Options Corner: NIO Sees Whales Taking Bullish Stance

Options Corner: NIO Sees Whales Taking Bullish Stance

Investors with a lot of money to spend have taken a bullish stance on $NIO Inc (NIO.US)$.

有很多钱可以花的投资者持看涨立场 $蔚来 (NIO.US)$。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

今天,当交易出现在我们在本辛加追踪的公开期权历史记录上时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NIO, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当蔚来发生这么大的事情时,通常意味着有人知道某件事即将发生。

So how do we know what these investors just did?

那么我们怎么知道这些投资者刚才做了什么?

Today, Benzinga's options scanner spotted 15 uncommon options trades for NIO.

今天,Benzinga的期权扫描仪发现了NIO的15种不常见的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 53% bullish and 40%, bearish.

这些大资金交易者的整体情绪介于53%的看涨和40%的看跌之间。

Out of all of the special options we uncovered, 7 are puts, for a total amount of $788,156, and 8 are calls, for a total amount of $397,807.

在我们发现的所有特殊期权中,有7个是看跌期权,总额为788,156美元,8个是看涨期权,总额为397,807美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $2.5 and $8.0 for NIO, spanning the last three months.

在评估了交易量和未平仓合约之后,很明显,主要市场推动者将注意力集中在蔚来过去三个月的2.5美元至8.0美元的价格区间上。

Volume & Open Interest Development

交易量和未平仓合约的发展

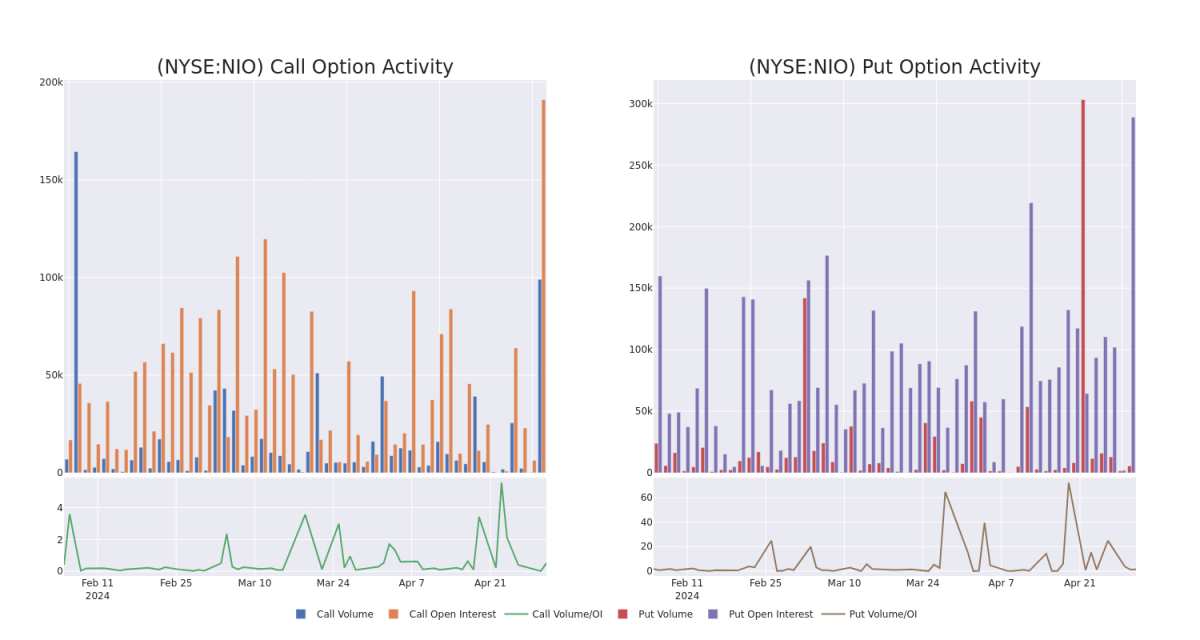

In terms of liquidity and interest, the mean open interest for NIO options trades today is 13693.08 with a total volume of 36,063.00.

就流动性和利息而言,今天蔚来期权交易的平均未平仓合约为13693.08,总交易量为36,063.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for NIO's big money trades within a strike price range of $2.5 to $8.0 over the last 30 days.

在下图中,我们可以跟踪过去30天NIO在2.5美元至8.0美元行使价区间内的看涨和看跌期权交易的交易量和未平仓合约的变化。

NIO Option Activity Analysis: Last 30 Days

NIO 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到的重要期权交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

NIO |

PUT |

SWEEP |

BEARISH |

01/16/26 |

$3.6 |

$3.5 |

$3.6 |

$8.00 |

$360.1K |

13.3K |

2.7K |

NIO |

PUT |

SWEEP |

NEUTRAL |

05/10/24 |

$0.45 |

$0.43 |

$0.44 |

$5.50 |

$120.6K |

2.3K |

4.5K |

NIO |

PUT |

SWEEP |

BEARISH |

01/16/26 |

$3.6 |

$3.5 |

$3.6 |

$8.00 |

$108.0K |

13.3K |

3.0K |

NIO |

CALL |

SWEEP |

BEARISH |

11/15/24 |

$0.64 |

$0.61 |

$0.61 |

$8.00 |

$106.7K |

11.2K |

878 |

NIO |

PUT |

SWEEP |

BEARISH |

05/10/24 |

$0.33 |

$0.31 |

$0.33 |

$5.50 |

$99.0K |

2.3K |

7.8K |

符号 |

看跌/看涨 |

交易类型 |

情绪 |

Exp。日期 |

问 |

出价 |

价格 |

行使价 |

总交易价格 |

未平仓合约 |

音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

不是 |

放 |

扫 |

粗鲁的 |

01/16/26 |

3.6 美元 |

3.5 美元 |

3.6 美元 |

8.00 美元 |

360.1 万美元 |

13.3K |

2.7K |

不是 |

放 |

扫 |

中立 |

05/10/24 |

0.45 美元 |

0.43 美元 |

0.44 美元 |

5.50 美元 |

120.6 万美元 |

2.3K |

4.5K |

不是 |

放 |

扫 |

粗鲁的 |

01/16/26 |

3.6 美元 |

3.5 美元 |

3.6 美元 |

8.00 美元 |

108.0 万美元 |

13.3K |

3.0K |

不是 |

打电话 |

扫 |

粗鲁的 |

11/15/24 |

0.64 美元 |

0.61 美元 |

0.61 美元 |

8.00 美元 |

106.7 万美元 |

11.2K |

878 |

不是 |

放 |

扫 |

粗鲁的 |

05/10/24 |

0.33 美元 |

0.31 美元 |

0.33 美元 |

5.50 美元 |

99.0K |

2.3K |

7.8K |

About NIO

关于蔚来

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

Nio是领先的电动汽车制造商,目标是高端市场。Nio 成立于 2014 年 11 月,设计、开发、联合制造和销售优质智能电动汽车。该公司通过持续的技术突破和创新(例如电池交换和自动驾驶技术)脱颖而出。蔚来于2017年12月推出了其首款车型,即ES8七座电动SUV,并于2018年6月开始交付。其目前的车型组合包括中型到大型轿车和越野车。它在2023年售出了超过16万辆电动汽车,约占中国乘用新能源汽车市场的2%。

Where Is NIO Standing Right Now?

蔚来现在的立场如何?

With a trading volume of 90,268,695, the price of NIO is up by 6.45%, reaching $5.61.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 36 days from now.

蔚来汽车的交易量为90,268,695美元,上涨了6.45%,达到5.61美元。

当前的RSI值表明该股可能已接近超买。

下一份收益报告定于即日起36天后发布。

What The Experts Say On NIO

专家对蔚来汽车的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $5.0.

在过去的一个月中,1位行业分析师分享了他们对该股的见解,提出平均目标价为5.0美元。

Reflecting concerns, an analyst from Macquarie lowers its rating to Neutral with a new price target of $5.

麦格理的一位分析师将其评级下调至中性,新的目标股价为5美元,这反映了人们的担忧。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for NIO with Benzinga Pro for real-time alerts.

交易期权涉及更大的风险,但也提供了更高利润的潜力。精明的交易者通过持续的教育、战略贸易调整、利用各种指标以及随时关注市场动态来降低这些风险。使用 Benzinga Pro 获取实时警报,随时了解蔚来的最新期权交易。