Ranpak Holdings (NYSE:PACK Shareholders Incur Further Losses as Stock Declines 20% This Week, Taking Three-year Losses to 65%

Ranpak Holdings (NYSE:PACK Shareholders Incur Further Losses as Stock Declines 20% This Week, Taking Three-year Losses to 65%

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Ranpak Holdings Corp. (NYSE:PACK) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 65% decline in the share price in that time. Furthermore, it's down 37% in about a quarter. That's not much fun for holders.

如果你正在建立适当多元化的股票投资组合,那么你的某些选择很可能会表现不佳。长期 兰帕克控股公司 纽约证券交易所代码:PACK)的股东们非常清楚这一点,因为股价在三年内大幅下跌。不幸的是,在那段时间里,他们的股价一直下跌了65%。此外,它在大约一个季度内下降了37%。对于持有者来说,这没什么好玩的。

After losing 20% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

在上周下跌了20%之后,值得调查该公司的基本面,以了解我们可以从过去的表现中推断出什么。

See our latest analysis for Ranpak Holdings

查看我们对 Ranpak Holdings 的最新分析

Because Ranpak Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

由于Ranpak Holdings在过去十二个月中亏损,我们认为市场可能更关注收入和收入增长,至少目前是如此。无利可图公司的股东通常期望收入增长强劲。可以想象,收入的快速增长如果持续下去,通常会带来快速的利润增长。

Over three years, Ranpak Holdings grew revenue at 4.9% per year. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 18% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

在过去的三年中,Ranpak Holdings的收入以每年4.9%的速度增长。考虑到它不赚钱,这不是一个很高的增长率。在过去三年中,这种疲软的增长可能使年化回报率达到18%。当股票像这样大幅下跌时,一些投资者喜欢将该公司添加到关注名单中(以防业务复苏,从长远来看)。请记住,优秀企业经历艰难时期或几年平淡无奇的情况并不少见。

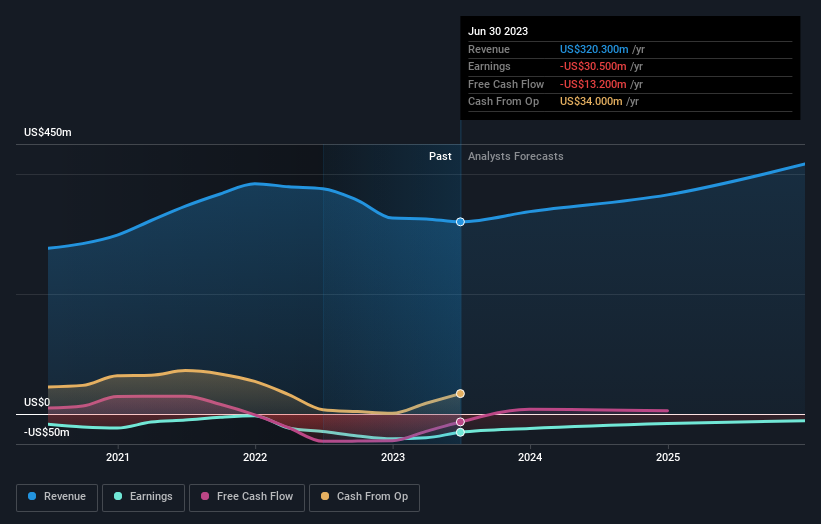

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

您可以在下面看到收入和收入如何随着时间的推移而变化(点击图片了解确切的值)。

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free report showing analyst forecasts should help you form a view on Ranpak Holdings

可能值得注意的是,我们在上个季度看到了大量的内幕买盘,我们认为这是积极的。另一方面,我们认为收入和收益趋势是衡量业务的更有意义的指标。这个 免费的 显示分析师预测的报告应该可以帮助你对Ranpak Holdings形成看法

A Different Perspective

不同的视角

Ranpak Holdings provided a TSR of 4.7% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Ranpak Holdings has 2 warning signs we think you should be aware of.

在过去的十二个月中,Ranpak Holdings的股东总回报率为4.7%。但是这种回报低于市场。但至少这仍然是一种收获!五年来,股东总回报率在五年内每年下降10%。很可能是业务正在稳定下来。尽管值得考虑市场状况可能对股价产生的不同影响,但还有其他因素更为重要。例如,冒险——Ranpak Holdings 有 2 个警告标志 我们认为你应该知道。

Ranpak Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Ranpak Holdings并不是内部人士购买的唯一股票。对于那些喜欢寻找的人 获胜的投资 这个 免费的 最近进行内幕收购的成长型公司名单可能只是门票。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文引用的市场回报反映了目前在美国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

Because Ranpak Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Because Ranpak Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.