- 要闻

- What Box, Inc. 's(纽约证券交易所代码:BOX)市销率没有告诉你

What Box, Inc.'s (NYSE:BOX) P/S Is Not Telling You

What Box, Inc.'s (NYSE:BOX) P/S Is Not Telling You

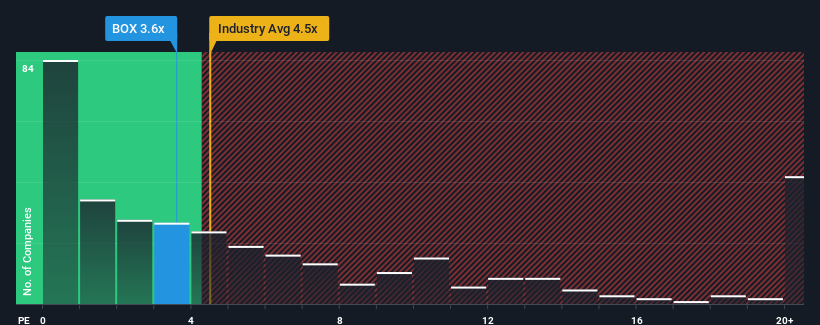

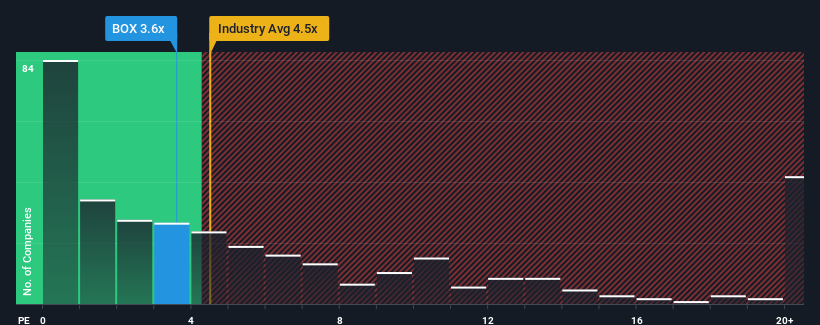

It's not a stretch to say that Box, Inc.'s (NYSE:BOX) price-to-sales (or "P/S") ratio of 3.6x right now seems quite "middle-of-the-road" for companies in the Software industry in the United States, where the median P/S ratio is around 4.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Box

What Does Box's Recent Performance Look Like?

Box could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Box's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Box?

Box's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Box's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.6% last year. The latest three year period has also seen an excellent 37% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 6.5% per year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 17% each year growth forecast for the broader industry.

With this in mind, we find it intriguing that Box's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Box's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with Box (including 1 which is potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

这么说 Box, Inc. 并不费吹灰之力。”s(纽约证券交易所代码:BOX)3.6倍的市销率(或 “市盈率”)对于美国软件行业的公司来说似乎相当 “中间道路”,市销率中位数约为4.5倍。尽管这可能不会引起任何关注,但如果市销率不合理,投资者可能会错过潜在的机会或无视迫在眉睫的失望情绪。

查看我们对 Box 的最新分析

Box 最近的表现是什么样子?

Box可能会做得更好,因为它最近的收入增长幅度低于大多数其他公司。也许市场预计未来的收入表现将有所提高,这阻止了市销率的下降。你真的希望如此,否则你会为一家具有这种增长概况的公司付出相对较高的代价。

想了解分析师如何看待Box的未来与行业的对立吗?在这种情况下,我们的免费报告是一个很好的起点。预计Box的收入会增长吗?

Box的市销率对于一家预计只会实现适度增长且重要的是表现与行业持平的公司来说是典型的。

Box的市销率对于一家预计只会实现适度增长且重要的是表现与行业持平的公司来说是典型的。

首先回顾一下,我们发现该公司去年的收入成功增长了6.6%。在最近三年中,总收入也实现了37%的出色增长,这在一定程度上得益于其短期表现。因此,可以公平地说,该公司最近的收入增长非常好。

展望未来,该公司的分析师表示,预计未来三年收入每年将增长6.5%。这将大大低于整个行业每年17%的增长预期。

考虑到这一点,我们发现有趣的是,Box的市销率与业内同行非常接近。显然,该公司的许多投资者没有分析师所表示的那么看跌,并且不愿意立即放弃股票。如果市销率降至更符合增长前景的水平,这些股东可能会为未来的失望做好准备。

关键要点

通常,我们倾向于限制使用市销率来确定市场对公司整体健康状况的看法。

当你考虑到与整个行业相比,Box的收入增长预期相当低时,不难理解我们为何认为以目前的市销率进行交易是出乎意料的。当我们看到与该行业相比收入前景相对疲软的公司时,我们怀疑股价有下跌的风险,从而使温和的市销售率走低。为了证明当前的市销率是合理的,需要做出积极的改变。

另外,你还应该了解我们在Box中发现的这两个警告信号(包括一个可能严重的警告)。

如果你喜欢强势的公司盈利,那么你需要免费查看这份以低市盈率进行交易(但已证明可以增加收益)的有趣公司名单。

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧