Jiangyin Jianghua Microelectronics Materials Co., Ltd (SHSE:603078) Analysts Are Reducing Their Forecasts For This Year

Jiangyin Jianghua Microelectronics Materials Co., Ltd (SHSE:603078) Analysts Are Reducing Their Forecasts For This Year

The analysts covering Jiangyin Jianghua Microelectronics Materials Co., Ltd (SHSE:603078) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

报道江阴江华微电子材料有限公司(SHSE: 603078)的分析师今天对今年的法定预测进行了实质性修订,从而向股东传递了一定负面情绪。收入和每股收益(EPS)的预测都出现了偏差,这表明分析师对该业务的表现主要不佳。

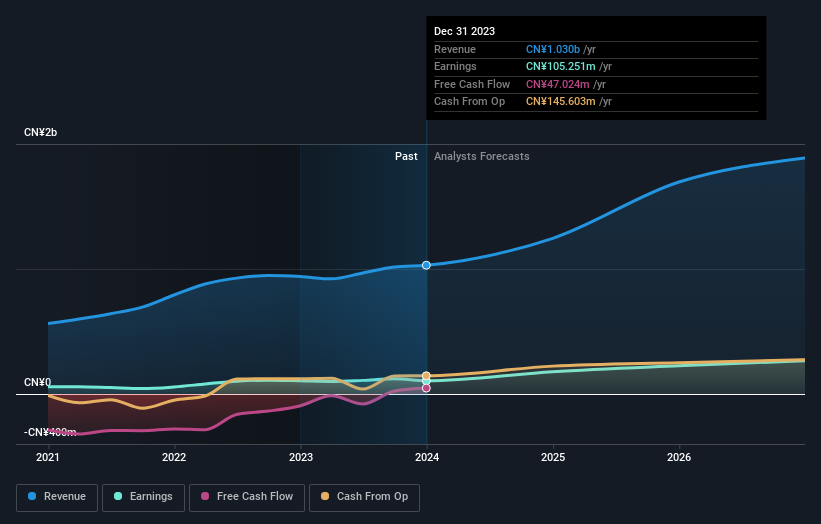

Following the downgrade, the most recent consensus for Jiangyin Jianghua Microelectronics Materials from its three analysts is for revenues of CN¥1.2b in 2024 which, if met, would be a major 21% increase on its sales over the past 12 months. Per-share earnings are expected to shoot up 50% to CN¥0.41. Before this latest update, the analysts had been forecasting revenues of CN¥1.6b and earnings per share (EPS) of CN¥0.56 in 2024. Indeed, we can see that the analysts are a lot more bearish about Jiangyin Jianghua Microelectronics Materials' prospects, administering a pretty serious reduction to revenue estimates and slashing their EPS estimates to boot.

评级下调后,三位分析师对江阴江华微电子材料的最新共识是,2024年的收入为12亿元人民币,如果得到满足,其销售额将比过去12个月大幅增长21%。预计每股收益将飙升50%,至0.41元人民币。在最新更新之前,分析师一直预测2024年的收入为16亿元人民币,每股收益(EPS)为0.56元人民币。事实上,我们可以看出,分析师对江阴江华微电子材料的前景更加悲观,他们大幅下调了收入预期,并下调了每股收益预期。

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Jiangyin Jianghua Microelectronics Materials' past performance and to peers in the same industry. We can infer from the latest estimates that forecasts expect a continuation of Jiangyin Jianghua Microelectronics Materials'historical trends, as the 21% annualised revenue growth to the end of 2024 is roughly in line with the 21% annual revenue growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 18% per year. So although Jiangyin Jianghua Microelectronics Materials is expected to maintain its revenue growth rate, it's only growing at about the rate of the wider industry.

这些估计很有趣,但是在查看预测与江阴江华微电子材料过去的表现以及与同一行业的同行进行比较时,可以更粗略地描述一些细节。我们可以从最新估计中推断,预测预计江阴江华微电子材料的历史趋势将延续,因为到2024年底的21%的年化收入增长与过去五年21%的年收入增长大致一致。将其与我们的数据并列,该数据表明,预计该行业其他公司(有分析师报道)的收入每年将增长18%。因此,尽管江阴江华微电子材料预计将保持其收入增长率,但其增长速度仅与整个行业差不多。

The Bottom Line

底线

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Jiangyin Jianghua Microelectronics Materials, and their negativity could be grounds for caution.

要了解的最重要的一点是,分析师下调了每股收益预期,预计业务状况将明显下降。可悲的是,他们还下调了销售预期,但预计该业务的增长速度仍将与市场本身大致相同。在这些下调评级之后,股东们感到有些震惊,我们也不会感到惊讶。看来分析师对江阴江华微电子材料的看跌情绪变得更加看跌,他们的消极情绪可能是谨慎的理由。

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Jiangyin Jianghua Microelectronics Materials going out to 2026, and you can see them free on our platform here.

即便如此,业务的长期发展轨迹对于股东的价值创造更为重要。在Simply Wall St,我们有分析师对江阴江华微电子材料到2026年的全方位估计,你可以在我们的平台上免费查看。

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

寻找可能达到转折点的有趣公司的另一种方法是使用内部人士收购的成长型公司的免费清单,跟踪管理层是买入还是卖出。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Jiangyin Jianghua Microelectronics Materials, and their negativity could be grounds for caution.

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Jiangyin Jianghua Microelectronics Materials, and their negativity could be grounds for caution.