近的收入在中期内一直在下降,而整个行业都在增长。当我们看到营收在行业预测不断增长的背景下回落时,我们有理由预计,股价可能会下跌,导致温和的市盈率/S指数走低。除非最近的中期状况明显改善,否则投资者将很难接受股价为公允价值。

You should always think about risks. Case in point, we've spotted 6 warning signs for Universe Printshop Holdings you should be aware of, and 3 of them are a bit unpleasant.

你应该时刻考虑风险。举个例子,我们发现宇宙印刷店控股公司的6个警告标志你应该知道,其中有3个有点令人不快。

If you're unsure about the strength of Universe Printshop Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定宇宙Printshop Holdings的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

For instance, Universe Printshop Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

For instance, Universe Printshop Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.