AMD's Success in Cloud Expansion - This Analyst Sees Potential for Market Leadership

AMD's Success in Cloud Expansion - This Analyst Sees Potential for Market Leadership

KeyBanc analyst John Vinh maintained an Overweight rating on $Advanced Micro Devices (AMD.US)$, with a price target of $270.

KeyBanc分析师约翰·荣维持增持评级 $美国超微公司 (AMD.US)$,目标股价为270美元。

The analyst said AMD grew modestly in February, as Genoa's growth remained strong.

该分析师表示,由于热那亚的增长仍然强劲,AMD在2月份略有增长。

AMD processor instances were +1% month-on-month (M/M), +24% Y/Y, compared with January (+1% M/M,+35% Y/Y).

与1月份(环比增长1%,同比增长35%)相比,AMD处理器实例环比(M/M)增长1%,同比增长24%。

Genoa instance growth remained strong (+19% M/M), led by $Amazon (AMZN.US)$ AWS, after growing +13% M/M in January. Rome was +1% M/M,+14% Y/Y.

热那亚的实例增长仍然强劲(环比增长19%),其中 $亚马逊 (AMZN.US)$ AWS,在1月份环比增长了13%之后。罗马环比上涨1%,同比增长14%。

AMD's price target is $270, based on 30x Vinh's 2025 EPS estimate of $9.05. AMD is trading at 21x Vinh's 2025 EPS estimate and 38x the 2025 consensus EPS estimate compared to its peers, trading at an average consensus 2025E P/E multiple of 34x.

根据Vinh对2025年每股收益9.05美元的30倍估计,AMD的目标股价为270美元。与同行相比,AMD的交易价格是Vinh2025年每股收益估计值的21倍,是2025年共识每股收益估计值的38倍,2025年的平均共识市盈倍数为34倍。

Vinh's February results showed a continued decline in traditional server demand and China, as cloud instances saw a slight decrease of 1% M/M, a downturn from January's 1% growth M/M.

Vinh的2月份业绩显示,传统服务器需求和中国持续下降,云实例环比略有下降1%,低于1月份的1%的环比增长。

This overall decline was marked by $Alibaba (BABA.US)$ significant 11% reduction in M/M, underscoring the weakness in China's cloud sector.

总体下降的标志是 $阿里巴巴 (BABA.US)$ M/M大幅下降了11%,凸显了中国云行业的疲软。

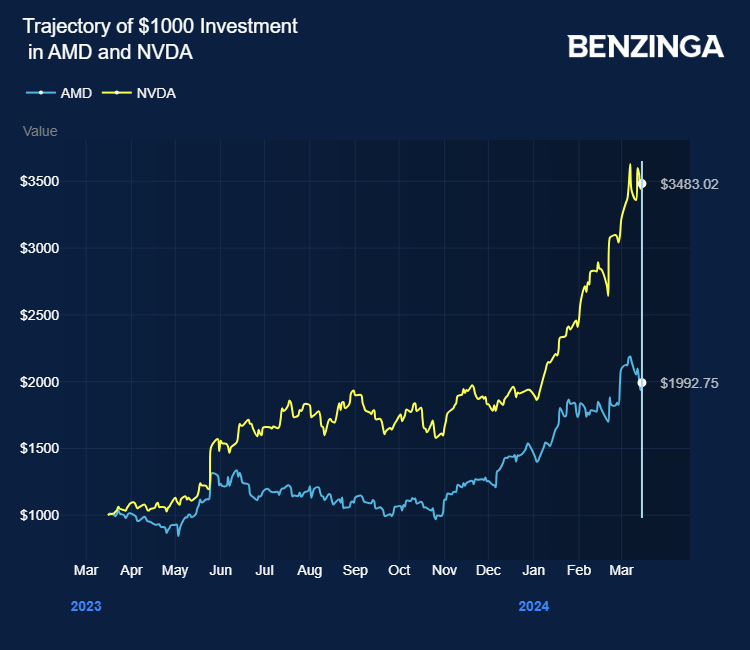

On a company basis, $NVIDIA (NVDA.US)$ and $Arm Holdings (ARM.US)$ remained stable M/M, and $Intel (INTC.US)$ experienced a 1% decline M/M.

在公司基础上, $英伟达 (NVDA.US)$ 和 $Arm Holdings (ARM.US)$ M/M 保持稳定,并且 $英特尔 (INTC.US)$ 环比下降了1%。

In contrast, Intel's Sapphire Rapids instances slowed to 2% M/M growth following a significant 50% M/M surge in January.

相比之下,英特尔的Sapphire Rapids实例在1月份环比大幅增长50%之后,放缓至2%的月率增长。

Nvidia's GPU growth remained stagnant M/M, mirroring its January performance, with U.S. cloud service providers (CSPs) allocating capital expenditure towards internal generative AI workloads.

Nvidia的GPU增长仍然停滞不前,反映了其1月份的表现,美国云服务提供商(CSP)将资本支出分配给内部生成式人工智能工作负载。

ARM's server growth was flat m/m versus a slight 1% M/M increase in January.

ARM的服务器环比增长持平,而1月份的月度略有增长1%。

Based on the latest cloud tracker data, these findings suggest a moderately positive outlook for AMD and a neutral impact on ARM, Intel, and Nvidia.

根据最新的云跟踪数据,这些发现表明,AMD的前景略为乐观,对ARM、英特尔和英伟达的影响为中性。

Investors can gain exposure to AMD via $AOT GROWTH AND INNOVATION ETF (AOTG.US)$ and $INVESCO PHLX SEMICONDUCTOR ETF (SOXQ.US)$.

投资者可以通过以下方式获得 AMD 的投资机会 $AOT GROWTH AND INNOVATION ETF (AOTG.US)$ 和 $INVESCO PHLX SEMICONDUCTOR ETF (SOXQ.US)$。

Genoa instance growth remained strong (+19% M/M), led by

Genoa instance growth remained strong (+19% M/M), led by