Here's Why We're Wary Of Buying Cadence Bank's (NYSE:CADE) For Its Upcoming Dividend

Here's Why We're Wary Of Buying Cadence Bank's (NYSE:CADE) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Cadence Bank (NYSE:CADE) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Cadence Bank's shares before the 14th of March in order to be eligible for the dividend, which will be paid on the 1st of April.

普通读者会知道我们喜欢Simply Wall St的股息,这就是为什么看到Cadence Bank(纽约证券交易所代码:CADE)即将在未来四天内进行除息交易令人兴奋的原因。除息日通常设置为记录日期前一个工作日,即您必须作为股东出现在公司账簿上才能获得股息的截止日期。除息日是需要注意的重要日期,因为在该日期或之后购买的任何股票都可能意味着延迟结算,而结算日期并未显示在记录日期。换句话说,投资者可以在3月14日之前购买Cadence Bank的股票,以便有资格获得股息,股息将于4月1日支付。

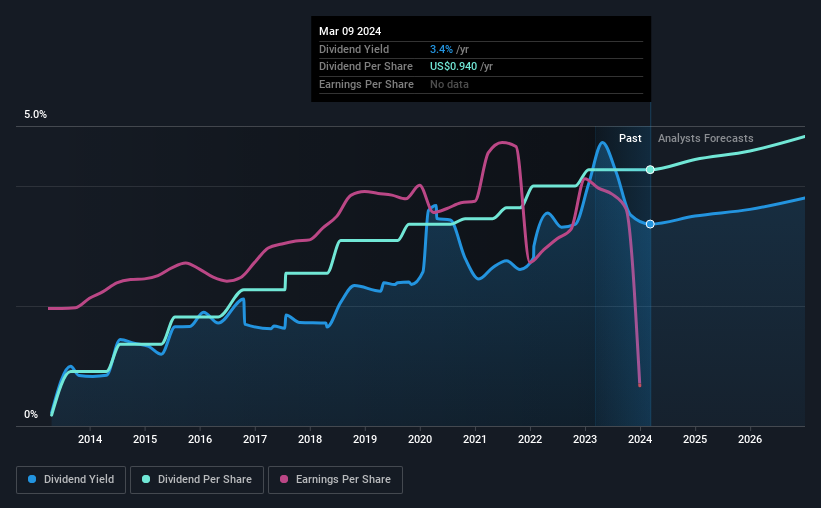

The company's next dividend payment will be US$0.25 per share. Last year, in total, the company distributed US$0.94 to shareholders. Looking at the last 12 months of distributions, Cadence Bank has a trailing yield of approximately 3.4% on its current stock price of US$27.93. If you buy this business for its dividend, you should have an idea of whether Cadence Bank's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

该公司的下一次股息将为每股0.25美元。去年,该公司总共向股东分配了0.94美元。从过去12个月的分配情况来看,Cadence银行的追踪收益率约为3.4%,而目前的股价为27.93美元。如果你收购这家企业是为了分红,你应该知道Cadence Bank的股息是否可靠和可持续。我们需要看看股息是否由收益支付,以及股息是否在增长。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Cadence Bank paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run.

股息通常从公司收入中支付,因此,如果公司支付的股息超过其收入,则其股息被削减的风险通常更高。尽管无利可图,但Cadence银行去年还是派发了股息。这可能是一次性事件,但从长远来看,这不是一种可持续的状态。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

点击此处查看该公司的派息率,以及分析师对其未来股息的估计。

Have Earnings And Dividends Been Growing?

收益和股息一直在增长吗?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Cadence Bank reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

当收益下降时,股息公司变得更加难以分析和安全拥有。如果业务陷入低迷并削减股息,该公司的价值可能会急剧下降。Cadence Bank去年公布了亏损,总体趋势表明,其收益近年来也一直在下降,这使我们怀疑股息是否存在风险。

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Cadence Bank has increased its dividend at approximately 37% a year on average.

大多数投资者评估公司股息前景的主要方式是查看历史股息增长率。在过去的10年中,Cadence银行的股息平均每年增加约37%。

Get our latest analysis on Cadence Bank's balance sheet health here.

在此处获取我们对Cadence银行资产负债表状况的最新分析。

To Sum It Up

总结一下

Has Cadence Bank got what it takes to maintain its dividend payments? It's definitely not great to see that it paid a dividend despite reporting a loss last year. Worse, the general trend in its earnings looks negative in recent times. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Cadence 银行有能力维持其股息支付吗?尽管去年报告了亏损,但看到它派发了股息绝对不是一件好事。更糟糕的是,近来其收益的总体趋势看上去是负面的。这些特征通常不会带来出色的股息表现,投资者可能对持有这只股票进行分红的结果不满意。

With that in mind though, if the poor dividend characteristics of Cadence Bank don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 1 warning sign for Cadence Bank that we recommend you consider before investing in the business.

但是,考虑到这一点,如果Cadence Bank糟糕的股息特征没有让你感到困惑,那么值得注意这项业务所涉及的风险。例如,我们发现了Cadence Bank的1个警告信号,建议您在投资该业务之前考虑一下。

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

如果您在市场上寻找强劲的股息支付者,我们建议您查看我们精选的顶级股息股票。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.