December Jobs Report: Do Economists See Cooling Signals Or Steady Growth?

December Jobs Report: Do Economists See Cooling Signals Or Steady Growth?

The Bureau of Labor Statistics' December jobs report released Friday generated varied reactions from economists and financial analysts.

劳工统计局周五发布的12月就业报告引起了经济学家和金融分析师的不同反应。

With non-farm payrolls (NFPs) growing by 216,000 and surpassing expectations, wage growth advancing more than expected and unemployment holding steady at 3.7%, experts are decoding what this means for the economy and the markets.

随着非农就业人数(NFP)增长21.6万人,超出预期,工资增长超过预期,失业率稳定在3.7%,专家们正在解读这对经济和市场意味着什么。

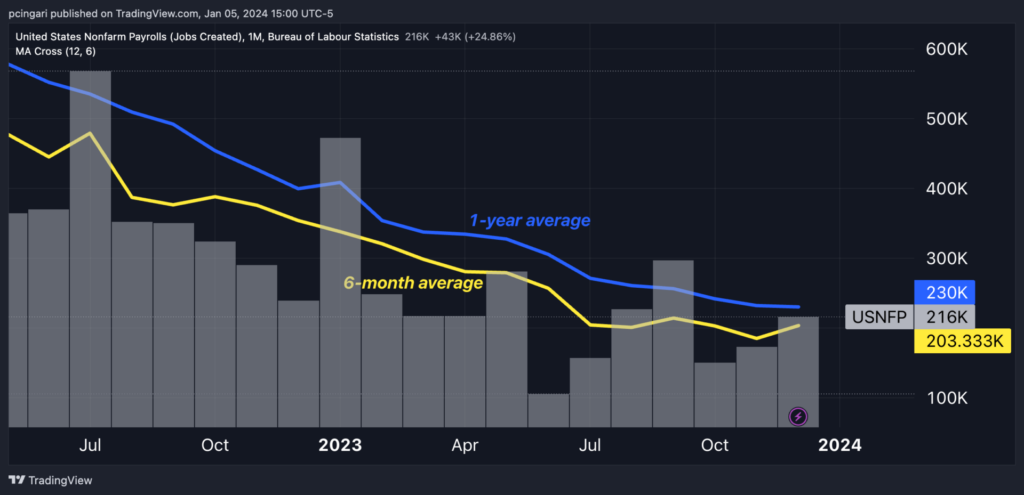

Chart: Pace Of Job Creation Surges In December 2023

图表:2023 年 12 月创造就业机会的步伐激增

Michael Gapen, chief U.S. economist, Bank of America: Gapen observed a "gradual cooling in the labor market," suggesting a trend towards a soft landing rather than a recession.

He noted, "Nonfarm payroll employment beat expectations with a 216,00 increase. However, there were net downward revisions of 71,000 to the prior two months."

Gapen's analysis pointed to a decrease in the three-month average change in nonfarm payrolls, indicating a slowdown in job growth.

美国银行首席美国经济学家迈克尔·加彭:加彭观察到 “劳动力市场逐渐降温”,这表明呈软着陆而不是衰退的趋势。

他指出:“非农就业人数超出预期,增长了216,00人。但是,与前两个月相比,净向下修正了71,000个。”

加彭的分析表明,非农就业人数的三个月平均变化有所下降,这表明就业增长放缓。

Jeffrey Roach, chief economist, LPL Financial: Roach highlighted a concerning trend, stating, "The ratio of part-timers to full-timers spiked in December, now above the pre-pandemic rate." He also pointed out the downward revisions in payroll gains, a sign of slowing economic growth.

However, Roach believed "the recent uptick in average hourly earnings is not enough for the Fed to alter its policy plans in the upcoming months."

LPL Financial首席经济学家杰弗里·罗奇:罗奇强调了一个令人担忧的趋势,他说:“12月兼职人员与全职人员的比例激增,目前已超过疫情前的水平。”他还指出,工资增长向下修正,这表明经济增长放缓。

但是,罗奇认为 “最近平均时薪的上升不足以让美联储在未来几个月内改变其政策计划。”

Chris Todd, CEO, UKG: Offering a more optimistic view, Todd said, "Employees still have the upper hand, and that advantage is here to stay for the foreseeable future."

UKG首席执行官克里斯·托德:托德提供了更为乐观的观点,他说:“员工仍然占上风,这种优势在可预见的将来将继续存在。”

He emphasized the challenges for employers in the current labor market and noted "our real-time workforce activity data shows strength and consistency." Todd's positive outlook is bolstered by moderating inflation and steady wages.

他强调了雇主在当前劳动力市场中面临的挑战,并指出 “我们的实时劳动力活动数据显示出力量和一致性。”通货膨胀放缓和和的工资支撑了托德的乐观前景。

Chris Zaccarelli, chief investment officer, Independent Advisor Alliance: Zaccarelli expressed surprise at the job market's resilience, saying, "The fact that 216,000 net jobs were added — shows that the labor market is still really hot."

He warned that high average hourly earnings could add to inflationary pressures. Zaccarelli also believed a strong economy would lead to higher revenues and profits for companies, which in turn would bolster stock prices. According to Zaccarelli, calling the end of this bull market was highly exaggerated.

独立顾问联盟首席投资官克里斯·扎卡雷利:扎卡雷利对就业市场的弹性表示惊讶,他说:“净增加21.6万个工作岗位这一事实表明劳动力市场仍然非常炎热。”

他警告说,较高的平均小时收入可能会增加通货膨胀压力。扎卡雷利还认为,强劲的经济将为公司带来更高的收入和利润,这反过来将提振股价。根据扎卡雷利的说法,称这场牛市的结束被夸大了。

Jeremy Straub, CEO and chief investment officer, Coastal Wealth: Straub's analysis suggested the robust jobs report could delay the Fed's rate cuts. He stated, "Clearly, the economy is strong enough as of now to withstand the Fed's currently elevated interest rates."

海岸财富首席执行官兼首席投资官杰里米·斯特劳布:斯特劳布的分析表明,强劲的就业报告可能会推迟美联储的降息。他说:“显然,到目前为止,经济足够强劲,足以承受美联储目前的高利率。”

Straub expected the stock market to remain range-bound in the short term due to typical profit-taking after recent rallies.

斯特劳布预计,由于近期涨势后出现典型的获利回吐,股市将在短期内保持区间波动。

Market reactions: Friday session saw U.S. Treasury yields moving higher with the 10-year benchmark reaching 4.05% yield. Longer-dated 30-year yields surged to 4.20%.

市场反应:周五交易日美国国债收益率走高,10年期基准收益率达到4.05%。长期的30年期国债收益率飙升至4.20%。

In response, bond-related ETFs took a hit. The popular iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) tumbled 1%, while the US Treasury 10 Year Note ETF (NYSE:UTEN) fell 0.4%.

作为回应,与债券相关的ETF受到了打击。广受欢迎的iShares 20年期以上国债ETF(纳斯达克股票代码:TLT)下跌了1%,而美国国债10年期国债ETF(纽约证券交易所代码:UTEN)下跌0.4%。

Read Now: Interest Rates Unlikely To Fall Soon: Bond Guru Projects 10-Year Yields Spiking To 5.5% In 2024

立即阅读: 利率不太可能很快下降:债券大师预计10年期收益率将在2024年飙升至5.5%

Photo: Shutterstock

照片:Shutterstock

Jeffrey Roach, chief economist, LPL Financial: Roach highlighted a concerning trend, stating, "The ratio of part-timers to full-timers spiked in December, now above the pre-pandemic rate." He also pointed out the downward revisions in payroll gains, a sign of slowing economic growth.

Jeffrey Roach, chief economist, LPL Financial: Roach highlighted a concerning trend, stating, "The ratio of part-timers to full-timers spiked in December, now above the pre-pandemic rate." He also pointed out the downward revisions in payroll gains, a sign of slowing economic growth.