Zhejiang Hisun BiomaterialsLtd's (SHSE:688203) Weak Earnings May Only Reveal A Part Of The Whole Picture

Zhejiang Hisun BiomaterialsLtd's (SHSE:688203) Weak Earnings May Only Reveal A Part Of The Whole Picture

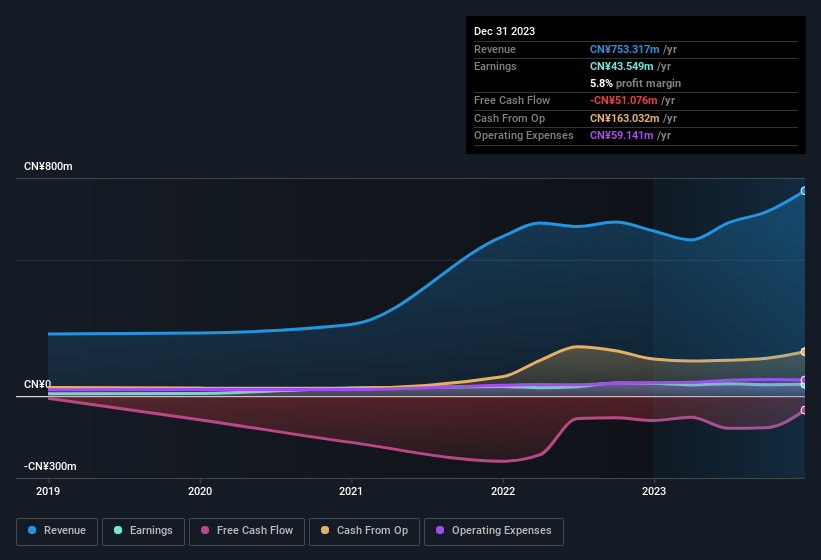

The subdued market reaction suggests that Zhejiang Hisun Biomaterials Co.Ltd.'s (SHSE:688203) recent earnings didn't contain any surprises. However, we believe that investors should be aware of some underlying factors which may be of concern.

疲软的市场反应表明,浙江海正生物材料有限公司”s(上海证券交易所代码:688203)最近的收益没有任何意外。但是,我们认为,投资者应注意一些可能令人担忧的潜在因素。

The Impact Of Unusual Items On Profit

不寻常物品对利润的影响

To properly understand Zhejiang Hisun BiomaterialsLtd's profit results, we need to consider the CN¥2.8m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. If Zhejiang Hisun BiomaterialsLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

为了正确了解浙江海正生物材料有限公司的利润业绩,我们需要考虑不寻常项目带来的280万元人民币的收益。虽然获得更高的利润总是件好事,但来自不寻常物品的巨额捐款有时会抑制我们的热情。我们统计了全球大多数上市公司的数字,不寻常的物品在自然界中很常见。这正如你所预料的那样,因为这些增强被描述为 “不寻常”。如果浙江海正生物材料有限公司认为这一贡献不会重演,那么在其他条件相同的情况下,我们预计其本年度的利润将下降。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Zhejiang Hisun BiomaterialsLtd.

注意:我们始终建议投资者检查资产负债表的实力。点击此处查看我们对浙江海正生物材料有限公司的资产负债表分析

Our Take On Zhejiang Hisun BiomaterialsLtd's Profit Performance

我们对浙江海正生物材料有限公司盈利表现的看法

We'd posit that Zhejiang Hisun BiomaterialsLtd's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Zhejiang Hisun BiomaterialsLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Zhejiang Hisun BiomaterialsLtd you should know about.

我们认为,浙江海正生物材料有限公司的法定收益并不能完全反映持续的生产力,因为这笔巨额不寻常。因此,在我们看来,浙江海正生物材料有限公司的真正基础盈利能力实际上可能低于其法定利润。不幸的是,在过去的十二个月中,其每股收益有所下降。归根结底,如果你想正确地了解公司,必须考虑的不仅仅是上述因素。因此,如果你想更深入地研究这只股票,那么考虑它面临的任何风险至关重要。每家公司都有风险,我们发现了一个你应该知道的浙江海正生物材料有限公司的警告信号。

Today we've zoomed in on a single data point to better understand the nature of Zhejiang Hisun BiomaterialsLtd's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

今天,我们放大了单一数据点,以更好地了解浙江海正生物材料有限公司利润的性质。但是,还有很多其他方法可以让你对公司的看法。例如,许多人认为高股本回报率是有利的商业经济的标志,而另一些人则喜欢 “关注资金”,寻找内部人士正在买入的股票。因此,你可能希望看到这份免费收藏的拥有高股本回报率的公司,或者这份内部人士正在购买的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

We'd posit that Zhejiang Hisun BiomaterialsLtd's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Zhejiang Hisun BiomaterialsLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Zhejiang Hisun BiomaterialsLtd you should know about.

We'd posit that Zhejiang Hisun BiomaterialsLtd's statutory earnings aren't a clean read on ongoing productivity, due to the large unusual item. Therefore, it seems possible to us that Zhejiang Hisun BiomaterialsLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for Zhejiang Hisun BiomaterialsLtd you should know about.