Some Scully Royalty Ltd. (NYSE:SRL) Shareholders Look For Exit As Shares Take 30% Pounding

Some Scully Royalty Ltd. (NYSE:SRL) Shareholders Look For Exit As Shares Take 30% Pounding

To the annoyance of some shareholders, Scully Royalty Ltd. (NYSE:SRL) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

令一些股东恼火的是,Scully Royalty Ltd.(纽约证券交易所股票代码:SRL)的股价在上个月大幅下跌了30%,这对该公司来说继续着可怕的涨势。过去30天的下跌为股东们艰难的一年画上了句号,股价在此期间下跌了44%。

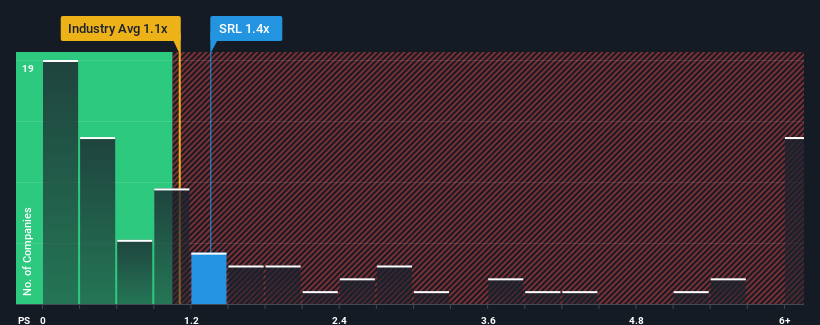

Although its price has dipped substantially, it's still not a stretch to say that Scully Royalty's price-to-sales (or "P/S") ratio of 1.4x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in the United States, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

尽管Scully Royalty的价格已经大幅下降,但仍然可以毫不夸张地说,Scully Royalty目前1.4倍的价格与销售额(或P/S)的比率,与美国金属和矿业的P/S比率中值约为1.1倍相比,似乎相当“中间”。尽管如此,在没有解释的情况下简单地忽视市盈率S是不明智的,因为投资者可能会忽视一个独特的机会或代价高昂的错误。

Check out our latest analysis for Scully Royalty

查看我们对Scully Royalty的最新分析

How Has Scully Royalty Performed Recently?

Scully Royalty最近的表现如何?

As an illustration, revenue has deteriorated at Scully Royalty over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

举例来说,Scully Royalty的收入在过去一年里一直在恶化,这根本不是理想的情况。或许投资者认为,最近的营收表现足以与行业保持一致,这让市盈率/S指数不会下跌。如果你喜欢这家公司,你至少会希望情况是这样的,这样你就可以在它不太受欢迎的时候买入一些股票。

Is There Some Revenue Growth Forecasted For Scully Royalty?

对Scully Royalty的收入增长有预测吗?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Scully Royalty's to be considered reasonable.

有一个固有的假设,即一家公司应该与行业匹配,才能让人认为像Scully Royalty这样的P/S比率是合理的。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. This means it has also seen a slide in revenue over the longer-term as revenue is down 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

回顾过去一年的财务状况,我们沮丧地看到该公司的收入下降到了11%。这意味着,该公司的长期营收也出现了下滑,因为过去三年的总营收下降了44%。因此,公平地说,最近的收入增长对公司来说是不可取的。

Comparing that to the industry, which is predicted to deliver 4.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,该行业预计未来12个月将实现4.7%的增长,根据最近的中期营收结果,该公司的下滑势头令人警醒。

With this in mind, we find it worrying that Scully Royalty's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

考虑到这一点,我们感到担忧的是,Scully Royalty的P/S超过了行业同行。似乎大多数投资者都忽视了最近糟糕的增长率,并希望该公司的业务前景有所好转。只有最大胆的人才会认为这些价格是可持续的,因为最近收入趋势的延续最终可能会拖累股价。

What Does Scully Royalty's P/S Mean For Investors?

史高丽王室的P/S对投资者意味着什么?

Scully Royalty's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Scully Royalty暴跌的股价使其P/S回到了与业内其他公司类似的地区。虽然市销率不应该成为你是否买入一只股票的决定性因素,但它是一个很好的收入预期晴雨表。

We find it unexpected that Scully Royalty trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

我们发现,尽管在中期经历了收入下降,但Scully Royalty的市盈率/S比率与行业其他公司相当,这是意想不到的,而整个行业预计将会增长。当我们看到营收在行业预测不断增长的背景下回落时,我们有理由预计,股价可能会下跌,导致温和的市盈率/S指数走低。除非近期的中期形势有所好转,否则预计公司股东未来将迎来一段艰难时期,这并不错。

Plus, you should also learn about these 3 warning signs we've spotted with Scully Royalty (including 1 which is concerning).

另外,你还应该了解这些我们在Scully Royalty身上发现了3个警告信号(包括涉及的1个)。

If you're unsure about the strength of Scully Royalty's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定Scully Royalty的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

As an illustration, revenue has deteriorated at Scully Royalty over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

As an illustration, revenue has deteriorated at Scully Royalty over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.