Investors in Paylocity Holding (NASDAQ:PCTY) Have Seen Solid Returns of 124% Over the Past Five Years

Investors in Paylocity Holding (NASDAQ:PCTY) Have Seen Solid Returns of 124% Over the Past Five Years

It hasn't been the best quarter for Paylocity Holding Corporation (NASDAQ:PCTY) shareholders, since the share price has fallen 25% in that time. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 124% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend.

对于Paylocity Holding Corporation(纳斯达克股票代码:PCTY)股东来说,这并不是最好的季度,因为当时股价已经下跌了25%。但与之形成鲜明对比的是,过去五年的回报给人留下了深刻的印象。我们认为,在此期间,大多数投资者会对124%的回报感到满意。因此,尽管看到股价下跌从来都不是一件好事,但重要的是要着眼于更长的时间跨度。最终,业务表现将决定股价是否延续长期的积极趋势。

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

因此,让我们评估过去5年的基本面,看看它们是否与股东回报同步变化。

Check out our latest analysis for Paylocity Holding

查看我们对 Paylocity Holding 的最新分析

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

尽管一些人继续教导高效市场假说,但事实证明,市场是反应过度的动态系统,投资者并不总是理性的。通过比较每股收益(EPS)和股价随时间推移的变化,我们可以了解投资者对公司的态度随着时间的推移而发生了怎样的变化。

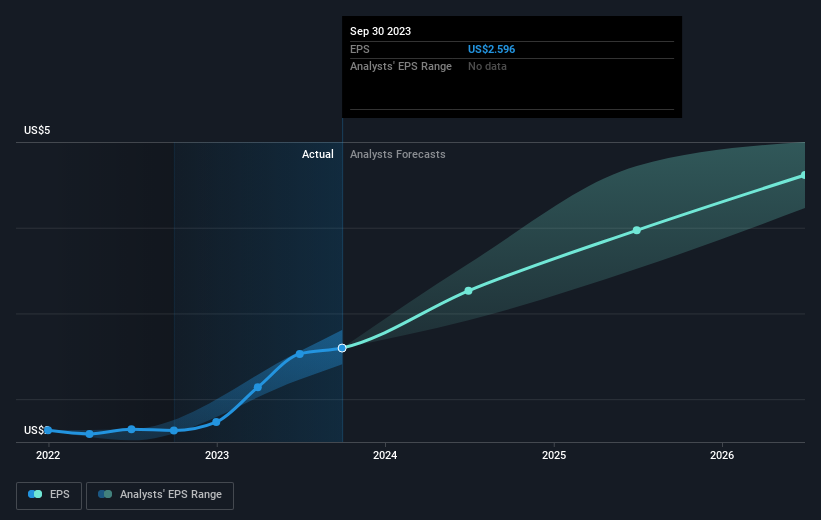

During five years of share price growth, Paylocity Holding achieved compound earnings per share (EPS) growth of 23% per year. This EPS growth is higher than the 17% average annual increase in the share price. Therefore, it seems the market has become relatively pessimistic about the company. Having said that, the market is still optimistic, given the P/E ratio of 58.17.

在五年的股价增长中,Paylocity Holding实现了每年23%的复合每股收益(EPS)增长。每股收益的增长高于股价平均年增长17%。因此,市场似乎对该公司变得相对悲观。话虽如此,鉴于市盈率为58.17,市场仍然乐观。

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

您可以在下图中看到每股收益如何随着时间的推移而变化(点击图表查看确切值)。

We know that Paylocity Holding has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

我们知道Paylocity Holding在过去三年中提高了利润,但是未来会发生什么?可能值得一看我们关于其财务状况如何随着时间的推移而变化的免费报告。

A Different Perspective

不同的视角

While the broader market gained around 16% in the last year, Paylocity Holding shareholders lost 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 17% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research Paylocity Holding in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

尽管去年整个市场上涨了约16%,但Paylocity Holding的股东却下跌了28%。但是,请记住,即使是最好的股票有时也会在十二个月内表现不如市场。好的一面是,长期股东赚了钱,在过去的五年中,每年增长17%。最近的抛售可能是一个机会,因此可能值得查看基本面数据以寻找长期增长趋势的迹象。如果你想更详细地研究Paylocity Holding,那么你可能需要看看内部人士是否在买入或卖出该公司的股票。

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

如果你想和管理层一起购买股票,那么你可能会喜欢这份免费的公司清单。(提示:内部人士一直在买入它们)。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

请注意,本文引用的市场回报反映了目前在美国交易所交易的股票的市场加权平均回报率。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.