Would TECON BIOLOGYLTD (SZSE:002100) Be Better Off With Less Debt?

Would TECON BIOLOGYLTD (SZSE:002100) Be Better Off With Less Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that TECON BIOLOGY Co.LTD (SZSE:002100) does use debt in its business. But is this debt a concern to shareholders?

霍华德·马克斯说得好,他说的不是担心股价的波动,而是 “永久损失的可能性是我担心的风险... 也是我认识的每位实际投资者所担心的风险。”因此,当你评估公司的风险时,看来聪明的货币知道债务(通常涉及破产)是一个非常重要的因素。我们可以看到,拓康生物有限公司(深圳证券交易所:002100)确实在其业务中使用了债务。但是这笔债务是股东关心的问题吗?

When Is Debt A Problem?

债务何时会成为问题?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

债务是帮助企业发展的工具,但是如果企业无法还清贷款人,那么债务就任由他们摆布。归根结底,如果公司无法履行偿还债务的法律义务,股东可能会一无所有地离开。尽管这种情况并不常见,但我们经常看到负债公司永久稀释股东,因为贷款人迫使他们以不良价格筹集资金。当然,债务的好处是它通常代表廉价资本,尤其是当它取代了具有高回报率再投资能力的公司的稀释时。当我们研究债务水平时,我们首先将现金和债务水平放在一起考虑。

See our latest analysis for TECON BIOLOGYLTD

查看我们对 TECON BIOLOGYLTD 的最新分析

What Is TECON BIOLOGYLTD's Debt?

TECON BIOLOGYLTD 的债务是多少?

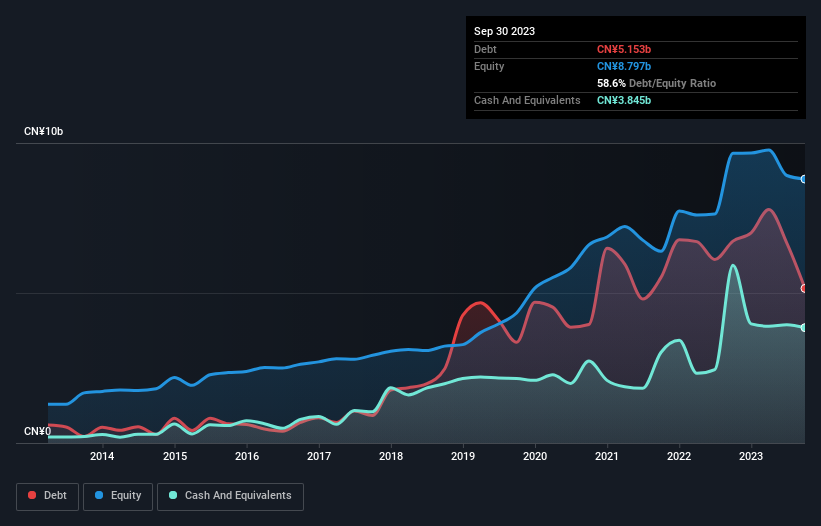

As you can see below, TECON BIOLOGYLTD had CN¥5.15b of debt at September 2023, down from CN¥6.73b a year prior. On the flip side, it has CN¥3.84b in cash leading to net debt of about CN¥1.31b.

如下所示,截至2023年9月,拓康生物有限公司的债务为51.5亿元人民币,低于去年同期的67.3亿加元。另一方面,它拥有38.4亿元人民币的现金,净负债约为13.1亿元人民币。

How Healthy Is TECON BIOLOGYLTD's Balance Sheet?

TECON BIOLOGYLTD 的资产负债表有多健康?

According to the last reported balance sheet, TECON BIOLOGYLTD had liabilities of CN¥5.47b due within 12 months, and liabilities of CN¥2.35b due beyond 12 months. Offsetting this, it had CN¥3.84b in cash and CN¥1.17b in receivables that were due within 12 months. So it has liabilities totalling CN¥2.81b more than its cash and near-term receivables, combined.

根据上次报告的资产负债表,拓康生物有限公司在12个月内到期的负债为54.7亿元人民币,12个月以后到期的负债为23.5亿元人民币。与此相抵消的是,它有38.4亿元人民币的现金和11.7亿元人民币的应收账款将在12个月内到期。因此,它的负债总额为28.1亿元人民币,比现金和短期应收账款的总和还要多。

This deficit isn't so bad because TECON BIOLOGYLTD is worth CN¥10.6b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if TECON BIOLOGYLTD can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

这种赤字还不错,因为TECON BIOLOGYLTD的市值为106亿元人民币,因此,如果需要,可能会筹集足够的资金来支撑其资产负债表。但是,我们绝对希望留意其债务带来过大风险的迹象。毫无疑问,我们从资产负债表中学到的关于债务的知识最多。但最终,该业务未来的盈利能力将决定TECON BIOLOGYLTD能否随着时间的推移加强其资产负债表。因此,如果您专注于未来,可以查看这份显示分析师利润预测的免费报告。

In the last year TECON BIOLOGYLTD wasn't profitable at an EBIT level, but managed to grow its revenue by 14%, to CN¥19b. We usually like to see faster growth from unprofitable companies, but each to their own.

去年,TECON BIOLOGYLTD在息税前利润水平上没有盈利,但成功将其收入增长了14%,达到190亿元人民币。我们通常希望看到无利可图的公司实现更快的增长,但每家公司都有自己的发展。

Caveat Emptor

Caveat Emptor

Over the last twelve months TECON BIOLOGYLTD produced an earnings before interest and tax (EBIT) loss. Indeed, it lost CN¥242m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. For example, we would not want to see a repeat of last year's loss of CN¥461m. So we do think this stock is quite risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - TECON BIOLOGYLTD has 1 warning sign we think you should be aware of.

在过去的十二个月中,TECON BIOLOGYLTD出现了息税前收益(EBIT)亏损。事实上,它在息税前利润水平上损失了2.42亿加元人民币。当我们审视这一点并回顾其资产负债表上相对于现金的负债时,对我们来说,公司有任何债务似乎是不明智的。因此,我们认为其资产负债表有些紧张,尽管并非无法修复。例如,我们不希望看到去年4.61亿元人民币的亏损重演。因此,我们确实认为这只股票风险很大。在分析债务水平时,资产负债表是显而易见的起点。但是,并非所有的投资风险都存在于资产负债表中,远非如此。例如,TECON BIOLOGYLTD 有 1 个我们认为你应该注意的警告标志。

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

归根结底,通常最好将注意力集中在没有净负债的公司身上。您可以访问我们的此类公司的特别名单(所有公司都有利润增长记录)。它是免费的。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

As you can see below, TECON BIOLOGYLTD had CN¥5.15b of debt at September 2023, down from CN¥6.73b a year prior. On the flip side, it has CN¥3.84b in cash leading to net debt of about CN¥1.31b.

As you can see below, TECON BIOLOGYLTD had CN¥5.15b of debt at September 2023, down from CN¥6.73b a year prior. On the flip side, it has CN¥3.84b in cash leading to net debt of about CN¥1.31b.