Options Corner: CrowdStrike Sees Unusual Options Activity With Bearish Slant

Options Corner: CrowdStrike Sees Unusual Options Activity With Bearish Slant

Financial giants have made a conspicuous bearish move on CrowdStrike Holdings. Our analysis of options history for $CrowdStrike (CRWD.US)$ revealed 43 unusual trades.

金融巨头对CrowdStrike Holdings采取了明显的看跌举动。我们对期权历史的分析 $CrowdStrike (CRWD.US)$ 公布了43笔不寻常的交易。

Delving into the details, we found 41% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $714,621, and 29 were calls, valued at $1,325,211.

深入研究细节,我们发现41%的交易者看涨,而51%的交易者表现出看跌倾向。在我们发现的所有交易中,有14笔是看跌期权,价值714,621美元,29笔是看涨期权,价值1,325,211美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $500.0 for CrowdStrike Holdings over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将CrowdStrike Holdings的价格范围从100.0美元扩大到500.0美元。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

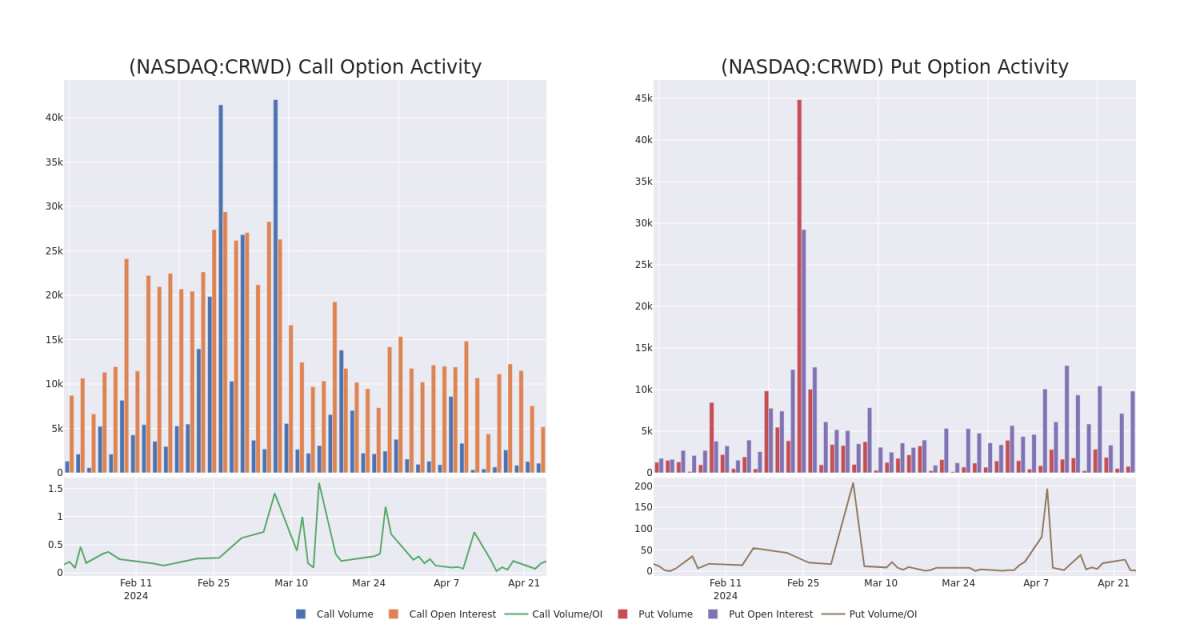

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平仓合约是一种对股票进行尽职调查的有见地的方法。

This data can help you track the liquidity and interest for CrowdStrike Holdings's options for a given strike price.

这些数据可以帮助您跟踪给定行使价下CrowdStrike Holdings期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale activity within a strike price range from $100.0 to $500.0 in the last 30 days.

下面,我们可以分别观察CrowdStrike Holdings在过去30天行使价范围内所有鲸鱼活动的看涨和看跌期权交易量和未平仓合约的变化。

CrowdStrike Holdings Call and Put Volume: 30-Day Overview

CrowdStrike Holdings 看涨期权和看跌交易量:

Largest Options Trades Observed:

观察到的最大期权交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

CRWD |

PUT |

SWEEP |

BEARISH |

06/20/25 |

$26.0 |

$25.2 |

$25.75 |

$240.00 |

$128.7K |

221 |

50 |

CRWD |

CALL |

TRADE |

BEARISH |

01/17/25 |

$48.0 |

$47.8 |

$47.8 |

$300.00 |

$109.9K |

443 |

30 |

CRWD |

PUT |

TRADE |

BULLISH |

05/17/24 |

$5.85 |

$5.7 |

$5.7 |

$275.00 |

$107.1K |

901 |

27 |

CRWD |

CALL |

TRADE |

NEUTRAL |

06/21/24 |

$200.85 |

$198.35 |

$199.52 |

$100.00 |

$99.7K |

153 |

0 |

CRWD |

CALL |

SWEEP |

BEARISH |

01/16/26 |

$26.95 |

$26.85 |

$26.9 |

$500.00 |

$96.6K |

71 |

113 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

人群 |

放 |

扫 |

粗鲁的 |

06/20/25 |

26.0 美元 |

25.2 美元 |

25.75 美元 |

240.00 美元 |

128.7 万美元 |

221 |

50 |

人群 |

打电话 |

贸易 |

粗鲁的 |

01/17/25 |

48.0 美元 |

47.8 美元 |

47.8 美元 |

300.00 美元 |

109.9 万美元 |

443 |

30 |

人群 |

放 |

贸易 |

看涨 |

05/17/24 |

5.85 美元 |

5.7 美元 |

5.7 美元 |

275.00 美元 |

107.1 万美元 |

901 |

27 |

人群 |

打电话 |

贸易 |

中立 |

06/21/24 |

200.85 美元 |

198.35 美元 |

199.52 美元 |

100.00 美元 |

99.7K |

153 |

0 |

人群 |

打电话 |

扫 |

粗鲁的 |

01/16/26 |

26.95 美元 |

26.85 美元 |

26.9 美元 |

500.00 美元 |

96.6 万美元 |

71 |

113 |

About CrowdStrike Holdings

关于 CrowdStrike

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike是一家基于云的网络安全公司,专门从事下一代安全垂直领域,例如端点、云工作负载、身份和安全运营。CrowdStrike的主要产品是其Falcon平台,该平台为企业提供了众所周知的单一管理面板,以检测和应对攻击其IT基础设施的安全威胁。这家总部位于德克萨斯州的公司成立于2011年,并于2019年上市。

After a thorough review of the options trading surrounding CrowdStrike Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对围绕CrowdStrike Holdings的期权交易进行了全面审查之后,我们开始更详细地研究该公司。这包括评估其当前的市场地位和表现。

Present Market Standing of CrowdStrike Holdings

CrowdStrike Holdings 目前的

With a trading volume of 1,390,262, the price of CRWD is up by 0.15%, reaching $298.08.

Current RSI values indicate that the stock is may be approaching oversold.

Next earnings report is scheduled for 34 days from now.

CRWD的交易量为1,390,262美元,上涨了0.15%,达到298.08美元。

当前的RSI值表明该股可能已接近超卖。

下一份收益报告定于34天后发布。

What Analysts Are Saying About CrowdStrike Holdings

分析师对于 CrowdStrike Holdings

In the last month, 3 experts released ratings on this stock with an average target price of $392.0.

上个月,3位专家发布了该股的评级,平均目标价为392.0美元。

Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $400.

An analyst from Rosenblatt has decided to maintain their Buy rating on CrowdStrike Holdings, which currently sits at a price target of $400.

Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for CrowdStrike Holdings, targeting a price of $376.

坎托·菲茨杰拉德的一位分析师将其评级下调至增持,新的目标股价为400美元,这反映了人们的担忧。

罗森布拉特的一位分析师决定维持对CrowdStrike Holdings的买入评级,该股目前的目标股价为400美元。

Keybanc的一位分析师保持立场,继续维持CrowdStrike Holdings的增持评级,目标价格为376美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在的回报。精明的交易者通过不断自我教育、调整策略、监控多个指标以及密切关注市场走势来管理这些风险。借助Benzinga Pro的实时提醒,随时了解CrowdStrike Holdings的最新期权交易。