Is Shandong Bohui Paper IndustryLtd (SHSE:600966) Using Debt Sensibly?

Is Shandong Bohui Paper IndustryLtd (SHSE:600966) Using Debt Sensibly?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Shandong Bohui Paper Industry Co.,Ltd. (SHSE:600966) does carry debt. But the real question is whether this debt is making the company risky.

由伯克希尔哈撒韦的Li·芒格支持的外部基金经理Lu直言不讳地说,最大的投资风险不是价格的波动,而是你是否会遭受永久性的资本损失。当你考察一家公司的风险有多大时,考虑它的资产负债表是很自然的,因为当一家企业倒闭时,债务往往会涉及到它。重要的是山东博汇纸业有限公司。(上海证券交易所:600966)确实背负着债务。但真正的问题是,这笔债务是否让该公司面临风险。

What Risk Does Debt Bring?

债务会带来什么风险?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

一般来说,只有当一家公司无法轻松偿还债务时,债务才会成为一个真正的问题,无论是通过筹集资金还是用自己的现金流。资本主义的一部分是“创造性破坏”的过程,破产的企业被银行家无情地清算。然而,更常见(但代价仍然高昂)的情况是,一家公司必须以极低的价格发行股票,永久性地稀释股东的股份,只是为了支撑其资产负债表。当然,债务的好处是,它往往代表着廉价资本,特别是当它用能够以高回报率进行再投资的能力取代公司的稀释时。当我们检查债务水平时,我们首先同时考虑现金和债务水平。

See our latest analysis for Shandong Bohui Paper IndustryLtd

查看我们对山东博汇纸业有限公司的最新分析

What Is Shandong Bohui Paper IndustryLtd's Net Debt?

山东博汇纸业有限公司的净债务是多少?

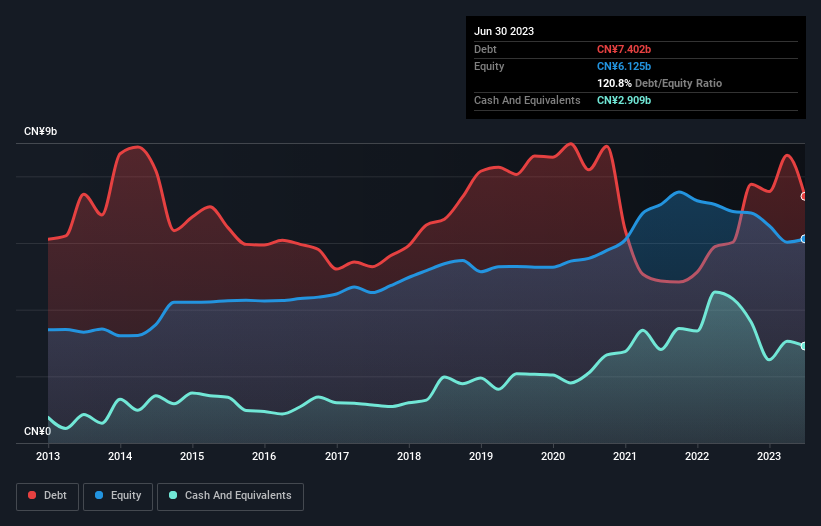

You can click the graphic below for the historical numbers, but it shows that as of June 2023 Shandong Bohui Paper IndustryLtd had CN¥7.40b of debt, an increase on CN¥6.02b, over one year. However, it does have CN¥2.91b in cash offsetting this, leading to net debt of about CN¥4.49b.

你可以点击下图查看历史数据,但它显示,截至2023年6月,山东博汇纸业有限公司的债务为74亿元人民币,比一年前增加了60.2亿元人民币。然而,它确实有29.1亿加元的现金来抵消这一点,导致净债务约为44.9亿加元。

How Strong Is Shandong Bohui Paper IndustryLtd's Balance Sheet?

山东博汇纸业的资产负债表有多强?

Zooming in on the latest balance sheet data, we can see that Shandong Bohui Paper IndustryLtd had liabilities of CN¥13.5b due within 12 months and liabilities of CN¥2.72b due beyond that. On the other hand, it had cash of CN¥2.91b and CN¥1.95b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥11.3b.

放大最新的资产负债表数据,我们可以看到,山东博汇纸业有限公司有135亿加元的负债在12个月内到期,还有27.2亿加元的负债在12个月内到期。另一方面,一年内有29.1亿加元现金和19.5亿加元应收账款到期。因此,它的负债超过了现金和(近期)应收账款的总和113亿元。

When you consider that this deficiency exceeds the company's CN¥8.65b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Shandong Bohui Paper IndustryLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

当你考虑到这一缺口超过了该公司86.5亿元的市值时,你很可能会倾向于专心审查资产负债表。假设,如果该公司被迫通过以当前股价筹集资金来偿还债务,将需要极大的稀释。当你分析债务时,资产负债表显然是你关注的领域。但最终,该业务未来的盈利能力将决定山东博汇纸业有限公司能否随着时间的推移加强其资产负债表。所以,如果你关注未来,你可以看看这个免费显示分析师利润预测的报告。

In the last year Shandong Bohui Paper IndustryLtd wasn't profitable at an EBIT level, but managed to grow its revenue by 5.9%, to CN¥18b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

去年,山东博汇纸业股份有限公司没有实现息税前利润,但收入增长了5.9%,达到人民币180亿元。这种增长速度对我们的品味来说有点慢,但它需要所有类型的人来创造一个世界。

Caveat Emptor

告诫买入者

Importantly, Shandong Bohui Paper IndustryLtd had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at CN¥467m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through CN¥1.5b in negative free cash flow over the last year. That means it's on the risky side of things. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Shandong Bohui Paper IndustryLtd that you should be aware of before investing here.

重要的是,山东博汇纸业有限公司去年出现息税前利润(EBIT)亏损。具体地说,息税前亏损为4.67亿加元。考虑到上面提到的债务,让我们对公司感到紧张。在对这只股票产生太大兴趣之前,我们希望看到一些强劲的短期改善。尤其是因为它在去年消耗了15亿元人民币的负自由现金流。这意味着它在事情中处于危险的一边。毫无疑问,我们从资产负债表中了解到的债务最多。然而,并非所有投资风险都存在于资产负债表中--远非如此。例如,我们发现山东博汇纸业有限公司1个警示标志在这里投资之前你应该意识到这一点。

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

如果你对一家增长迅速、资产负债表坚如磐石的公司更感兴趣,那么请立即查看我们的净现金成长型股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。