These Developed Markets Outside US Are Getting Bullish: Here's What VEA ETF Technical Chart Shows

These Developed Markets Outside US Are Getting Bullish: Here's What VEA ETF Technical Chart Shows

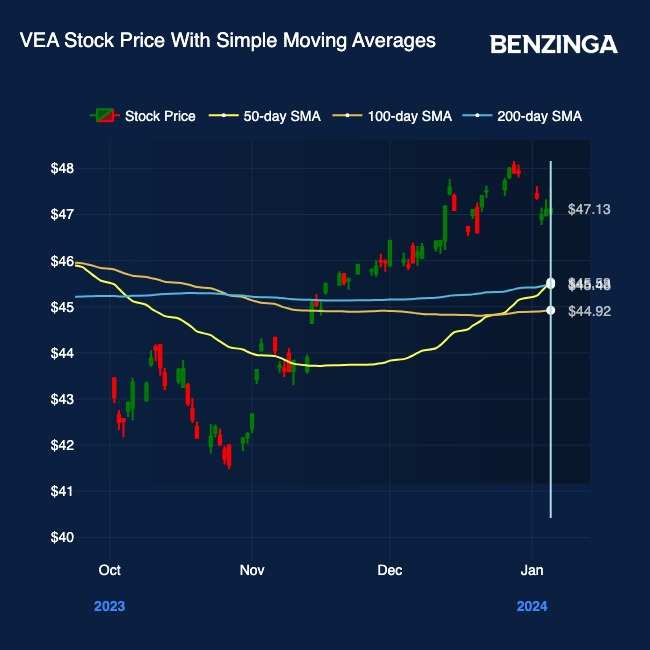

The Vanguard FTSE Developed Markets ETF (NYSE:VEA) just formed a Golden Cross on the technical charts. Developed markets, outside the U.S., hope for a bullish price trend ahead.

Vanguard富时发达市场ETF(纽约证券交易所代码:VEA)刚刚在技术图表上形成了金十字勋章。美国以外的发达市场希望未来出现看涨的价格走势。

The VEA ETF: The VEA ETF tracks the FTSE Developed ex-U.S. All Cap Net Tax (US RIC) Index. It offers exposure to developed markets outside of North America, including:

VEA ETF:VEA ETF追踪除美国以外的富时开发指数所有市值净税(美国 RIC)指数。它为北美以外的发达市场提供了机会,包括:

- Europe (~53%)

- Japan (20%)

- Australia (6%).

- 欧洲(约 53%)

- 日本(20%)

- 澳大利亚 (6%)。

In essence, it is an investment vehicle popularly used to get overweight ex-U.S. developed markets.

从本质上讲,它是一种投资工具,通常用于增持美国以外的发达市场。

Currently, 70% of the ETF is invested in large-cap stocks, with the financial sector being the dominating sector at 21.62%.

目前,ETF的70%投资于大盘股,其中金融板块占主导地位,为21.62%。

The VEA ETF trumps the iShares MSCI EAFE ETF (NYSE:EFA) in depth of holdings and cost efficiency. While the VEA is invested across 4,500 holdings, the EFA portfolio is spread across 1,000 holdings. The VEA has an expense ratio of 0.05% versus the EFA which charges 0.35%.

VEA ETF在持股深度和成本效率方面胜过iShares MSCI EAFE ETF(纽约证券交易所代码:EFA)。虽然VEA投资于4500个持股,但EFA投资组合分布在1,000个持股中。VEA的支出比率为0.05%,而EFA的费用比率为0.35%。

"Japanese stocks remain attractive, given rerating potential driven by corporate governance reforms," John Bilton, head of Global Multi-Asset Strategy at JPMorgan, said.

摩根大通全球多资产策略主管约翰·比尔顿表示:“鉴于公司治理改革推动的重新评级潜力,日本股市仍然具有吸引力。”

For the first quarter of 2024, Bilton expects to see U.K. equity as cheap and supported by valuations and flows.

比尔顿预计,在2024年第一季度,英国股票价格低廉,并得到估值和流量的支持。

"It is a defensive market; with a positive gearing towards commodities," he added.

他补充说:“这是一个防御性市场;对大宗商品的利率为正。”

Wells Fargo has a year-end 2024 target of 2,000-2,200 for the MSCI EAFE Index which tracks the developed markets ex-U.S. and Canada. The investment firm said they "prefer developed-market over emerging-market equities."

富国银行将追踪除美国和加拿大以外的发达市场的摩根士丹利资本国际EAFE指数的目标定为2024年底2,000-2,200。该投资公司表示,他们 “更喜欢发达市场而不是新兴市场股票。”

Compelling alternatives to the VEA ETF include: the Vanguard Total International Stock ETF (NASDAQ:VXUS) and the RAFI-weighted Invesco FTSE RAFI Developed Markets ex-U.S. ETF (NYSE:PXF) (which also includes Canadian stocks).

VEA ETF的引人注目的替代品包括:Vanguard Total International Stock ETF(纳斯达克股票代码:VXUS)和RAFI加权的景顺富时RAFI除美国以外的发达市场ETF(纽约证券交易所代码:PXF)(其中还包括加拿大股票)。

The VEA Chart: The VEA technical price chart indicates a Golden Cross forming. The 50-day SMA can be seen crossing over the 200-day SMA, indicating a bullish trend kicking in.

VEA图表:VEA技术价格图表显示了金十字形的形成。可以看到50天均线突破了200天均线,这表明看涨趋势开始了。

At a P/E ratio of 12.97, investors in developed markets may find the VEA particularly attractive.

市盈率为12.97,发达市场的投资者可能会发现VEA特别有吸引力。

Now Read: Earnings Season Preview – How Will Corporate Profit Outlooks Impact Markets In 2024?

立即阅读:财报季预览——企业利润前景将如何影响2024年的市场?

Image: Shutterstock

图片:Shutterstock

Currently, 70% of the ETF is invested in large-cap stocks, with the financial sector being the dominating sector at 21.62%.

Currently, 70% of the ETF is invested in large-cap stocks, with the financial sector being the dominating sector at 21.62%.