Do Hubei Feilihua Quartz Glass' (SZSE:300395) Earnings Warrant Your Attention?

Do Hubei Feilihua Quartz Glass' (SZSE:300395) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

投资者往往以发现“下一个大事件”为指导,即使这意味着在没有任何收入、更不用说利润的情况下买入“故事股”。不幸的是,这些高风险的投资往往不太可能获得回报,许多投资者为此付出了代价。亏损的公司可能会像海绵一样吸收资本,因此投资者应该谨慎,不要把钱一笔接一笔地往上扔。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hubei Feilihua Quartz Glass (SZSE:300395). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

因此,如果这种高风险和高回报的想法不适合,你可能会对盈利的、成长型的公司更感兴趣,比如湖北飞利华石英玻璃(SZSE:300395)。虽然利润不是投资时应该考虑的唯一指标,但值得表彰能够持续产生利润的企业。

See our latest analysis for Hubei Feilihua Quartz Glass

参见我们对湖北飞利华石英玻璃的最新分析

How Quickly Is Hubei Feilihua Quartz Glass Increasing Earnings Per Share?

湖北飞利华石英玻璃每股收益增长速度有多快?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Hubei Feilihua Quartz Glass' EPS has grown 33% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

如果一家公司能够在足够长的时间内保持每股收益(EPS)的增长,其股价最终应该会随之而来。因此,有很多投资者喜欢购买每股收益不断增长的公司的股票。股东们会很高兴地知道,湖北飞利华石英玻璃的每股收益在过去三年里以每年33%的复合增长率增长。如果公司能够保持这样的增长,我们预计股东们会满意地离开。

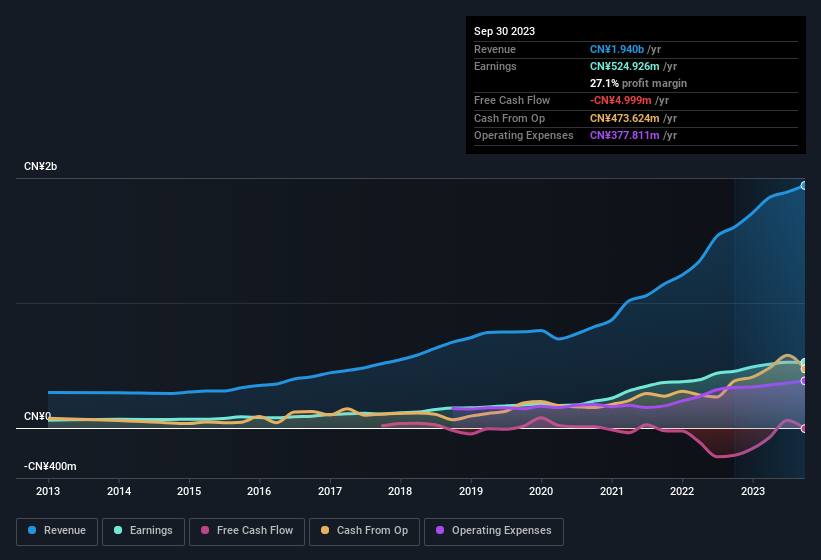

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Hubei Feilihua Quartz Glass' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. Hubei Feilihua Quartz Glass maintained stable EBIT margins over the last year, all while growing revenue 21% to CN¥1.9b. That's a real positive.

仔细考虑收入增长和息税前利润(EBIT)利润率有助于了解最近利润增长的可持续性。据指出,湖北飞利华石英玻璃的收入从运营部过去12个月的收入低于其收入,因此这可能会扭曲我们对其利润率的分析。湖北飞利华石英玻璃在去年保持稳定的息税前利润,同时收入增长21%,达到人民币19亿元。这是一个真正的积极因素。

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

下面的图表显示了该公司的利润和收入是如何随着时间的推移而变化的。点击图表查看确切的数字。

Fortunately, we've got access to analyst forecasts of Hubei Feilihua Quartz Glass' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

幸运的是,我们已经获得了分析师对湖北飞利华石英玻璃的预测。未来利润。你可以不看就做你自己的预测,或者你可以偷看一下专业人士的预测。

Are Hubei Feilihua Quartz Glass Insiders Aligned With All Shareholders?

湖北飞利华石英玻璃内部人士是否与全体股东一致?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Hubei Feilihua Quartz Glass insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth CN¥3.7b. That equates to 18% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

可以说,看到公司领导人把自己的钱拿来冒险是件令人高兴的事情,因为这增加了企业经营者和真正的所有者之间的激励一致性。因此,看到湖北飞利华石英玻璃内部人士有相当数量的资金投资于该股是件好事。值得注意的是,他们持有该公司令人羡慕的股份,价值37亿元人民币。这相当于公司18%的股份,这让内部人士变得强大,并与其他股东结盟。非常鼓舞人心。

Is Hubei Feilihua Quartz Glass Worth Keeping An Eye On?

湖北飞利华石英玻璃值得关注吗?

If you believe that share price follows earnings per share you should definitely be delving further into Hubei Feilihua Quartz Glass' strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Hubei Feilihua Quartz Glass' continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Of course, just because Hubei Feilihua Quartz Glass is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

如果你相信股价跟随每股收益,你肯定应该进一步研究湖北飞利华石英玻璃每股收益的强劲增长。此外,高水平的内部人持股令人印象深刻,表明管理层欣赏每股收益的增长,并对湖北飞利华石英玻璃的持续实力充满信心。权衡其优点,稳健的每股收益增长和与股东结盟的公司内部人士将表明这是一项值得进一步研究的业务。当然,仅仅因为湖北飞利华石英玻璃在增长并不意味着它被低估了。如果你想知道它的估值,看看这个衡量其市盈率的指标,它与其行业相比。

Although Hubei Feilihua Quartz Glass certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

尽管湖北飞利华石英玻璃看起来确实不错,但如果内部人士买入股票,它可能会吸引更多的投资者。如果你想看到内幕交易,那么这本书免费内部人士正在收购的成长型公司名单,可能正是你正在寻找的。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易指的是相关司法管辖区内的应报告交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Hubei Feilihua Quartz Glass' EPS has grown 33% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Hubei Feilihua Quartz Glass' EPS has grown 33% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.