Psychemedics Corporation's (NASDAQ:PMD) 30% Share Price Plunge Could Signal Some Risk

Psychemedics Corporation's (NASDAQ:PMD) 30% Share Price Plunge Could Signal Some Risk

To the annoyance of some shareholders, Psychemedics Corporation (NASDAQ:PMD) shares are down a considerable 30% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

令一些股东恼火的是,精神化学公司纳斯达克(Sequoia Capital:PMD)股价在上个月大幅下跌30%,延续了该公司可怕的涨势。对于任何长期股东来说,最后一个月结束了一年的忘记,锁定了58%的股价跌幅。

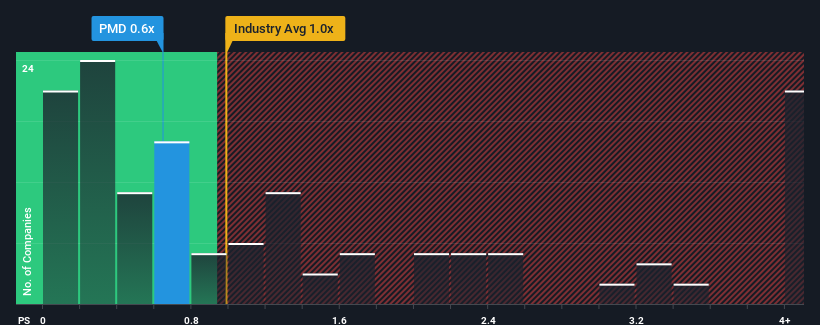

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Psychemedics' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is also close to 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

尽管它的价格已经大幅下跌,但你仍然可以原谅精神化疗公司0.6倍的P/S比率,因为美国医疗行业的中位数价格与销售额(或“P/S”)比率也接近1倍。然而,如果市盈率没有理性基础,投资者可能会忽视一个明显的机会或潜在的挫折。

See our latest analysis for Psychemedics

查看我们对精神化学的最新分析

What Does Psychemedics' Recent Performance Look Like?

《心理化学》最近的表现如何?

For example, consider that Psychemedics' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

例如,考虑到心理化学公司最近的财务表现一直很差,因为它的收入一直在下降。许多人可能预计,该公司在未来一段时间内将把令人失望的营收表现抛在脑后,这让市盈率/S指数没有下跌。如果不是,那么现有股东可能会对股价的生存能力感到有点紧张。

What Are Revenue Growth Metrics Telling Us About The P/S?

收入增长指标告诉我们有关市盈率的哪些信息?

Psychemedics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

对于一家预计只会实现适度增长,而且重要的是表现与行业一致的公司来说,精神化学的P/S比率是典型的。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.6%. The last three years don't look nice either as the company has shrunk revenue by 20% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回顾过去一年的财务状况,我们沮丧地看到该公司的收入下降到了9.6%。过去三年的情况也不妙,因为该公司的总收入缩水了20%。因此,不幸的是,我们不得不承认,在这段时间里,该公司在收入增长方面做得并不出色。

In contrast to the company, the rest of the industry is expected to grow by 7.4% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

与该公司形成鲜明对比的是,该行业其他业务预计明年将增长7.4%,这确实让人对该公司最近的中期收入下降有了正确的认识。

With this in mind, we find it worrying that Psychemedics' P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

考虑到这一点,我们发现令人担忧的是,精神化学的P/S超过了行业同行。似乎大多数投资者都忽视了最近糟糕的增长率,并希望该公司的业务前景有所好转。如果市盈率/S指数跌至与近期负增长更为一致的水平,现有股东很可能正在为未来的失望做准备。

The Key Takeaway

关键的外卖

Following Psychemedics' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

在心理化学股价暴跌后,其市盈率S只是紧抓着行业中值市盈率不变。一般来说,我们倾向于将市盈率的使用限制在确定市场对公司整体健康状况的看法上。

The fact that Psychemedics currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

心理化学公司目前的市盈率与行业其他公司持平,这一事实令我们感到惊讶,因为该公司最近的收入在中期内一直在下降,而该行业将会增长。当我们看到营收在行业预测不断增长的背景下回落时,我们有理由预计,股价可能会下跌,导致温和的市盈率/S指数走低。除非近期的中期形势有所好转,否则预计公司股东未来将迎来一段艰难时期,这并不错。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Psychemedics (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

总是有必要考虑到投资风险的幽灵无处不在。我们发现了5个心理化疗的警示信号(至少有一个不应该被忽视),理解它们应该是你投资过程的一部分。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

当然了,利润丰厚、盈利增长迅速的公司通常是更安全的押注。所以你可能想看看这个免费其他市盈率合理、盈利增长强劲的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

For example, consider that Psychemedics' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

For example, consider that Psychemedics' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.