Industry Analysts Just Made A Sizeable Upgrade To Their Tango Therapeutics, Inc. (NASDAQ:TNGX) Revenue Forecasts

Industry Analysts Just Made A Sizeable Upgrade To Their Tango Therapeutics, Inc. (NASDAQ:TNGX) Revenue Forecasts

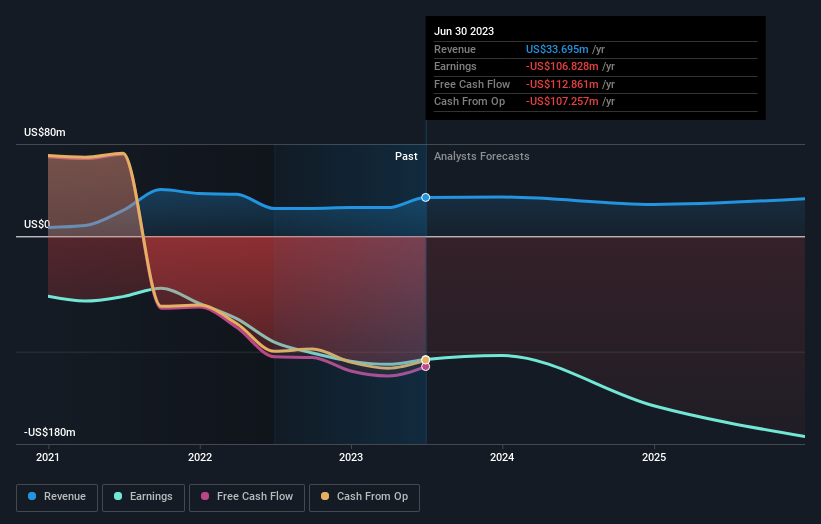

Tango Therapeutics, Inc. (NASDAQ:TNGX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's forecasts. The revenue forecast for next year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. The stock price has risen 8.9% to US$8.94 over the past week, suggesting investors are becoming more optimistic. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

探戈疗法, Inc. 纳斯达克股票代码:TNGX)的股东今天将有理由微笑,分析师大幅上调了明年的预测。明年的收入预测有所改观,分析师现在对其销售渠道更加乐观。过去一周,股价上涨8.9%,至8.94美元,这表明投资者变得更加乐观。但是,升级是否足以推动股价上涨还有待观察。

After the upgrade, the consensus from Tango Therapeutics' five analysts is for revenues of US$32m in 2024, which would reflect a noticeable 6.0% decline in sales compared to the last year of performance. Losses are supposed to balloon 29% to US$1.36 per share. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$28m and losses of US$1.44 per share in 2024. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a sizeable increase to their revenue forecasts while also reducing the estimated loss as the business grows towards breakeven.

上调后,Tango Therapeutics的五位分析师一致认为,2024年的收入为3200万美元,这将反映销售额与去年业绩相比明显下降6.0%。亏损预计将激增29%,至每股1.36美元。然而,在最新估计之前,分析师一直预测2024年的收入为2,800万美元,每股亏损1.44美元。因此,在最近的共识更新之后,人们的看法发生了很大变化,随着业务向盈亏平衡的发展,分析师大幅提高了收入预期,同时也减少了估计的亏损。

Check out our latest analysis for Tango Therapeutics

查看我们对 Tango Therapeutics 的最新分析

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 4.9% by the end of 2024. This indicates a significant reduction from annual growth of 40% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. It's pretty clear that Tango Therapeutics' revenues are expected to perform substantially worse than the wider industry.

获取有关这些预测的更多背景信息的一种方法是研究它们与过去的业绩相比如何,以及同一行业中其他公司的表现。这些估计表明,预计销售将放缓,预计到2024年底,年化收入将下降4.9%。这表明,与去年40%的年增长率相比,已大幅下降。相比之下,我们的数据表明,在可预见的将来,同一行业的其他公司(包括分析师报道)的收入预计每年将增长15%。很明显,预计Tango Therapeutics的收入表现将大大低于整个行业。

The Bottom Line

底线

The highlight for us was that the consensus reduced its estimated losses next year, perhaps suggesting Tango Therapeutics is moving incrementally towards profitability. Fortunately, they also upgraded their revenue estimates, and are forecasting revenues to grow slower than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Tango Therapeutics.

对我们来说,亮点是,该共识减少了明年的预计亏损,这可能表明Tango Therapeutics正在逐步实现盈利。幸运的是,他们还上调了收入预期,并预测收入增长将低于整个市场。鉴于分析师似乎预计销售渠道将取得实质性改善,现在可能是重新审视Tango Therapeutics的合适时机。

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 4 potential warning signs with Tango Therapeutics, including dilutive stock issuance over the past year. For more information, you can click through to our platform to learn more about this and the 2 other warning signs we've identified .

这些收益上调看起来像是英镑的支持,但在跳水之前,你应该知道,我们已经发现了Tango Therapeutics的4个潜在警告信号,包括过去一年的稀释性股票发行。欲了解更多信息,您可以点击进入我们的平台,详细了解这一点以及我们发现的其他两个警告信号。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

当然,看看公司管理层 投入大量资金 在股票中与了解分析师是否在提高估计值一样有用。所以你可能还想搜索这个 免费的 内部人士正在购买的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 4.9% by the end of 2024. This indicates a significant reduction from annual growth of 40% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. It's pretty clear that Tango Therapeutics' revenues are expected to perform substantially worse than the wider industry.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 4.9% by the end of 2024. This indicates a significant reduction from annual growth of 40% over the last year. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 15% annually for the foreseeable future. It's pretty clear that Tango Therapeutics' revenues are expected to perform substantially worse than the wider industry.