PetMed Express, Inc. (NASDAQ:PETS) Might Not Be As Mispriced As It Looks After Plunging 33%

PetMed Express, Inc. (NASDAQ:PETS) Might Not Be As Mispriced As It Looks After Plunging 33%

Unfortunately for some shareholders, the PetMed Express, Inc. (NASDAQ:PETS) share price has dived 33% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 69% loss during that time.

不幸的是,对于一些股东来说, PetMed Express, In 纳斯达克股票代码:PETS)的股价在过去三十天中下跌了33%,延续了最近的痛苦。对于股东来说,最近的下跌结束了灾难性的十二个月,在此期间,他们的亏损为69%。

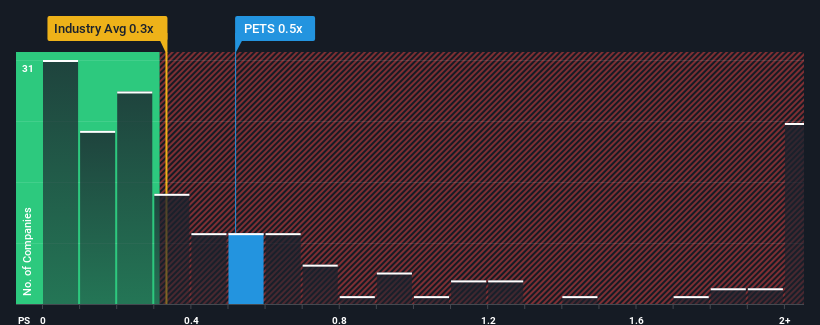

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about PetMed Express' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in the United States is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

尽管价格大幅下跌,但你对PetMed Express的0.5倍市盈率漠不关心仍然是可以原谅的,因为美国专业零售行业的中位数市盈率(或 “市盈率”)也接近0.3倍。但是,如果市盈率没有合理的基础,投资者可能会忽视明显的机会或潜在的挫折。

View our latest analysis for PetMed Express

查看我们对PetMed Express的最新分析

What Does PetMed Express' Recent Performance Look Like?

PetMed Express 最近的表现是什么样子?

PetMed Express' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on PetMed Express will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

PetMed Express最近的收入增长与大多数其他公司非常相似。也许市场预计未来的收入表现不会显示出剧烈变化的迹象,这证明市盈率保持在当前水平是合理的。那些看好PetMed Express的人希望收入表现能够回升,这样他们就可以以略低的估值买入该股。

How Is PetMed Express' Revenue Growth Trending?

PetMed Express 的收入增长趋势如何?

There's an inherent assumption that a company should be matching the industry for P/S ratios like PetMed Express' to be considered reasonable.

人们固有的假设是,一家公司应该与行业相提并论,这样像PetMed Express这样的市盈率才算合理。

If we review the last year of revenue growth, the company posted a worthy increase of 3.1%. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 12% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

如果我们回顾一下去年的收入增长,该公司公布了3.1%的可观增长。但是,它最终无法扭转前一时期的糟糕表现,在过去三年中,总收入下降了12%。因此,股东们会对中期收入增长率感到悲观。

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 16% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.6%, which is noticeably less attractive.

展望未来,报道该公司的两位分析师的估计表明,明年收入将增长16%。同时,该行业的其他部门预计仅增长6.6%,这明显降低了吸引力。

With this in consideration, we find it intriguing that PetMed Express' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

考虑到这一点,我们发现有趣的是,PetMed Express的市盈率与行业同行非常接近。显然,一些股东对预测持怀疑态度,并一直在接受较低的销售价格。

What Does PetMed Express' P/S Mean For Investors?

PetMed Express的市盈率对投资者意味着什么?

PetMed Express' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

PetMed Express的股价暴跌使其市盈率回到了与该行业其他公司相似的区域。通常,我们倾向于将价格与销售比率的使用限制在确定市场对公司整体健康状况的看法上。

We've established that PetMed Express currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

我们已经确定,PetMed Express目前的市盈率低于预期,因为其预测的收入增长高于整个行业。也许收入预测的不确定性是使市盈率与行业其他部门保持一致的原因。看来有些人确实在预测收入不稳定,因为这些条件通常应该会提振股价。

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with PetMed Express, and understanding should be part of your investment process.

始终需要考虑永远存在的投资风险幽灵。我们已经确定了 1 个带有 PetMed Express,理解应该是你投资过程的一部分。

If these risks are making you reconsider your opinion on PetMed Express, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些 风险让你重新考虑你对 PetMed Express 的看法,浏览我们的高品质股票互动清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

PetMed Express' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on PetMed Express will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

PetMed Express' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on PetMed Express will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.