Shareholders Would Not Be Objecting To Twin Disc, Incorporated's (NASDAQ:TWIN) CEO Compensation And Here's Why

Shareholders Would Not Be Objecting To Twin Disc, Incorporated's (NASDAQ:TWIN) CEO Compensation And Here's Why

Key Insights

主要见解

- Twin Disc will host its Annual General Meeting on 26th of October

- CEO John Batten's total compensation includes salary of US$648.4k

- Total compensation is similar to the industry average

- Twin Disc's EPS grew by 91% over the past three years while total shareholder return over the past three years was 148%

- 双碟公司将于10月26日举行年度股东大会

- 首席执行官约翰·巴顿的总薪酬包括648.4万美元的工资

- 总薪酬与行业平均水平相似

- 双碟公司的每股收益在过去三年中增长了91%,而总股东回报率在过去三年中为148%

We have been pretty impressed with the performance at Twin Disc, Incorporated (NASDAQ:TWIN) recently and CEO John Batten deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 26th of October. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

我们对这场演出印象非常深刻双光盘,公司提供纳斯达克(双胞胎)最近和首席执行官约翰·巴顿在其中所扮演的角色值得一提。在10月26日即将举行的年度股东大会上,股东们将把这一点放在首位。随着股东听取董事会的意见,并就高管薪酬和其他事项等决议投票,未来的重点很可能是公司战略。我们认为首席执行官的工作做得相当不错,我们讨论了为什么首席执行官薪酬是合适的。

See our latest analysis for Twin Disc

查看我们对双碟的最新分析

How Does Total Compensation For John Batten Compare With Other Companies In The Industry?

与业内其他公司相比,约翰·巴顿的总薪酬如何?

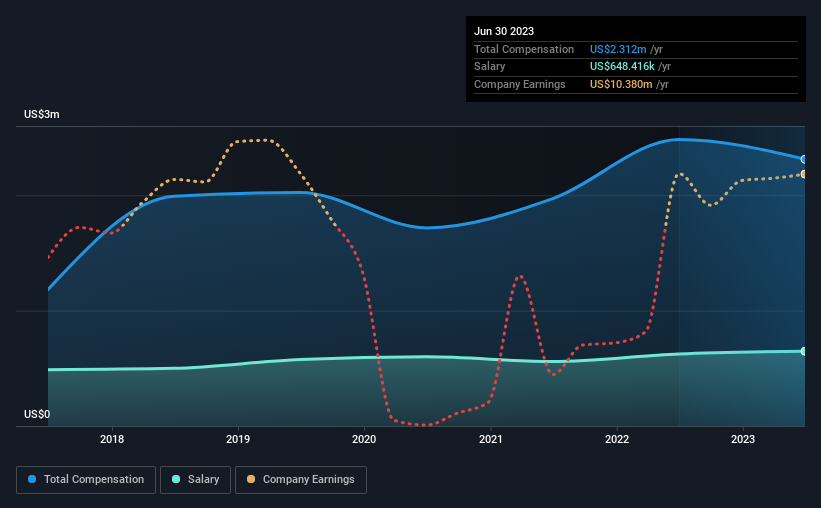

At the time of writing, our data shows that Twin Disc, Incorporated has a market capitalization of US$187m, and reported total annual CEO compensation of US$2.3m for the year to June 2023. That's slightly lower by 6.9% over the previous year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$648k.

在撰写本文时,我们的数据显示,Twin Disc,Inc.的市值为1.87亿美元,截至2023年6月的一年,首席执行官的年度薪酬总额为230万美元。这比上一年略有下降6.9%。虽然这项分析关注的是总薪酬,但值得承认的是,薪酬部分较低,为64.8万美元。

For comparison, other companies in the American Machinery industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$2.1m. From this we gather that John Batten is paid around the median for CEOs in the industry. Moreover, John Batten also holds US$34m worth of Twin Disc stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

相比之下,美国机械行业市值在1亿美元至4亿美元之间的其他公司的首席执行官总薪酬中值为210万美元。由此可见,约翰·巴顿的薪酬约为业内CEO的中位数。此外,约翰·巴顿还直接以自己的名义持有价值3400万美元的Twin Disc股票,这向我们表明,他们在该公司拥有相当大的个人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$648k | US$624k | 28% |

| Other | US$1.7m | US$1.9m | 72% |

| Total Compensation | US$2.3m | US$2.5m | 100% |

| 组件 | 2023年 | 2022 | 比例(2023年) |

| 薪金 | 64.8万美元 | 62.4万美元 | 28% |

| 其他 | 170万美元 | 190万美元 | 百分之七十二 |

| 全额补偿 | 230万美元 | 250万美元 | 100% |

Talking in terms of the industry, salary represented approximately 16% of total compensation out of all the companies we analyzed, while other remuneration made up 84% of the pie. According to our research, Twin Disc has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

就行业而言,在我们分析的所有公司中,薪酬约占总薪酬的16%,而其他薪酬占总薪酬的84%。根据我们的研究,与更广泛的行业相比,Twin Disc对薪酬的分配比例更高。如果总薪酬倾向于非工资福利,则表明CEO薪酬与公司业绩挂钩。

A Look at Twin Disc, Incorporated's Growth Numbers

Twin Disc,Inc.增长数据一瞥

Twin Disc, Incorporated has seen its earnings per share (EPS) increase by 91% a year over the past three years. It achieved revenue growth of 14% over the last year.

在过去的三年里,双碟公司的每股收益(EPS)以每年91%的速度增长。它在去年实现了14%的收入增长。

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

这表明公司最近一直在改善,对股东来说是个好消息。去年收入出现可观的增长也是件好事,这表明该业务健康且在增长。虽然我们没有分析师对该公司的预测,但股东们可能想看看这张关于收益、收入和现金流的详细历史曲线图。

Has Twin Disc, Incorporated Been A Good Investment?

双碟公司是一项好的投资吗?

Most shareholders would probably be pleased with Twin Disc, Incorporated for providing a total return of 148% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

大多数股东可能会对Twin Disc公司感到满意,因为它在三年内提供了148%的总回报率。因此,如果首席执行官的薪酬高于同等规模公司的正常水平,他们可能根本不会担心。

In Summary...

总结一下..。

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

鉴于该公司的良好表现,CEO薪酬政策可能不是股东在年度股东大会上关注的焦点。事实上,对投资者来说,可能影响业务未来的战略决策可能是一个有趣得多的话题,因为这将帮助他们设定更长期的预期。

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Twin Disc that investors should think about before committing capital to this stock.

虽然CEO薪酬是一个需要注意的重要因素,但投资者也应该注意其他领域。这就是为什么我们做了一些挖掘并确定了1个双碟警告标志这是投资者在向这只股票投入资金之前应该考虑的问题。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

当然了,通过观察不同的股票组合,你可能会发现这是一项非常棒的投资。所以让我们来看看这个免费有趣的公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

For comparison, other companies in the American Machinery industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$2.1m. From this we gather that John Batten is paid around the median for CEOs in the industry. Moreover, John Batten also holds US$34m worth of Twin Disc stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

For comparison, other companies in the American Machinery industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$2.1m. From this we gather that John Batten is paid around the median for CEOs in the industry. Moreover, John Batten also holds US$34m worth of Twin Disc stock directly under their own name, which reveals to us that they have a significant personal stake in the company.