Zhidao International (Holdings) Limited's (HKG:1220) Shares Leap 152% Yet They're Still Not Telling The Full Story

Zhidao International (Holdings) Limited's (HKG:1220) Shares Leap 152% Yet They're Still Not Telling The Full Story

Despite an already strong run, Zhidao International (Holdings) Limited (HKG:1220) shares have been powering on, with a gain of 152% in the last thirty days. The annual gain comes to 137% following the latest surge, making investors sit up and take notice.

尽管已经表现强劲,但智道国际(控股)有限公司(HKG:1220)的股价一直在上涨,在过去三十天中上涨了152%。在最近的飙升之后,年涨幅达到137%,这让投资者大吃一惊。

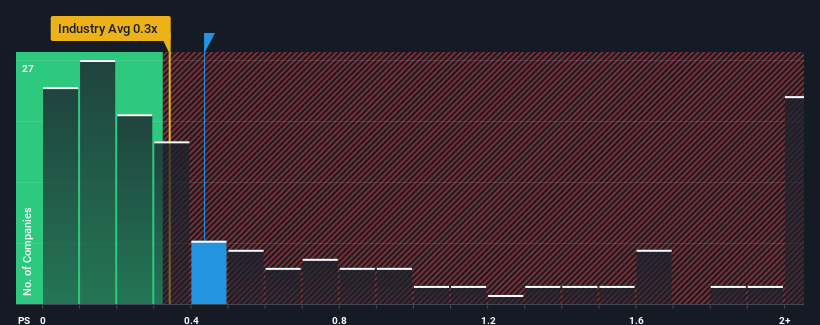

Although its price has surged higher, you could still be forgiven for feeling indifferent about Zhidao International (Holdings)'s P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Construction industry in Hong Kong is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

尽管其价格飙升,但你对智道国际(控股)0.4倍的市盈率漠不关心仍然是可以原谅的,因为香港建筑业的市盈率(或 “市盈率”)中位数也接近0.3倍。但是,如果市盈率没有合理的基础,投资者可能会忽视明显的机会或潜在的挫折。

See our latest analysis for Zhidao International (Holdings)

查看我们对智道国际(控股)的最新分析

SEHK:1220 Price to Sales Ratio vs Industry December 18th 2023

香港交易所:1220 市销比与行业的比率 2023 年 12 月 18 日

What Does Zhidao International (Holdings)'s Recent Performance Look Like?

智道国际(控股)最近的表现如何?

Zhidao International (Holdings) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

智道国际(控股)最近确实做得很好,因为它的收入增长非常快。也许市场预计未来的收入表现将逐渐减弱,这使市盈率无法上升。如果你喜欢这家公司,你会希望情况并非如此,这样你就有可能在它不太有利的情况下买入一些股票。

Although there are no analyst estimates available for Zhidao International (Holdings), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

尽管没有分析师对智道国际(控股)的估计,但请看一下这个数据丰富的免费可视化,看看该公司如何增加收益、收入和现金流。

What Are Revenue Growth Metrics Telling Us About The P/S?

收入增长指标告诉我们有关市盈率的哪些信息?

The only time you'd be comfortable seeing a P/S like Zhidao International (Holdings)'s is when the company's growth is tracking the industry closely.

看到像智道国际(控股)这样的市盈率只有当公司的增长密切关注行业时,你才会感到舒服。

If we review the last year of revenue growth, the company posted a terrific increase of 206%. Pleasingly, revenue has also lifted 300% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

如果我们回顾一下去年的收入增长,该公司公布了206%的惊人增长。令人高兴的是,得益于过去12个月的增长,总收入也比三年前增长了300%。因此,可以公平地说,该公司最近的收入增长非常好。

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

与该行业预测的13%一年增长相比,最新的中期收入轨迹明显更具吸引力

In light of this, it's curious that Zhidao International (Holdings)'s P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

有鉴于此,奇怪的是,智道国际(控股)的市盈率与其他大多数公司持平。显然,一些股东认为最近的表现已达到极限,并一直在接受较低的销售价格。

What Does Zhidao International (Holdings)'s P/S Mean For Investors?

智道国际(控股)的市盈率对投资者意味着什么?

Zhidao International (Holdings) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

智道国际(控股)似乎重新受到青睐,股价稳步上涨,使其市盈率与业内其他公司持平。通常,在做出投资决策时,我们谨慎行事,不要过多地考虑市售比率,尽管这可以充分揭示其他市场参与者对公司的看法。

We didn't quite envision Zhidao International (Holdings)'s P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

考虑到过去三年的收入增长高于当前的行业前景,我们并不完全设想智道国际(控股)的市盈率将与整个行业保持一致。可以公平地假设,该公司面临的潜在风险可能是市盈率低于预期的原因。看来有些人确实在预测收入不稳定,因为这些最近的中期条件的持续存在通常会提振股价。

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zhidao International (Holdings) (1 is potentially serious!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也发现智道国际(控股)有两个警告标志(其中一个可能很严重!)你需要注意的。

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

重要的是要确保你寻找一家优秀的公司,而不仅仅是你遇到的第一个想法。因此,如果盈利能力的增长与你对一家优秀公司的想法一致,那就来看看这份免费名单吧,列出了最近收益增长强劲(市盈率低)的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。

SEHK:1220 Price to Sales Ratio vs Industry December 18th 2023

SEHK:1220 Price to Sales Ratio vs Industry December 18th 2023