Investors Still Aren't Entirely Convinced By China Shenghai Group Limited's (HKG:1676) Revenues Despite 39% Price Jump

Investors Still Aren't Entirely Convinced By China Shenghai Group Limited's (HKG:1676) Revenues Despite 39% Price Jump

The China Shenghai Group Limited (HKG:1676) share price has done very well over the last month, posting an excellent gain of 39%. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

中国升海集团有限公司(HKG: 1676)的股价在上个月表现良好,涨幅为39%。再往前看,该股去年上涨了83%,令人鼓舞。

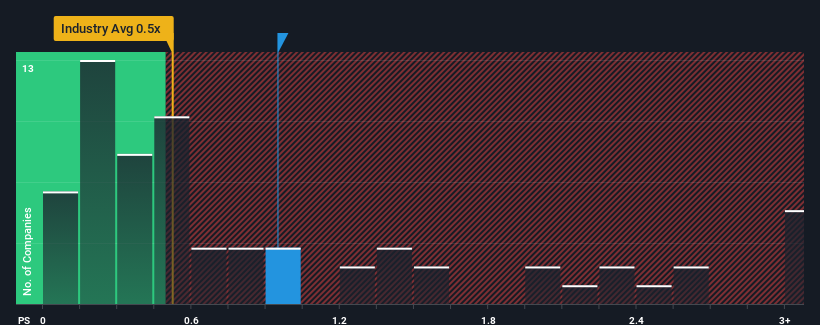

Even after such a large jump in price, you could still be forgiven for feeling indifferent about China Shenghai Group's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Food industry in Hong Kong is also close to 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

即使在价格大幅上涨之后,你仍然对中国升海集团0.9倍的市盈率漠不关心,这是可以原谅的,因为香港食品行业的中位数市销率(或 “市盈率”)也接近0.5倍。尽管这可能不会引起任何关注,但如果市销率不合理,投资者可能会错过潜在的机会或无视迫在眉睫的失望情绪。

SEHK:1676 Price to Sales Ratio vs Industry February 28th 2024

SEHK: 1676 2024 年 2 月 28 日与行业的股价销售比率

How China Shenghai Group Has Been Performing

中国升海集团的表现如何

Recent times have been quite advantageous for China Shenghai Group as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

最近对中国升海集团来说非常有利,因为其收入增长非常迅速。市销率可能适中,因为投资者认为这种强劲的收入增长可能不足以在不久的将来跑赢整个行业。如果最终没有发生这种情况,那么现有股东就有理由对股价的未来走向感到乐观。

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Shenghai Group will help you shine a light on its historical performance.

想全面了解公司的收益、收入和现金流吗?那么我们关于中国升海集团的免费报告将帮助您了解其历史表现。

Is There Some Revenue Growth Forecasted For China Shenghai Group?

预计中国升海集团的收入会增长吗?

The only time you'd be comfortable seeing a P/S like China Shenghai Group's is when the company's growth is tracking the industry closely.

你唯一能放心地看到像中国升海集团这样的市销率的时候是公司的增长密切关注该行业的时候。

Taking a look back first, we see that the company grew revenue by an impressive 127% last year. The latest three year period has also seen an excellent 32% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

首先回顾一下,我们发现该公司去年的收入增长了127%,令人印象深刻。在短期表现的推动下,最近三年的总体收入也实现了32%的出色增长。因此,我们可以首先确认该公司在这段时间内在增加收入方面做得很好。

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.7% shows it's noticeably more attractive.

将最近的中期收入轨迹与该行业6.7%的年度增长预测进行比较,可以看出该行业明显更具吸引力。

In light of this, it's curious that China Shenghai Group's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

有鉴于此,奇怪的是,中国升海集团的市销率与其他多数公司持平。可能是大多数投资者不相信该公司能够维持其近期的增长率。

What Does China Shenghai Group's P/S Mean For Investors?

中国升海集团的市销率对投资者意味着什么?

Its shares have lifted substantially and now China Shenghai Group's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

其股价已大幅上涨,现在中国升海集团的市销率已恢复在行业中位数范围内。尽管市销率不应该成为决定你是否买入股票的决定性因素,但它是衡量收入预期的有力晴雨表。

We've established that China Shenghai Group currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

我们已经确定,中国升海集团目前的市销率低于预期,因为其最近三年的增长高于整个行业的预测。当我们看到强劲的收入和快于行业的增长速度时,我们只能假设潜在风险可能会给市销率带来压力。如果最近的中期收入趋势持续下去,至少价格下跌的风险似乎有所减弱,但投资者似乎认为未来的收入可能会出现一些波动。

We don't want to rain on the parade too much, but we did also find 4 warning signs for China Shenghai Group (1 is a bit concerning!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们还发现了中国升海集团的 4 个警告标志(1 个有点令人担忧!)这是你需要注意的。

If these risks are making you reconsider your opinion on China Shenghai Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些风险让你重新考虑你对中国升海集团的看法,请浏览我们的高质量股票互动清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

Recent times have been quite advantageous for China Shenghai Group as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Recent times have been quite advantageous for China Shenghai Group as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.