Shanghai MicroPort EP MedTech Co., Ltd.'s (SHSE:688351) Share Price Matching Investor Opinion

Shanghai MicroPort EP MedTech Co., Ltd.'s (SHSE:688351) Share Price Matching Investor Opinion

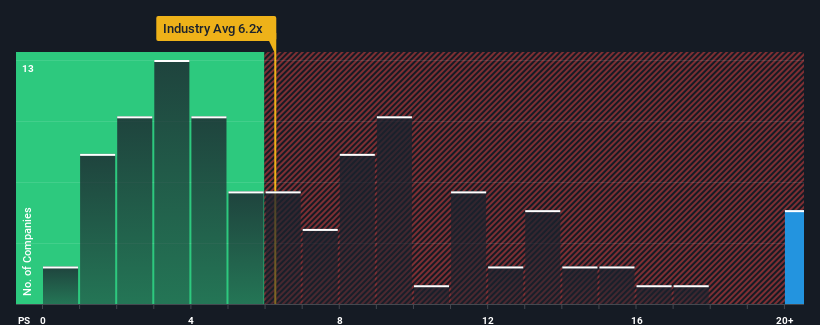

You may think that with a price-to-sales (or "P/S") ratio of 34.8x Shanghai MicroPort EP MedTech Co., Ltd. (SHSE:688351) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in China have P/S ratios under 6.2x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

你可能会认为,以34.8倍的市售比(或“P/S”)上海微港爱普医疗科技有限公司。上海证券交易所股票代码:688351)是一只完全应该避免的股票,因为中国几乎一半的医疗设备公司的市盈率都在6.2倍以下,即使是低于3倍的市盈率S也不是不寻常的。然而,P/S可能是有原因的,需要进一步调查才能确定是否合理。

View our latest analysis for Shanghai MicroPort EP MedTech

查看我们对上海微港EP MedTech的最新分析

How Shanghai MicroPort EP MedTech Has Been Performing

上海微港EP MedTech的表现如何

Shanghai MicroPort EP MedTech certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

上海微港EP MedTech最近肯定做得很好,因为它的收入增长速度超过了大多数其他公司。似乎许多人预计强劲的营收表现将持续下去,这提高了市盈率。然而,如果不是这样,投资者可能会被发现支付过高的股票价格。

Do Revenue Forecasts Match The High P/S Ratio?

收入预测是否与高市盈率相匹配?

Shanghai MicroPort EP MedTech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

上海微港EP MedTech的市盈率/S比率对于一家有望实现非常强劲增长的公司来说是典型的,而且重要的是,它的表现远远好于行业。

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Pleasingly, revenue has also lifted 116% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

如果我们回顾去年的收入增长,该公司公布了24%的惊人增长。令人欣喜的是,得益于过去12个月的增长,该公司的总收入较三年前增长了116%。因此,股东肯定会欢迎这些中期收入增长率。

Turning to the outlook, the next three years should generate growth of 41% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 20% per annum, which is noticeably less attractive.

谈到前景,观察该公司的五位分析师估计,未来三年的年增长率应为41%。与此同时,预计该行业的其他行业每年只会增长20%,这显然不那么有吸引力。

With this in mind, it's not hard to understand why Shanghai MicroPort EP MedTech's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

考虑到这一点,就不难理解为什么上海微港EP MedTech的市盈率比行业同行高。显然,股东们并不热衷于出售那些可能着眼于更繁荣未来的资产。

What Does Shanghai MicroPort EP MedTech's P/S Mean For Investors?

上海微港EP医疗科技的P/S对投资者意味着什么?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

虽然市销率不应该成为你是否买入一只股票的决定性因素,但它是一个很好的收入预期晴雨表。

Our look into Shanghai MicroPort EP MedTech shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

我们对上海微港EP MedTech的调查显示,由于其强劲的未来收入,其市盈率仍保持在较高水平。在现阶段,投资者感觉营收恶化的可能性相当渺茫,这证明市盈率/S比率偏高是合理的。除非分析师们真的没有达到预期,否则这些强劲的收入预测应该会让股价保持上涨。

Before you settle on your opinion, we've discovered 2 warning signs for Shanghai MicroPort EP MedTech (1 shouldn't be ignored!) that you should be aware of.

在你决定你的观点之前,我们发现上海微港EP MedTech的2个警示标志(1不应该被忽视!)这一点你应该知道。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果强大的盈利公司激起了你的想象力,那么你就会想要看看这个。免费市盈率较低(但已证明它们可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

Shanghai MicroPort EP MedTech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Shanghai MicroPort EP MedTech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.