Weak Statutory Earnings May Not Tell The Whole Story For EQT (NYSE:EQT)

Weak Statutory Earnings May Not Tell The Whole Story For EQT (NYSE:EQT)

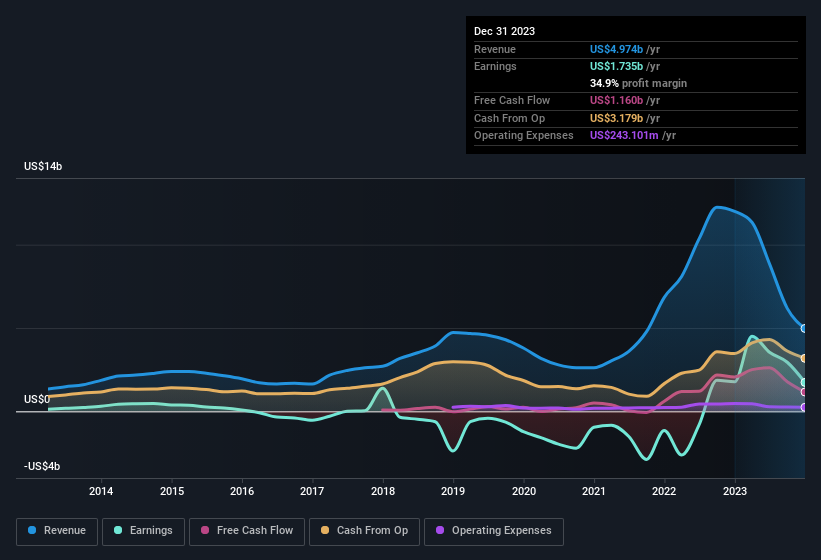

The subdued market reaction suggests that EQT Corporation's (NYSE:EQT) recent earnings didn't contain any surprises. We think that investors are worried about some weaknesses underlying the earnings.

市场反应疲软,表明殷拓公司(纽约证券交易所代码:EQT)最近的财报没有任何意外。我们认为,投资者担心收益背后的一些弱点。

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. EQT expanded the number of shares on issue by 22% over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of EQT's EPS by clicking here.

评估收益质量的一个重要方面是研究一家公司在多大程度上稀释了股东。与去年相比,殷拓将已发行股票数量扩大了22%。这意味着其收益将分配给更多的股票。每股收益等每股指标可以帮助我们了解实际股东从公司的利润中受益的程度,而净收入水平则使我们能够更好地了解公司的绝对规模。您可以点击此处查看殷拓每股收益图表。

How Is Dilution Impacting EQT's Earnings Per Share (EPS)?

稀释如何影响殷拓的每股收益(EPS)?

EQT was losing money three years ago. And even focusing only on the last twelve months, we see profit is down 2.0%. Sadly, earnings per share fell further, down a full 4.8% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

三年前,殷拓亏损。而且,即使只关注过去的十二个月,我们也认为利润下降了2.0%。可悲的是,收入 每股 进一步下跌,当时下跌了整整4.8%。因此,你可以清楚地看到稀释正在影响股东收益。

In the long term, if EQT's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

从长远来看,如果殷拓的收益 每股 可以上涨,那么股价也应该上涨。但另一方面,得知利润(但不是每股收益)正在改善,我们就不那么兴奋了。出于这个原因,假设目标是评估公司的股价是否可能上涨,你可以说从长远来看,每股收益比净收入更为重要。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

这可能会让你想知道分析师对未来盈利能力的预测。幸运的是,您可以单击此处查看根据他们的估计描绘未来盈利能力的交互式图表。

Our Take On EQT's Profit Performance

我们对殷拓利润表现的看法

Over the last year EQT issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Because of this, we think that it may be that EQT's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you'd like to know more about EQT as a business, it's important to be aware of any risks it's facing. While conducting our analysis, we found that EQT has 2 warning signs and it would be unwise to ignore these.

在过去的一年中,殷拓发行了新股,因此,每股收益和净收入增长之间存在明显的差异。因此,我们认为殷拓的法定利润可能好于其基础盈利能力。另一个坏消息是,其每股收益在去年有所下降。归根结底,如果你想正确地了解公司,必须考虑的不仅仅是上述因素。如果您想进一步了解殷拓作为一家企业,请务必了解其面临的任何风险。在进行分析时,我们发现殷拓有两个警告信号,忽视这些信号是不明智的。

This note has only looked at a single factor that sheds light on the nature of EQT's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

本报告仅研究了揭示殷拓利润性质的单一因素。但是,还有很多其他方法可以让你对公司的看法。例如,许多人认为高股本回报率是有利的商业经济的标志,而另一些人则喜欢 “关注资金”,寻找内部人士正在买入的股票。因此,你可能希望看到这份免费收藏的拥有高股本回报率的公司,或者这份内部人士正在购买的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

In the long term, if EQT's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

In the long term, if EQT's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.