Does Equitrans Midstream Corporation (NYSE:ETRN) Create Value For Shareholders?

Does Equitrans Midstream Corporation (NYSE:ETRN) Create Value For Shareholders?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Equitrans Midstream Corporation (NYSE:ETRN).

尽管一些投资者已经精通财务指标(帽子提示),但本文适用于那些想了解股本回报率(ROE)及其重要性的人。通过边干边学的方式,我们将研究投资回报率,以更好地了解Equitrans Midstream Corporation(纽约证券交易所代码:ETRN)。

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

投资回报率或股本回报率是评估公司如何有效地从股东那里获得投资回报的有用工具。简而言之,投资回报率显示了每美元从其股东投资中产生的利润。

How Do You Calculate Return On Equity?

你如何计算股本回报率?

Return on equity can be calculated by using the formula:

股本回报率可以使用以下公式计算:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回报率 = 净利润(来自持续经营业务)÷ 股东权益

So, based on the above formula, the ROE for Equitrans Midstream is:

因此,根据上述公式,Equitrans Midstream的投资回报率为:

18% = US$387m ÷ US$2.2b (Based on the trailing twelve months to September 2023).

18% = 3.87亿美元 ¥22亿美元(基于截至2023年9月的过去十二个月)。

The 'return' is the amount earned after tax over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.18 in profit.

“回报” 是过去十二个月的税后收入。这意味着,每获得价值1美元的股东权益,该公司就会产生0.18美元的利润。

Does Equitrans Midstream Have A Good Return On Equity?

Equitrans Midstream 的股本回报率是否良好?

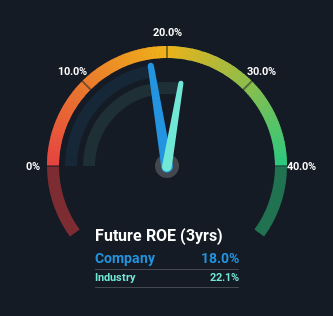

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. The image below shows that Equitrans Midstream has an ROE that is roughly in line with the Oil and Gas industry average (22%).

可以说,评估公司投资回报率的最简单方法是将其与行业平均水平进行比较。但是,这种方法仅在粗略检查时有用,因为各公司在相同的行业分类中确实存在很大差异。下图显示,Equitrans Midstream的投资回报率与石油和天然气行业的平均水平(22%)大致持平。

That's neither particularly good, nor bad. While at least the ROE is not lower than the industry, its still worth checking what role the company's debt plays as high debt levels relative to equity may also make the ROE appear high. If true, then it is more an indication of risk than the potential. You can see the 2 risks we have identified for Equitrans Midstream by visiting our risks dashboard for free on our platform here.

这既不是特别好,也不是特别糟糕。尽管至少投资回报率不低于该行业,但仍值得检查该公司的债务起了什么作用,因为相对于股权的高债务水平也可能使投资回报率显得很高。如果属实,则与其说是潜在风险,不如说是风险。您可以访问我们的 Equitrans Midstream 确定的两种风险 风险仪表板 在我们的平台上免费使用。

How Does Debt Impact ROE?

债务如何影响投资回报率?

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same.

几乎所有公司都需要资金来投资业务,以增加利润。这些现金可以来自发行股票、留存收益或债务。在前两种情况下,投资回报率将反映这种资本的增长用途。在后一种情况下,用于增长的债务将提高回报,但不会影响总权益。通过这种方式,债务的使用将提高投资回报率,尽管该业务的核心经济保持不变。

Combining Equitrans Midstream's Debt And Its 18% Return On Equity

将Equitrans Midstream的债务及其18%的股本回报率结合起来

It seems that Equitrans Midstream uses a huge volume of debt to fund the business, since it has an extremely high debt to equity ratio of 3.33. Its ROE is decent, but once I consider all the debt, I'm not really impressed.

看来Equitrans Midstream使用巨额债务为该业务提供资金,因为其债务权益比率极高,为3.33。它的投资回报率不错,但是一旦我考虑了所有的债务,我就不会留下深刻的印象。

Summary

摘要

Return on equity is one way we can compare its business quality of different companies. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have the same ROE, then I would generally prefer the one with less debt.

股本回报率是我们可以比较不同公司的业务质量的一种方式。在我们的账簿中,尽管债务很低,但质量最高的公司的股本回报率却很高。如果两家公司的投资回报率相同,那么我通常更喜欢负债较少的公司。

But when a business is high quality, the market often bids it up to a price that reflects this. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. So you might want to check this FREE visualization of analyst forecasts for the company.

但是,当企业质量很高时,市场通常会以反映这一点的价格出价。还必须考虑利润可能增长的速度,相对于当前价格所反映的利润增长预期。因此,您可能需要查看该公司的分析师预测的免费可视化效果。

But note: Equitrans Midstream may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但请注意:Equitrans Midstream可能不是最好的买入股票。因此,来看看这份投资回报率高、负债率低的有趣公司的免费清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。