It's Unlikely That BExcellent Group Holdings Limited's (HKG:1775) CEO Will See A Huge Pay Rise This Year

It's Unlikely That BExcellent Group Holdings Limited's (HKG:1775) CEO Will See A Huge Pay Rise This Year

Key Insights

关键见解

- BExcellent Group Holdings will host its Annual General Meeting on 19th of December

- Total pay for CEO Wai Lung Tam includes HK$1.34m salary

- The total compensation is 86% higher than the average for the industry

- BExcellent Group Holdings' EPS grew by 2.9% over the past three years while total shareholder loss over the past three years was 62%

- bExcellent Group Holdings将于12月19日举办年度股东大会

- 首席执行官谭伟隆的总薪酬包括134万港元的薪水

- 总薪酬比行业平均水平高86%

- bExcellent Group Holdings的每股收益在过去三年中增长了2.9%,而过去三年的股东总亏损为62%

In the past three years, the share price of BExcellent Group Holdings Limited (HKG:1775) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 19th of December. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

在过去三年中,bExcellent Group Holdings Limited(HKG: 1775)的股价一直难以增长,现在股东们处于亏损状态。令人担忧的是,尽管每股收益正增长,但股价并未追踪基本面趋势。这些是股东可能希望在12月19日举行的下一次年度股东大会上提出的一些担忧。他们还可以通过对高管薪酬等决议进行投票来影响管理层。下文将讨论为什么我们认为股东目前在批准加薪首席执行官时应谨慎行事。

Check out our latest analysis for BExcellent Group Holdings

查看我们对bCellent Group Holdings的最新分析

Comparing BExcellent Group Holdings Limited's CEO Compensation With The Industry

将 bExcellent 集团控股有限公司的首席执行官薪酬与业界的比较

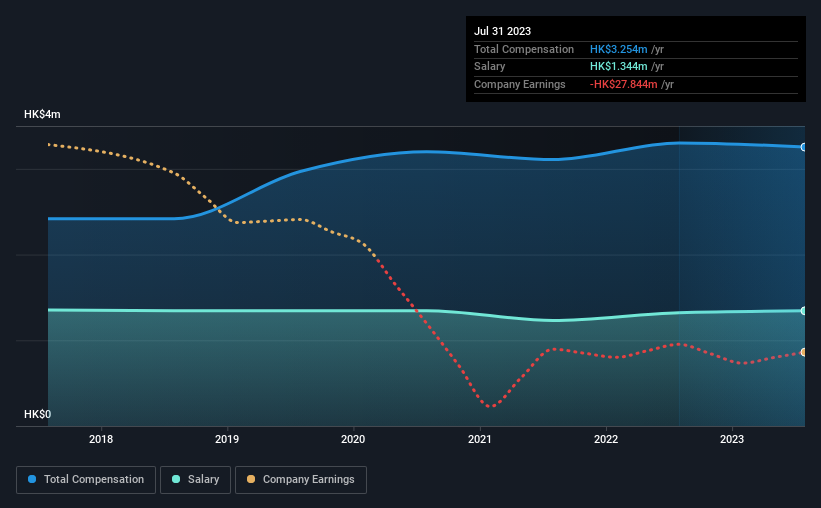

At the time of writing, our data shows that BExcellent Group Holdings Limited has a market capitalization of HK$96m, and reported total annual CEO compensation of HK$3.3m for the year to July 2023. That is, the compensation was roughly the same as last year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$1.3m.

在撰写本文时,我们的数据显示,bExcellent 集团控股有限公司的市值为9,600万港元,截至2023年7月的一年中,首席执行官的年度薪酬总额为330万港元。也就是说,薪酬与去年大致相同。虽然我们总是首先考虑总薪酬,但我们的分析表明,薪资部分较少,为130万港元。

In comparison with other companies in the Hong Kong Consumer Services industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.7m. This suggests that Wai Lung Tam is paid more than the median for the industry.

与香港消费者服务行业中市值低于16亿港元的其他公司相比,报告的首席执行官薪酬总额中位数为170万港元。这表明,谭伟隆的薪水高于该行业的中位数。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$1.3m | HK$1.3m | 41% |

| Other | HK$1.9m | HK$2.0m | 59% |

| Total Compensation | HK$3.3m | HK$3.3m | 100% |

| 组件 | 2023 | 2022 | 比例 (2023) |

| 工资 | 130万港元 | 130万港元 | 41% |

| 其他 | 190 万港元 | 200 万港元 | 59% |

| 总薪酬 | 330 万港元 | 330 万港元 | 100% |

On an industry level, around 82% of total compensation represents salary and 18% is other remuneration. It's interesting to note that BExcellent Group Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

在行业层面上,总薪酬中约有82%代表工资,18%是其他薪酬。值得注意的是,与整个行业相比,bExcellent Group Holdings分配的薪酬比例较小。如果将总薪酬倾向于非薪金福利,则表明首席执行官的薪酬与公司业绩挂钩。

BExcellent Group Holdings Limited's Growth

bExcellent 集团控股有限公司的成长

BExcellent Group Holdings Limited has seen its earnings per share (EPS) increase by 2.9% a year over the past three years. In the last year, its revenue is down 3.8%.

在过去三年中,bExcellent 集团控股有限公司的每股收益(EPS)每年增长2.9%。去年,其收入下降了3.8%。

We generally like to see a little revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

我们通常希望看到收入略有增长,但每股收益的适度改善是件好事。现在很难就业务绩效得出结论。这可能值得关注。尽管我们没有分析师对公司的预测,但股东们可能需要查看这张详细的收益、收入和现金流历史图表。

Has BExcellent Group Holdings Limited Been A Good Investment?

bCellent 集团控股有限公司是一笔不错的投资吗?

Few BExcellent Group Holdings Limited shareholders would feel satisfied with the return of -62% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

很少有bCellent Group Holdings Limited的股东会对三年内-62%的回报感到满意。因此,股东们可能希望公司在首席执行官薪酬方面不那么慷慨。

To Conclude...

总而言之...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

在过去几年中,股东们的股票价值处于亏损状态,这一事实无疑令人不安。当收益增长时,股价增长的巨大滞后可能表明,目前市场关注的还有其他问题正在影响公司。股东们可能很想知道可能压低该股的其他因素有哪些。即将举行的股东周年大会将使股东有机会就关键问题向董事会提问,例如首席执行官薪酬或他们可能遇到的任何其他问题,并重新审视他们对公司的投资论点。

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for BExcellent Group Holdings (1 shouldn't be ignored!) that you should be aware of before investing here.

首席执行官的薪酬只是审查业务绩效时需要考虑的众多因素之一。我们为bExcellent Group Holdings确定了两个警告信号(其中一个不容忽视!)在这里投资之前,你应该意识到这一点。

Important note: BExcellent Group Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:bExcellent Group Holdings是一只令人兴奋的股票,但我们知道投资者可能正在寻找不受支配的资产负债表和丰厚的回报。在这份投资回报率高、债务低的有趣公司名单中,你可能会找到更好的东西。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

In comparison with other companies in the Hong Kong Consumer Services industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.7m. This suggests that Wai Lung Tam is paid more than the median for the industry.

In comparison with other companies in the Hong Kong Consumer Services industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.7m. This suggests that Wai Lung Tam is paid more than the median for the industry.