Investors Aren't Buying JiangSu WuZhong Pharmaceutical Development Co., Ltd.'s (SHSE:600200) Revenues

Investors Aren't Buying JiangSu WuZhong Pharmaceutical Development Co., Ltd.'s (SHSE:600200) Revenues

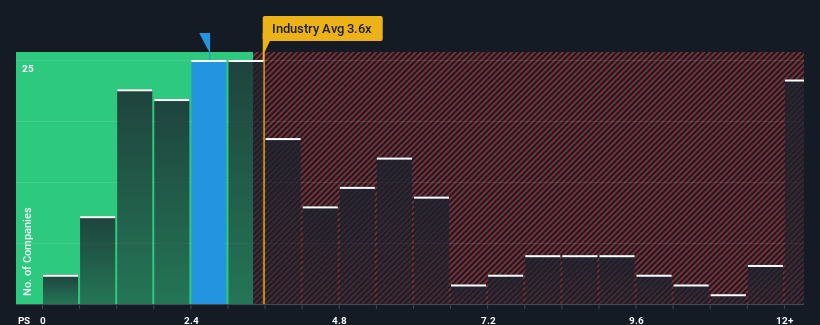

You may think that with a price-to-sales (or "P/S") ratio of 2.7x JiangSu WuZhong Pharmaceutical Development Co., Ltd. (SHSE:600200) is a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in China have P/S ratios greater than 3.6x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

你可能会认为,如果市盈率(或“市盈率”)为2.7倍江苏吴忠药业发展有限公司。上海证券交易所股票代码:600200)是一只值得一看的股票,因为中国几乎一半的制药公司的市盈率都超过3.6倍,即使是市盈率高于7倍的S也不是不寻常。尽管如此,我们需要更深入地挖掘,以确定P/S降低是否有合理的基础。

See our latest analysis for JiangSu WuZhong Pharmaceutical Development

查看我们对江苏吴忠医药发展的最新分析

How JiangSu WuZhong Pharmaceutical Development Has Been Performing

江苏吴忠药业发展的历程

With revenue growth that's superior to most other companies of late, JiangSu WuZhong Pharmaceutical Development has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

江苏吴忠医药发展有限公司最近的营收增长优于大多数其他公司,表现相对较好。这可能是因为许多人预计强劲的营收表现将大幅下滑,这压低了该公司的股价,从而压低了市盈率。如果你喜欢这家公司,你会希望情况并非如此,这样你就可以在它不再受青睐的时候买入一些股票。

How Is JiangSu WuZhong Pharmaceutical Development's Revenue Growth Trending?

江苏吴忠医药发展营收增长趋势如何?

In order to justify its P/S ratio, JiangSu WuZhong Pharmaceutical Development would need to produce sluggish growth that's trailing the industry.

为了证明其市盈率与S的比率是合理的,江苏吴忠医药发展有限公司需要实现落后于行业的低迷增长。

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

回顾过去一年,该公司营收实现了53%的不同寻常的增长。然而,最近三年的总体表现并不是很好,因为它根本没有实现任何增长。因此,股东们可能不会对不稳定的中期增长率过于满意。

Turning to the outlook, the next year should generate growth of 9.2% as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 167% growth forecast for the broader industry.

谈到前景,关注该公司的四位分析师估计,明年应该会产生9.2%的增长。这将大大低于整个行业167%的增长预期。

With this in consideration, its clear as to why JiangSu WuZhong Pharmaceutical Development's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

考虑到这一点,很明显,江苏吴忠药业发展有限公司的P/S落后于行业同行。似乎大多数投资者预计未来的增长有限,只愿意为该股支付较低的价格。

What We Can Learn From JiangSu WuZhong Pharmaceutical Development's P/S?

我们可以从江苏吴忠医药发展公司的P/S那里学到什么?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

仅仅用市销率来决定你是否应该出售你的股票是不明智的,但它可以成为公司未来前景的实用指南。

As expected, our analysis of JiangSu WuZhong Pharmaceutical Development's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

不出所料,我们对江苏吴忠医药发展分析师预测的分析证实,该公司平淡无奇的营收前景是导致其低市盈率的主要原因。股东对公司营收前景的悲观似乎是导致市盈率低迷的主要原因。除非这些条件得到改善,否则它们将继续构成股价在这些水平附近的障碍。

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for JiangSu WuZhong Pharmaceutical Development with six simple checks on some of these key factors.

该公司的资产负债表是风险分析的另一个关键领域。看看我们的免费对江苏吴忠医药发展的资产负债表分析,并对其中一些关键因素进行了六个简单的检查。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果强大的盈利公司激起了你的想象力,那么你就会想要看看这个。免费市盈率较低(但已证明它们可以增加收益)的有趣公司名单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。