NIO Surpasses Q4 Earnings Expectations, Eyes Growth With New Electric Flagship Launch

NIO Surpasses Q4 Earnings Expectations, Eyes Growth With New Electric Flagship Launch

Chinese electric vehicle startup NIO, Inc (NYSE: NIO) reported fourth-quarter revenue of 17.10 billion yuan ($2.41 billion), up by 6.5% year-over-year and down by 10.3% from the previous quarter. Analysts, on average, estimated revenue of $2.29 billion for the quarter.

中国电动汽车初创公司蔚来公司(纽约证券交易所代码:NIO)公布的第四季度收入为171.0亿元人民币(合24.1亿美元),同比增长6.5%,较上一季度下降10.3%。分析师平均估计本季度收入为22.9亿美元。

Excluding share-based compensation expenses, the company reported an adjusted loss of (2.81) yuan or ($0.39) compared to (3.07) yuan in the year-ago quarter and (2.28) yuan in the third quarter of 2023. Analysts had called for a loss of $(0.51) per share.

不包括基于股份的薪酬支出,该公司报告的调整后亏损为(2.81)元人民币或(0.39美元),而去年同期的亏损为(3.07元)元人民币,2023年第三季度为(2.28元)元。分析师曾呼吁每股亏损0.51美元。

Vehicle deliveries were 50,045 in the quarter, up by 25% Y/Y and down by 9.7% Q/Q. Consequently, vehicle revenue climbed 4.6% Y/Y and down by 11.3% Q/Q.

本季度汽车交付量为50,045辆,同比增长25%,环比下降9.7%。因此,汽车收入同比增长4.6%,环比下降11.3%。

Gross margin for the quarter expanded to 7.5%, up from the year ago's 3.9% and down from the previous quarter's 8.0%, as vehicle margin expanded from 6.8% a year ago to 11.9%.

由于汽车利润率从去年同期的6.8%增长到11.9%,该季度的毛利率从去年同期的3.9%上升至7.5%,低于上一季度的8.0%。

Cash and cash equivalents, restricted cash, short-term investment, and long-term time deposits were 57.3 billion yuan ($8.1 billion) as of December 31, 2023.

截至2023年12月31日,现金及现金等价物、限制性现金、短期投资和长期定期存款为573亿元人民币(合81亿美元)。

William Bin Li, founder, Chair and CEO of NIO, "At NIO Day 2023, we unveiled ET9, our smart electric executive flagship, showcasing a suite of our latest technologies, including our self-developed AD chip, full-domain 900V architecture, advanced intelligent chassis system and various other industry-leading innovations."

蔚来创始人、董事长兼首席执行官李威廉(William Bin Li)表示:“在2023年蔚来日上,我们推出了我们的智能电动执行旗舰产品ET9,展示了一系列最新技术,包括我们自主开发的AD芯片、全域900V架构、先进的智能底盘系统和其他各种行业领先的创新。”

"We will soon start deliveries of 2024 NIO products equipped with the highest computing power among production vehicles and constantly enhance users' driving and digital experience. Meanwhile, we plan to release Navigate on Pilot Plus (NOP+) for urban roads to all NT2.0 users in the second quarter."

“我们将很快开始交付2024款蔚来产品,这些产品配备了量产车中最高的计算能力,并不断增强用户的驾驶和数字体验。同时,我们计划在第二季度向所有NT2.0用户发布适用于城市道路的Navigate on Pilot Plus(NOP+)。”

NIO's Forward Outlook: The company guided deliveries of 31,000 – 33,000 units for the first quarter, or (0.1)% – 6.3% Y/Y.

蔚来汽车的前瞻展望:该公司指导第一季度交付31,000至33,000辆,同比增长(0.1)%至6.3%。

The company expects first quarter revenue of $1.48 billion – $1.56 billion, representing (1.7)% – 3.8% Y/Y growth and below the consensus of $2.28 billion.

该公司预计第一季度收入为14.8亿美元至15.6亿美元,同比增长(1.7)%至3.8%,低于市场预期的22.8亿美元。

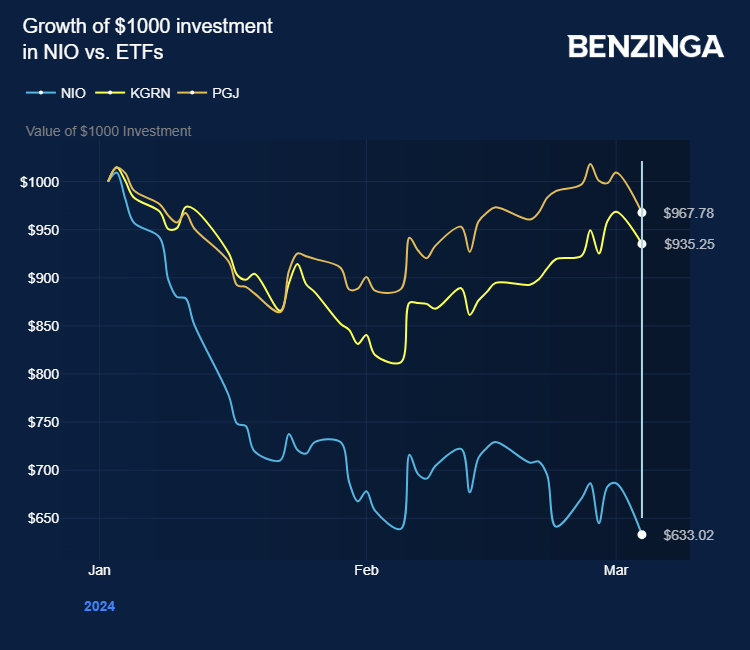

Investors can gain exposure to NIO via KraneShares MSCI China Clean Technology Index ETF (NYSE:KGRN) and Invesco Golden Dragon China ETF (NASDAQ:PGJ).

投资者可以通过KraneShares MSCI中国清洁技术指数ETF(纽约证券交易所代码:KGRN)和景顺金龙中国ETF(纳斯达克股票代码:PGJ)获得蔚来投资蔚来股票。

Price Action: NIO shares traded lower by 0.94% at $5.28 premarket on the last check Tuesday.

价格走势:蔚来股票在周二的最后一次盘前交易中下跌0.94%,至5.28美元。

Photo by T. Schneider on Shutterstock

T. Schneider 在 Shutterstock 上拍摄的照片

Gross

Gross