Earnings Not Telling The Story For China Daye Non-Ferrous Metals Mining Limited (HKG:661) After Shares Rise 51%

Earnings Not Telling The Story For China Daye Non-Ferrous Metals Mining Limited (HKG:661) After Shares Rise 51%

China Daye Non-Ferrous Metals Mining Limited (HKG:661) shareholders would be excited to see that the share price has had a great month, posting a 51% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 5.7% isn't as attractive.

中国大冶有色金属矿业有限公司(HKG: 661)股东会很高兴看到股价表现良好,涨幅为51%,并从先前的疲软中恢复过来。不幸的是,尽管上个月表现强劲,但全年5.7%的涨幅并不那么有吸引力。

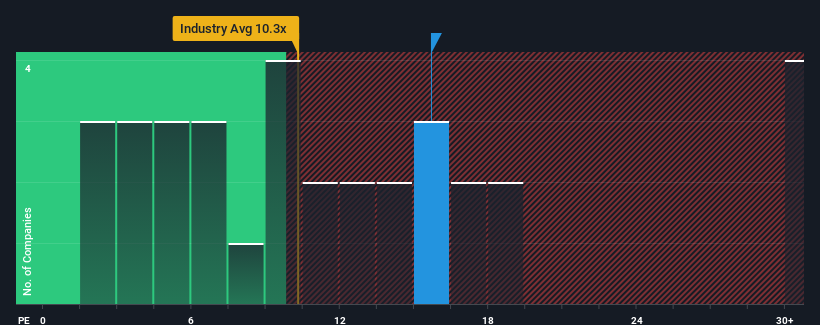

Following the firm bounce in price, China Daye Non-Ferrous Metals Mining may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 15.7x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

在价格稳步反弹之后,中国大冶有色金属矿业目前可能会发出非常看跌的信号,市盈率(或 “市盈率”)为15.7倍,因为几乎一半的香港公司的市盈率低于8倍,即使市盈率低于5倍也并不罕见。尽管如此,我们需要更深入地挖掘,以确定市盈率大幅上涨是否有合理的基础。

As an illustration, earnings have deteriorated at China Daye Non-Ferrous Metals Mining over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

举例来说,中国大冶有色金属矿业的收益在过去一年中有所下降,这根本不理想。许多人可能预计,在未来一段时间内,该公司的表现仍将超过大多数其他公司,这阻止了市盈率的暴跌。你真的希望如此,否则你会无缘无故地付出相当大的代价。

SEHK:661 Price to Earnings Ratio vs Industry March 19th 2024

SEHK: 661 对比行业的市盈率 2024 年 3 月 19 日

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Daye Non-Ferrous Metals Mining will help you shine a light on its historical performance.

想全面了解公司的收益、收入和现金流吗?那么我们关于中国大冶有色金属矿业的免费报告将帮助您了解其历史表现。

How Is China Daye Non-Ferrous Metals Mining's Growth Trending?

中国大冶有色金属矿业的增长趋势如何?

In order to justify its P/E ratio, China Daye Non-Ferrous Metals Mining would need to produce outstanding growth well in excess of the market.

为了证明其市盈率是合理的,中国大冶有色金属矿业需要实现远远超过市场的出色增长。

Retrospectively, the last year delivered a frustrating 63% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 41% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

回顾过去,去年该公司的利润下降了63%,令人沮丧。结果,三年前的总体收益也下降了41%。因此,不幸的是,我们必须承认,在此期间,该公司在增加收益方面做得不好。

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

相比之下,市场预计将在未来12个月内实现22%的增长,根据最近的中期收益业绩,该公司的下跌势头令人震惊。

With this information, we find it concerning that China Daye Non-Ferrous Metals Mining is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

根据这些信息,我们发现中国大冶有色金属矿业的市盈率高于市场。显然,该公司的许多投资者比最近所表示的要看涨得多,他们不愿意以任何价格抛售股票。只有最大胆的人才会假设这些价格是可持续的,因为近期盈利趋势的延续最终可能会严重压制股价。

The Final Word

最后一句话

The strong share price surge has got China Daye Non-Ferrous Metals Mining's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

股价的强劲上涨使中国大冶有色金属矿业的市盈率也飙升至很高的水平。通常,我们的倾向是将市盈率的使用限制在确定市场对公司整体健康状况的看法上。

Our examination of China Daye Non-Ferrous Metals Mining revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我们对中国大冶有色金属矿业的审查显示,鉴于市场即将增长,其中期收益萎缩对其高市盈率的影响没有我们预期的那么大。目前,我们对高市盈率越来越不满意,因为这种收益表现极不可能长期支撑这种积极情绪。如果最近的中期收益趋势继续下去,这将使股东的投资面临重大风险,潜在投资者面临支付过高溢价的危险。

We don't want to rain on the parade too much, but we did also find 3 warning signs for China Daye Non-Ferrous Metals Mining (2 shouldn't be ignored!) that you need to be mindful of.

我们不想在游行队伍中下太多雨,但我们也确实发现了中国大冶有色金属矿业的3个警告标志(2个不容忽视!)你需要注意的。

If you're unsure about the strength of China Daye Non-Ferrous Metals Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果您不确定中国大冶有色金属矿业业务的实力,为什么不浏览我们的互动式股票清单,其中列出了一些您可能错过的其他公司,这些股票具有稳健的业务基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧吗?请直接联系我们。或者,也可以发送电子邮件至编辑团队 (at) simplywallst.com。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

SEHK:661 Price to Earnings Ratio vs Industry March 19th 2024

SEHK:661 Price to Earnings Ratio vs Industry March 19th 2024