Investors Aren't Buying UGI Corporation's (NYSE:UGI) Revenues

Investors Aren't Buying UGI Corporation's (NYSE:UGI) Revenues

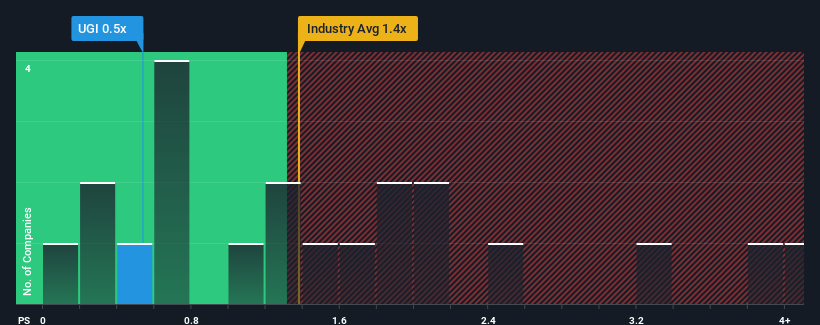

UGI Corporation's (NYSE:UGI) price-to-sales (or "P/S") ratio of 0.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Gas Utilities industry in the United States have P/S ratios greater than 1.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

考虑到美国燃气公用事业行业将近一半的公司的市销率大于1.6倍,UGI公司(纽约证券交易所代码:UGI)0.5倍的市销率(或 “市盈率”)可能看起来是一个非常有吸引力的投资机会。但是,我们需要更深入地挖掘以确定降低市销率是否有合理的依据。

Check out our latest analysis for UGI

查看我们对 UGI 的最新分析

NYSE:UGI Price to Sales Ratio vs Industry January 23rd 2024

纽约证券交易所:UGI 与行业的股价销售比率 2024 年 1 月 23 日

What Does UGI's Recent Performance Look Like?

UGI 最近的表现是什么样子?

UGI hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

UGI最近表现不佳,其收入下降与其他公司相比表现不佳,后者的平均收入有所增长。市销率可能很低,因为投资者认为这种糟糕的收入表现不会好转。因此,尽管你可以说股票很便宜,但投资者在将其视为物有所值之前会寻求改善。

Keen to find out how analysts think UGI's future stacks up against the industry? In that case, our free report is a great place to start.

想了解分析师如何看待UGI的未来与该行业的对立吗?在这种情况下,我们的免费报告是一个很好的起点。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

收入增长指标告诉我们低市销率有哪些?

In order to justify its P/S ratio, UGI would need to produce sluggish growth that's trailing the industry.

为了证明其市销率是合理的,UGI需要实现落后于该行业的缓慢增长。

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

回顾过去,去年该公司的收入下降了12%,令人沮丧。即便如此,尽管过去12个月,但总收入仍比三年前增长了36%,令人钦佩。尽管这是一个坎坷的旅程,但可以公平地说,最近的收入增长对公司来说已经足够了。

Turning to the outlook, the next three years should generate growth of 3.2% per year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 25% each year growth forecast for the broader industry.

展望来看,根据关注该公司的三位分析师的估计,未来三年将实现每年3.2%的增长。这将大大低于整个行业每年25%的增长预期。

In light of this, it's understandable that UGI's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

有鉴于此,UGI的市销率低于其他大部分公司是可以理解的。看来大多数投资者预计未来增长有限,只愿意为股票支付较少的费用。

The Final Word

最后一句话

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

仅使用市销率来确定是否应该出售股票是不明智的,但它可以作为公司未来前景的实用指南。

We've established that UGI maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

我们已经确定,UGI维持较低的市销率,原因是其预期的增长低于整个行业,正如预期的那样。在现阶段,投资者认为,收入改善的可能性不足以证明更高的市销率是合理的。该公司将需要改变命运,以证明未来市销率上升是合理的。

We don't want to rain on the parade too much, but we did also find 2 warning signs for UGI that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也确实找到了两个需要注意的 UGI 警告标志。

If these risks are making you reconsider your opinion on UGI, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑你对UGI的看法,请浏览我们的高质量股票互动清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗?直接联系我们。或者,发送电子邮件给编辑组(网址为)simplywallst.com。

Simply Wall St 的这篇文章本质上是笼统的。我们仅使用公正的方法提供基于历史数据和分析师预测的评论,我们的文章并非旨在提供财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不会考虑最新的价格敏感型公司公告或定性材料。华尔街只是没有持有上述任何股票的头寸。

UGI hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

UGI hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.