Do Haier Smart Home's (SHSE:600690) Earnings Warrant Your Attention?

Do Haier Smart Home's (SHSE:600690) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

对于初学者来说,收购一家向投资者讲述好故事的公司似乎是个好主意(也是一个令人兴奋的前景),即使该公司目前缺乏收入和利润记录。不幸的是,这些高风险投资通常几乎不可能获得回报,许多投资者为吸取教训付出了代价。亏损的公司可以像海绵一样争夺资本,因此投资者应谨慎行事,不要一笔又一笔地投入好钱。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Haier Smart Home (SHSE:600690). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Haier Smart Home with the means to add long-term value to shareholders.

尽管处于科技股蓝天投资时代,但许多投资者仍然采取更传统的策略:购买海尔智能家居(SHSE: 600690)等盈利公司的股票。即使这家公司受到市场的公平估值,投资者也会同意,创造持续的利润将继续为海尔智能家居提供为股东增加长期价值的手段。

How Quickly Is Haier Smart Home Increasing Earnings Per Share?

海尔智能家居每股收益增长速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Haier Smart Home grew its EPS by 10% per year. That's a good rate of growth, if it can be sustained.

如果你认为市场的效率甚至含糊不清,那么从长远来看,你预计公司的股价将遵循其每股收益(EPS)的结果。因此,有很多投资者喜欢购买每股收益不断增长的公司的股票。我们可以看到,在过去三年中,海尔智能家居的每股收益每年增长10%。如果可以持续的话,这是一个不错的增长率。

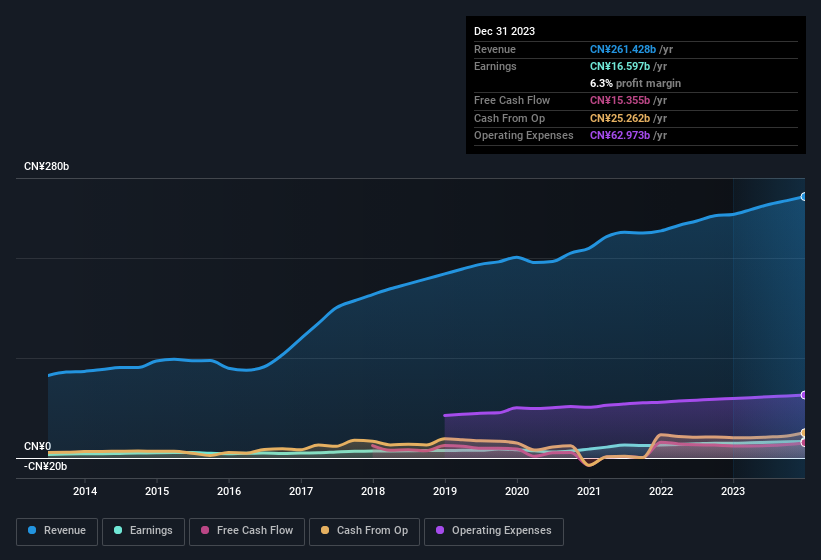

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Haier Smart Home remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 7.3% to CN¥261b. That's a real positive.

仔细考虑收入增长和息税前收益(EBIT)利润率有助于为近期利润增长的可持续性提供信息。海尔智能家居的息税前利润率与去年相比基本保持不变,但该公司应该乐于报告其收入增长7.3%,达到261亿元人民币。这确实是一个积极的方面。

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

您可以在下表中查看该公司的收入和收益增长趋势。要了解更多细节,请点击图片。

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Haier Smart Home's forecast profits?

在投资中,就像在生活中一样,未来比过去更重要。那么,为什么不看看这个海尔智能家居的免费交互式可视化效果呢 预测 利润?

Are Haier Smart Home Insiders Aligned With All Shareholders?

海尔智能家居内部人士是否与所有股东一致?

Owing to the size of Haier Smart Home, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Holding CN¥645m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This would indicate that the goals of shareholders and management are one and the same.

由于海尔智能家居的规模,我们预计内部人士不会持有该公司的很大一部分股份。但是,由于他们对公司的投资,令人高兴的是,仍然有激励措施使他们的行动与股东保持一致。持有该公司价值6.45亿元人民币的股票不是笑话,内部人士将致力于为股东带来最佳业绩。这将表明股东和管理层的目标是相同的。

Should You Add Haier Smart Home To Your Watchlist?

你应该将海尔智能家居添加到你的关注列表中吗?

One important encouraging feature of Haier Smart Home is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. If you think Haier Smart Home might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

海尔智能家居的一个重要令人鼓舞的特点是利润不断增长。如果这本身还不够,那么内部所有权的水平也相当可观。这种组合肯定受到投资者的青睐,因此可以考虑将公司保留在观察名单上。如果您认为海尔智能家居可能适合您作为投资者的风格,则可以直接查看其年度报告,也可以先查看我们对该公司的折扣现金流(DCF)估值。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

买入这样的股票总是有可能表现不错 不是 不断增长的收入和 不要 让内部人士购买股票。但是,对于那些考虑这些重要指标的人,我们鼓励您查看具有这些功能的公司。您可以访问量身定制的中国公司名单,这些公司在最近的内幕收购的支持下实现了增长。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文中讨论的内幕交易是指相关司法管辖区内应报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。