Options: Boeing Sees Smart Money Betting Big on the Stock

Options: Boeing Sees Smart Money Betting Big on the Stock

Financial giants have made a conspicuous bearish move on Boeing. Our analysis of options history for $Boeing (BA.US)$ revealed 8 unusual trades.

金融巨头对波音采取了明显的看跌举动。我们对期权历史的分析 $波音 (BA.US)$ 透露了8笔不寻常的交易。

Delving into the details, we found 25% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $299,540, and 2 were calls, valued at $149,391.

深入研究细节后,我们发现25%的交易者看涨,而62%的交易者表现出看跌趋势。在我们发现的所有交易中,有6笔是看跌期权,价值为299,540美元,2笔是看涨期权,价值149,391美元。

Predicted Price Range

预测的价格区间

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $160.0 to $250.0 for Boeing over the recent three months.

根据交易活动,看来主要投资者的目标是波音在最近三个月的价格区间内从160.0美元到250.0美元不等。

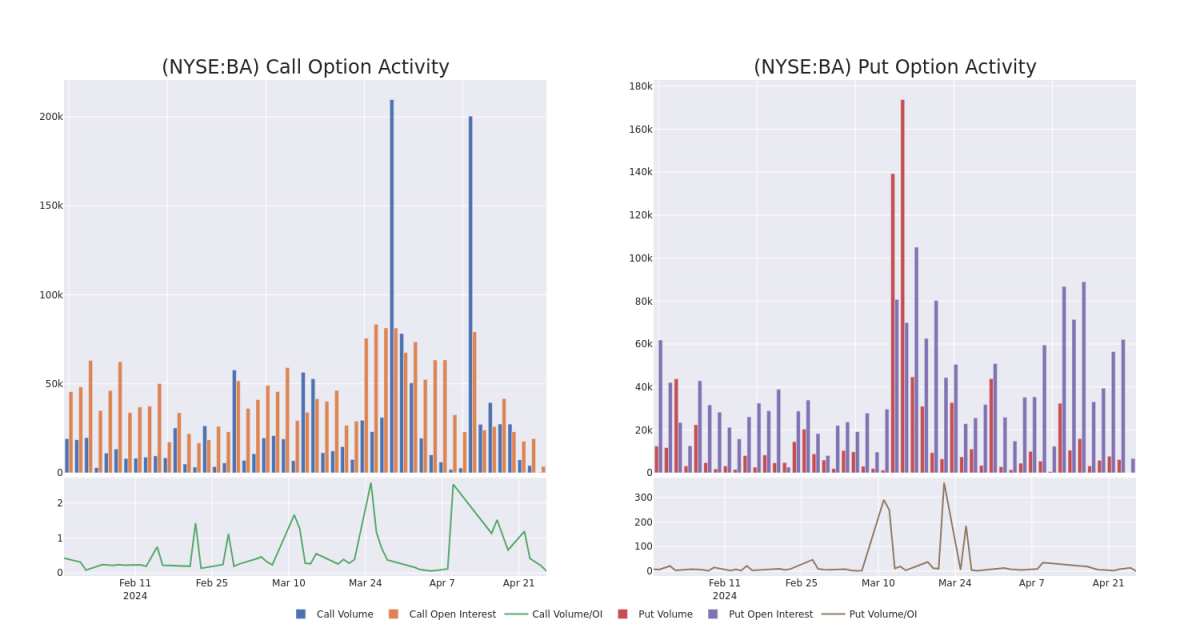

Volume & Open Interest Development

交易量和未平仓合约的发展

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下波音期权的流动性和利息。下面,我们可以观察到过去30天内波音所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,其行使价在160.0美元至250.0美元之间。

Boeing Call and Put Volume: 30-Day Overview

波音看涨期权和看跌期权交易量:30 天概述

Noteworthy Options Activity:

值得注意的期权活动:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

BA |

PUT |

TRADE |

NEUTRAL |

11/15/24 |

$50.2 |

$49.05 |

$49.65 |

$215.00 |

$99.3K |

307 |

0 |

BA |

CALL |

TRADE |

BEARISH |

12/18/26 |

$50.2 |

$49.2 |

$49.2 |

$160.00 |

$78.7K |

107 |

1 |

BA |

CALL |

SWEEP |

BEARISH |

05/03/24 |

$1.16 |

$1.1 |

$1.15 |

$170.00 |

$70.6K |

3.5K |

198 |

BA |

PUT |

TRADE |

BEARISH |

10/18/24 |

$39.0 |

$38.95 |

$39.0 |

$205.00 |

$62.4K |

79 |

0 |

BA |

PUT |

SWEEP |

BEARISH |

08/16/24 |

$19.2 |

$18.2 |

$18.25 |

$180.00 |

$40.1K |

1.2K |

0 |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

BA |

放 |

贸易 |

中立 |

11/15/24 |

50.2 美元 |

49.05 美元 |

49.65 美元 |

215.00 美元 |

99.3 万美元 |

307 |

0 |

BA |

打电话 |

贸易 |

粗鲁的 |

12/18/26 |

50.2 美元 |

49.2 美元 |

49.2 美元 |

160.00 美元 |

78.7 万美元 |

107 |

1 |

BA |

打电话 |

扫 |

粗鲁的 |

05/03/24 |

1.16 美元 |

1.1 美元 |

1.15 美元 |

170.00 美元 |

70.6K |

3.5K |

198 |

BA |

放 |

贸易 |

粗鲁的 |

10/18/24 |

39.0 美元 |

38.95 美元 |

39.0 美元 |

205.00 美元 |

62.4 万美元 |

79 |

0 |

BA |

放 |

扫 |

粗鲁的 |

08/16/24 |

19.2 美元 |

18.2 美元 |

18.25 美元 |

180.00 美元 |

40.1 万美元 |

1.2K |

0 |

About Boeing

关于波音

Boeing is a major aerospace and defense firm. It operates in three segments: commercial airplanes; defense, space, and security; and global services. Boeing's commercial airplanes segment competes with Airbus in the production of aircraft that can carry more than 130 passengers. Boeing's defense, space, and security segment competes with Lockheed, Northrop, and several other firms to create military aircraft and weaponry. Global services provides aftermarket support to airlines.

波音是一家大型航空航天和国防公司。它分为三个部门:商用飞机;国防、太空和安全;以及全球服务。波音的商用飞机部门在生产可运载超过130名乘客的飞机方面与空中客车公司竞争。波音的国防、太空和安全部门与洛克希德、诺斯罗普和其他几家公司竞争,以制造军用飞机和武器。全球服务为航空公司提供售后支持。

Boeing's Current Market Status

波音目前的市场地位

With a volume of 162,518, the price of BA is down -0.5% at $165.97.

RSI indicators hint that the underlying stock may be oversold.

Next earnings are expected to be released in 89 days.

英国航空的交易量为162,518美元,下跌了0.5%,至165.97美元。

RSI 指标暗示标的股票可能被超卖。

下一份财报预计将在89天后公布。

What Analysts Are Saying About Boeing

分析师对波音的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $220.0.

5位市场专家最近发布了该股的评级,共识目标价为220.0美元。

An analyst from Deutsche Bank persists with their Buy rating on Boeing, maintaining a target price of $225.

Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Boeing with a target price of $260.

An analyst from JP Morgan has decided to maintain their Overweight rating on Boeing, which currently sits at a price target of $210.

An analyst from RBC Capital persists with their Outperform rating on Boeing, maintaining a target price of $215.

Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Boeing with a target price of $190.

德意志银行的一位分析师坚持对波音的买入评级,维持225美元的目标价格。

Stifel的一位分析师在评估中保持了对波音的买入评级,目标价为260美元。

摩根大通的一位分析师已决定维持对波音的增持评级,目前波音的目标股价为210美元。

加拿大皇家银行资本的一位分析师坚持对波音的跑赢大盘评级,维持215美元的目标价格。

巴克莱银行的一位分析师在评估中保持对波音的同等权重评级,目标价为190美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Boeing with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了获得更高利润的可能性。精明的交易者通过持续的教育、战略交易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用Benzinga Pro了解波音的最新期权交易,获取实时警报。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Boeing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Boeing's whale trades within a strike price range from $160.0 to $250.0 in the last 30 days.