Koal Software (SHSE:603232) Pops 16% This Week, Taking Five-year Gains to 49%

Koal Software (SHSE:603232) Pops 16% This Week, Taking Five-year Gains to 49%

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the Koal Software share price has climbed 44% in five years, easily topping the market return of 32% (ignoring dividends).

一般来说,主动选股的目的是找到那些提供高于市场平均水平的回报的公司。根据我们的经验,购买合适的股票可以显著增加你的财富。也就是说,Koal Software的股价在五年内攀升了44%,轻松超过了32%的市场回报率(不考虑股息)。

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

在连续7天表现稳健的基础上,让我们来看看该公司的基本面在推动长期股东回报方面发挥了什么作用。

See our latest analysis for Koal Software

查看我们对Koal Software的最新分析

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

虽然市场是一种强大的定价机制,但股价反映的是投资者情绪,而不仅仅是潜在的企业表现。一种不完美但简单的方法来考虑市场对一家公司的看法是如何改变的,那就是将每股收益(EPS)的变化与股价走势进行比较。

Koal Software's earnings per share are down 23% per year, despite strong share price performance over five years.

尽管五年来股价表现强劲,但Koal Software的每股收益每年仍下降23%。

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

这意味着市场不太可能根据盈利增长来评判该公司。由于每股收益的变化似乎与股价的变化没有相关性,因此值得看看其他指标。

We doubt the modest 0.9% dividend yield is attracting many buyers to the stock. In contrast revenue growth of 19% per year is probably viewed as evidence that Koal Software is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

我们怀疑,0.9%的适度股息收益率是否吸引了许多买家买入该股。相比之下,每年19%的收入增长可能被视为考尔软件正在增长的证据,这是一个真正的积极因素。在这种情况下,该公司可能是在牺牲当前的每股收益来推动增长。

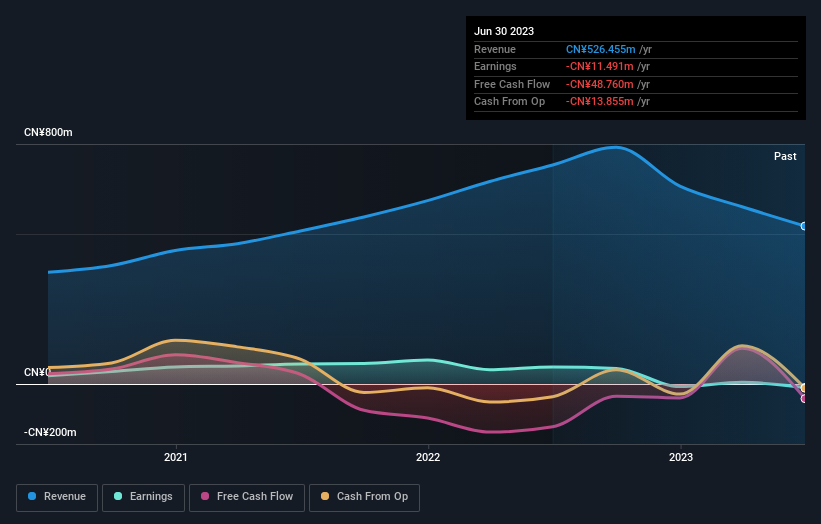

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

下图显示了收益和收入随时间的变化情况(如果您点击该图,您可以看到更多详细信息)。

If you are thinking of buying or selling Koal Software stock, you should check out this FREE detailed report on its balance sheet.

如果您正在考虑购买或出售Koal Software股票,您应该查看以下内容免费关于其资产负债表的详细报告。

What About Dividends?

那股息呢?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Koal Software, it has a TSR of 49% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

重要的是要考虑任何给定股票的总股东回报以及股价回报。TSR包括任何剥离或贴现融资的价值,以及任何股息,基于股息再投资的假设。公平地说,TSR为支付股息的股票提供了更完整的图景。以Koal Software为例,它在过去5年的TSR为49%。这超过了我们之前提到的它的股价回报。而且,猜测股息支付在很大程度上解释了这种差异是没有好处的!

A Different Perspective

不同的视角

While the broader market gained around 0.7% in the last year, Koal Software shareholders lost 18% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Koal Software you should be aware of, and 1 of them is significant.

虽然去年大盘上涨了约0.7%,但Koal Software的股东损失了18%(甚至包括股息)。然而,请记住,即使是最好的股票,在12个月的时间里,有时也会表现逊于市场。好的一面是,长期股东已经赚到了钱,过去五年的年回报率为8%。最近的抛售可能是一个机会,因此可能值得查看基本面数据,以寻找长期增长趋势的迹象。虽然值得考虑市场状况对股价可能产生的不同影响,但还有其他更重要的因素。一个恰当的例子:我们发现了Koal软件的2个警告标志你应该意识到,其中1个是重要的。

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

如果你喜欢和管理层一起买股票,那么你可能会喜欢这本书免费公司名单。(提示:内部人士一直在买入这些股票)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

请注意,本文引用的市场回报反映了目前在中国交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.