Is Musk Worth 160% Of Tesla's Total Profits? ESG Expert Thinks CEO's Pay Package Is 'Lunacy And Completely Detached From Reality'

Is Musk Worth 160% Of Tesla's Total Profits? ESG Expert Thinks CEO's Pay Package Is 'Lunacy And Completely Detached From Reality'

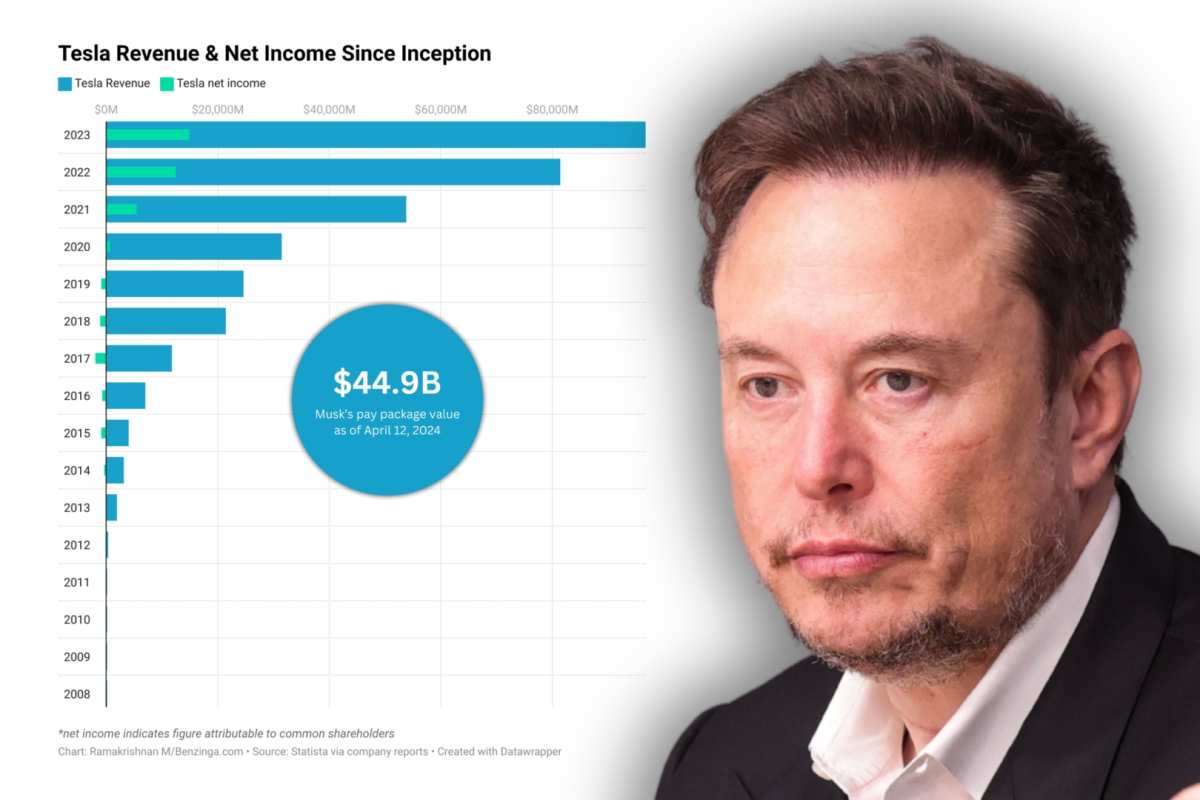

Tesla, Inc. (NASDAQ:TSLA) is asking shareholders to reapprove CEO Elon Musk's 2018 compensation plan, which was voided by a Delaware Chancery court. The decision remains divisive among stakeholders, and an environmental expert recently shared data highlighting the significant value of the pay package.

特斯拉公司(纳斯达克股票代码:TSLA)要求股东重新批准首席执行官埃隆·马斯克的2018年薪酬计划,该计划被特拉华州财政法院宣布无效。该决定在利益相关者之间仍然存在分歧,一位环境专家最近分享了数据,强调了薪酬待遇的巨大价值。

What Happened: Eric Roesch, an environmental expert and publisher of the ESG Hound blog, posted data on Threads in late April that sheds light on the size of the proposed payout. "Probably a good time to point out that Tesla's total revenues since inception are $338 billion. Total Gross Profits are 73 billion and net income is 27 billion."

发生了什么:环境专家兼ESG Hound博客的出版商埃里克·罗施于4月下旬在Threads上发布了数据,揭示了拟议的支出规模。“可能是指出特斯拉自成立以来的总收入为3380亿美元的好时机。总毛利为730亿美元,净收入为270亿美元。”

He questioned the rationale behind the proposed compensation for Musk. "Musk demanding a $53 billion payout would be the equivalent of 16% of total revenues since 2009 72% of gross profits since 2009 195% of net income (i.e. real economic profits) since 2009," Roesch said. "It's lunacy and completely detached from reality."

他质疑提议对马斯克进行补偿的理由。罗施说:“马斯克要求支付530亿美元,相当于自2009年以来总收入的16%,占2009年以来毛利润的72%,占2009年以来净收入(即实际经济利润)的195%。”“这太疯狂了,完全脱离了现实。”

Is He Right? Tesla's revenue grew to nearly $96.8 billion in 2023, an 18.8% increase. Data from Statista confirms that the company's total revenue since inception exceeds $338 billion, with net income attributable to common shareholders reaching $28 billion.

他是对的吗?特斯拉的收入在2023年增长到近968亿美元,增长了18.8%。Statista的数据证实,该公司自成立以来的总收入超过3380亿美元,归属于普通股股东的净收益达到280亿美元。

In a recent regulatory filing, Tesla stated it would request a shareholder vote on the same pay package again. The company claims it has a present intrinsic value of $44.9 billion based on the April 12, 2024, closing price of Tesla stock. This translates to 13.26% of Tesla's total revenue and nearly 160% of its total net income since inception.

在最近的一份监管文件中,特斯拉表示将再次要求股东对相同的薪酬待遇进行投票。该公司声称,根据特斯拉股票2024年4月12日的收盘价,其目前的内在价值为449亿美元。这意味着特斯拉自成立以来总收入的13.26%,占其总净收入的近160%。

Why It Matters: In 2018, Tesla shareholders approved a compensation package allowing Musk to purchase up to 304 million shares at a pre-set price of $23.34 upon achieving specific financial milestones. At the time, the company was valued at $59 billion, and the pay package, then at $55.8 billion, was unprecedented in corporate history.

为何重要:2018年,特斯拉股东批准了一项薪酬计划,允许马斯克在实现特定的财务里程碑后以23.34美元的预设价格购买多达3.04亿股股票。当时,该公司的估值为590亿美元,当时的薪酬待遇为558亿美元,在公司历史上是前所未有的。

The package's value has decreased due to the recent stock price slump. Following the Delaware court's decision, Tesla resubmitted the plan to shareholders in its mid-April proxy filing. This move coincided with the company's decision to switch its state of incorporation from Delaware to Texas.

由于最近的股价暴跌,该一揽子计划的价值有所下降。特拉华州法院作出裁决后,特斯拉在4月中旬的代理文件中向股东重新提交了该计划。此举恰逢该公司决定将其注册州从特拉华州转移到德克萨斯州。

Possible Shareholder Vote Hurdles: Analysts like Daniel Ives predict a contentious annual shareholder meeting in June, considering the stock's decline this year. While the stock rebounded somewhat after first-quarter results and Musk's China visit, recent macro concerns have triggered another sell-off.

可能的股东投票障碍:考虑到该股今年的下跌,像丹尼尔·艾夫斯这样的分析师预测,6月份将举行有争议的年度股东大会。尽管该股在第一季度业绩和马斯克访问中国后有所反弹,但最近的宏观担忧引发了又一次抛售。

However, analysts still expect shareholders to scrutinize the proposal. Ann Lipton, Associate Professor of Business Law and Entrepreneurship at Tulane University Law School, suggests the proposal might require unanimous approval, rather than a simple majority, in an interview with CNBC.

但是,分析师仍预计股东们将仔细审查该提案。杜兰大学法学院商法与创业学副教授安·利普顿在接受CNBC采访时表示,该提案可能需要一致批准,而不是简单多数。

She reasons that "since it's framed as a payment for work already performed, the company doesn't derive any benefit from it."

她认为,“由于这是对已经完成的工作的报酬,因此公司没有从中获得任何好处。”

Check out more of Benzinga's Future Of Mobility coverage by following this link.

通过以下方式查看更多本辛加的《出行未来》报道 点击这个链接。

Image created using photos on Shutterstock

使用 Shutterstock 上的照片创建的图片