Is Venustech Group (SZSE:002439) Using Too Much Debt?

Is Venustech Group (SZSE:002439) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Venustech Group Inc. (SZSE:002439) does use debt in its business. But should shareholders be worried about its use of debt?

大卫·伊本说得好,他说:“波动性不是我们关心的风险。我们关心的是避免资本的永久损失。”当我们思考一家公司的风险有多大时,我们总是喜欢考虑其债务的用途,因为债务过载可能导致破产。我们可以看到,Venustech Group Inc.(深圳证券交易所:002439)确实在其业务中使用了债务。但是,股东是否应该担心其债务的使用?

Why Does Debt Bring Risk?

为什么债务会带来风险?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

一般而言,只有当公司无法通过筹集资金或利用自己的现金流轻松偿还债务时,债务才会成为真正的问题。资本主义的重要组成部分是 “创造性破坏” 的过程,在这个过程中,倒闭的企业将被银行家无情地清算。但是,更常见(但仍然代价高昂)的情况是,公司必须以低廉的价格发行股票,永久稀释股东,以支撑其资产负债表。话虽如此,最常见的情况是公司合理地管理其债务,并从自己的利益出发。在考虑企业使用多少债务时,要做的第一件事是将现金和债务放在一起看。

What Is Venustech Group's Net Debt?

Venustech Group 的净负债是多少?

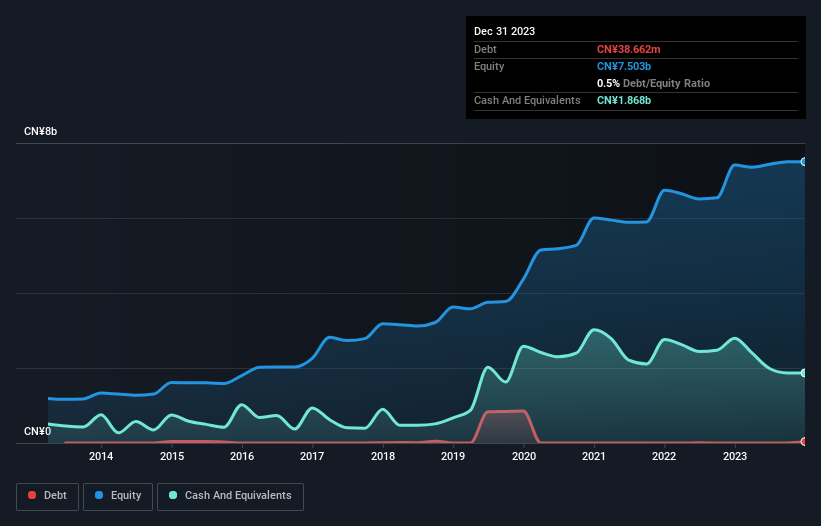

As you can see below, at the end of September 2023, Venustech Group had CN¥38.7m of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has CN¥1.87b in cash, leading to a CN¥1.83b net cash position.

如下所示,截至2023年9月底,Venustech集团的债务为3,870万元人民币,高于去年同期的零。点击图片查看更多细节。但另一方面,它也有18.7亿元人民币的现金,净现金状况为18.3亿元人民币。

How Strong Is Venustech Group's Balance Sheet?

Venustech Group 的资产负债表有多强?

According to the last reported balance sheet, Venustech Group had liabilities of CN¥2.15b due within 12 months, and liabilities of CN¥232.1m due beyond 12 months. Offsetting these obligations, it had cash of CN¥1.87b as well as receivables valued at CN¥4.59b due within 12 months. So it actually has CN¥4.08b more liquid assets than total liabilities.

根据上次报告的资产负债表,Venustech集团的负债为21.5亿元人民币,12个月后到期的负债为2.321亿元人民币。除了这些债务外,它还有18.7亿元人民币的现金以及价值45.9亿元人民币的应收账款将在12个月内到期。所以它实际上有4.08亿元人民币 更多 流动资产超过总负债。

This excess liquidity suggests that Venustech Group is taking a careful approach to debt. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Simply put, the fact that Venustech Group has more cash than debt is arguably a good indication that it can manage its debt safely.

这种过剩的流动性表明Venustech集团正在对债务采取谨慎的态度。由于它拥有充足的资产,因此不太可能与贷款人发生麻烦。简而言之,Venustech集团的现金多于债务这一事实可以说是一个很好的迹象,表明它可以安全地管理债务。

In addition to that, we're happy to report that Venustech Group has boosted its EBIT by 54%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Venustech Group can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

除此之外,我们很高兴地报告,Venustech集团已将其息税前利润提高了54%,从而减少了对未来债务偿还的担忧。资产负债表显然是分析债务时需要关注的领域。但最终,该业务的未来盈利能力将决定Venustech集团能否随着时间的推移加强其资产负债表。因此,如果你想看看专业人士的想法,你可能会发现这份关于分析师利润预测的免费报告很有趣。

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Venustech Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Venustech Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

最后,企业需要自由现金流来偿还债务;会计利润根本无法减少债务。尽管Venustech Group的资产负债表上有净现金,但仍值得一看其将利息税前收益(EBIT)转换为自由现金流的能力,以帮助我们了解其建立(或侵蚀)现金余额的速度有多快。在过去的三年中,Venustech集团消耗了大量现金。尽管这可能是增长支出的结果,但它确实使债务风险大大增加。

Summing Up

总结

While it is always sensible to investigate a company's debt, in this case Venustech Group has CN¥1.83b in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 54% over the last year. So is Venustech Group's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Venustech Group has 2 warning signs we think you should be aware of.

尽管调查公司的债务总是明智的,但在这种情况下,Venustech集团的净现金为18.3亿元人民币,资产负债表看起来不错。它的息税前利润比去年增长了54%,给我们留下了深刻的印象。那么 Venustech Group 的债务有风险吗?在我们看来,情况并非如此。毫无疑问,我们从资产负债表中学到的关于债务的知识最多。但是,并非所有的投资风险都存在于资产负债表中,远非如此。例如,Venustech集团有两个警告信号,我们认为您应该注意。

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

当然,如果你是那种喜欢在没有债务负担的情况下购买股票的投资者,那么请立即查看我们的独家净现金增长股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。