This Is What Whales Are Betting On Freeport-McMoRan

This Is What Whales Are Betting On Freeport-McMoRan

Deep-pocketed investors have adopted a bullish approach towards Freeport-McMoRan (NYSE:FCX), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in FCX usually suggests something big is about to happen.

财力雄厚的投资者对弗里波特-麦克莫兰铜金(纽约证券交易所代码:FCX)采取了看涨态度,这是市场参与者不容忽视的。我们对本辛加公开期权记录的追踪今天揭示了这一重大举措。这些投资者的身份仍然未知,但是FCX的如此重大变动通常表明即将发生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Freeport-McMoRan. This level of activity is out of the ordinary.

我们从今天的观察中收集了这些信息,当时Benzinga的期权扫描器重点介绍了弗里波特-麦克莫兰铜金的12项非同寻常的期权活动。这种活动水平与众不同。

The general mood among these heavyweight investors is divided, with 58% leaning bullish and 41% bearish. Among these notable options, 3 are puts, totaling $125,710, and 9 are calls, amounting to $958,202.

这些重量级投资者的总体情绪存在分歧,58%的人倾向于看涨,41%的人倾向于看跌。在这些值得注意的期权中,有3个是看跌期权,总额为125,710美元,9个是看涨期权,总额为958,202美元。

What's The Price Target?

目标价格是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $32.0 to $51.0 for Freeport-McMoRan over the recent three months.

根据交易活动,看来重要投资者的目标是在最近三个月中将弗里波特麦克莫兰金的价格区间从32.0美元降至51.0美元。

Volume & Open Interest Trends

交易量和未平仓合约趋势

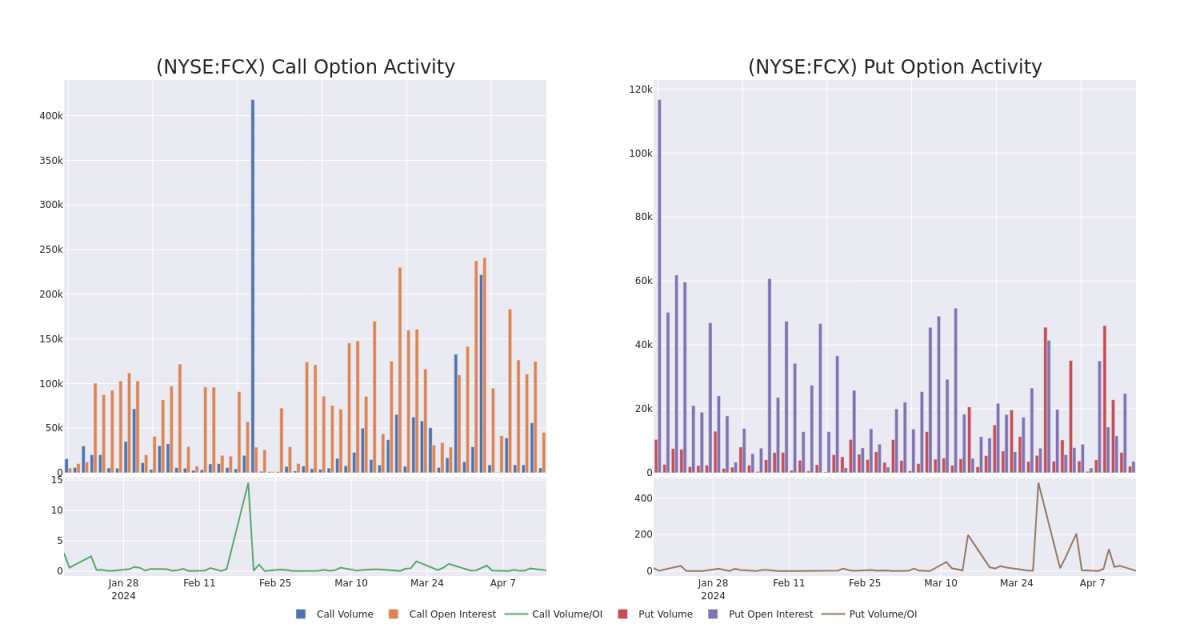

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price.

这些数据可以帮助您跟踪Freeport-McMoran期权在给定行使价下的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale activity within a strike price range from $32.0 to $51.0 in the last 30 days.

下面,我们可以观察到过去30天Freeport-McMoran所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化,其行使价在32.0美元至51.0美元之间。

Freeport-McMoRan 30-Day Option Volume & Interest Snapshot

弗里波特-麦克莫兰铜金30天期权交易量和利息快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | CALL | TRADE | BEARISH | 01/17/25 | $20.8 | $20.15 | $20.2 | $32.00 | $674.6K | 3.1K | 334 |

| FCX | PUT | SWEEP | BEARISH | 06/20/25 | $7.15 | $6.95 | $7.0 | $50.00 | $70.0K | 309 | 100 |

| FCX | CALL | TRADE | BULLISH | 04/19/24 | $1.12 | $1.11 | $1.12 | $50.00 | $56.0K | 11.0K | 2.8K |

| FCX | CALL | SWEEP | BEARISH | 07/19/24 | $4.55 | $4.5 | $4.5 | $50.00 | $45.0K | 23.2K | 173 |

| FCX | CALL | SWEEP | BEARISH | 04/19/24 | $1.38 | $1.3 | $1.3 | $49.50 | $39.0K | 4.1K | 1.0K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 20.8 美元 | 20.15 美元 | 20.2 美元 | 32.00 美元 | 674.6 万美元 | 3.1K | 334 |

| FCX | 放 | 扫 | 粗鲁的 | 06/20/25 | 7.15 美元 | 6.95 美元 | 7.0 美元 | 50.00 美元 | 70.0K | 309 | 100 |

| FCX | 打电话 | 贸易 | 看涨 | 04/19/24 | 1.12 美元 | 1.11 美元 | 1.12 美元 | 50.00 美元 | 56.0 万美元 | 11.0K | 2.8K |

| FCX | 打电话 | 扫 | 粗鲁的 | 07/19/24 | 4.55 美元 | 4.5 美元 | 4.5 美元 | 50.00 美元 | 45.0 万美元 | 23.2K | 173 |

| FCX | 打电话 | 扫 | 粗鲁的 | 04/19/24 | 1.38 | 1.3 美元 | 1.3 美元 | 49.50 美元 | 39.0 万美元 | 4.1K | 1.0K |

About Freeport-McMoRan

关于弗里波特-麦克莫兰铜金

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining. It derives key revenue from the sale of Copper.

弗里波特-麦克莫兰铜金公司是一家国际矿业公司。它已将其采矿业务分为四个主要部门:北美铜矿、南美采矿、印度尼西亚采矿和钼矿。其应报告的细分市场包括莫伦奇、佛得角山和格拉斯伯格(印度尼西亚矿业)铜矿、棒材和炼油业务以及大西洋铜冶炼和提炼。它从铜的销售中获得关键收入。

After a thorough review of the options trading surrounding Freeport-McMoRan, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕弗里波特-麦克莫兰铜金的期权交易进行了全面审查之后,我们将对该公司进行更详细的审查。这包括评估其当前的市场状况和表现。

Current Position of Freeport-McMoRan

弗里波特-麦克莫兰铜金的现状

- With a trading volume of 2,981,796, the price of FCX is up by 2.55%, reaching $50.73.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 8 days from now.

- FCX的交易量为2,981,796美元,上涨了2.55%,达到50.73美元。

- 当前的RSI值表明,该股目前在超买和超卖之间处于中立状态。

- 下一份收益报告定于8天后发布。

Expert Opinions on Freeport-McMoRan

关于弗里波特-麦克莫兰铜金的专家意见

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $57.0.

在过去的30天中,共有2位专业分析师对该股发表了看法,将平均目标股价设定为57.0美元。

- An analyst from B of A Securities has elevated its stance to Buy, setting a new price target at $59.

- Consistent in their evaluation, an analyst from Scotiabank keeps a Sector Outperform rating on Freeport-McMoRan with a target price of $55.

- Bof A证券的一位分析师已将其立场提高至买入,将新的目标股价定为59美元。

- 丰业银行的一位分析师在评估中保持弗里波特-麦克莫兰的行业跑赢大盘评级,目标价为55美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。