Futian Holdings Limited's (HKG:8196) CEO Compensation Looks Acceptable To Us And Here's Why

Futian Holdings Limited's (HKG:8196) CEO Compensation Looks Acceptable To Us And Here's Why

Key Insights

关键见解

- Futian Holdings will host its Annual General Meeting on 10th of May

- Total pay for CEO Yang Xie includes CN¥462.0k salary

- The total compensation is similar to the average for the industry

- Over the past three years, Futian Holdings' EPS grew by 110% and over the past three years, the total shareholder return was 16%

- 福田控股将于5月10日举办年度股东大会

- 首席执行官谢阳的总薪酬包括46.2万元人民币的工资

- 总薪酬与该行业的平均水平相似

- 在过去三年中,福田控股的每股收益增长了110%,在过去三年中,股东总回报率为16%

Performance at Futian Holdings Limited (HKG:8196) has been reasonably good and CEO Yang Xie has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 10th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

福田控股有限公司(HKG: 8196)的表现相当不错,首席执行官谢阳在引导公司朝着正确的方向前进方面做得不错。随着股东进入即将于5月10日举行的股东周年大会,首席执行官薪酬可能不是他们的重点,而是管理层为延续增长势头将采取的措施。我们举例说明了为什么我们认为首席执行官的薪酬看起来很公平。

How Does Total Compensation For Yang Xie Compare With Other Companies In The Industry?

杨谢的总薪酬与业内其他公司相比如何?

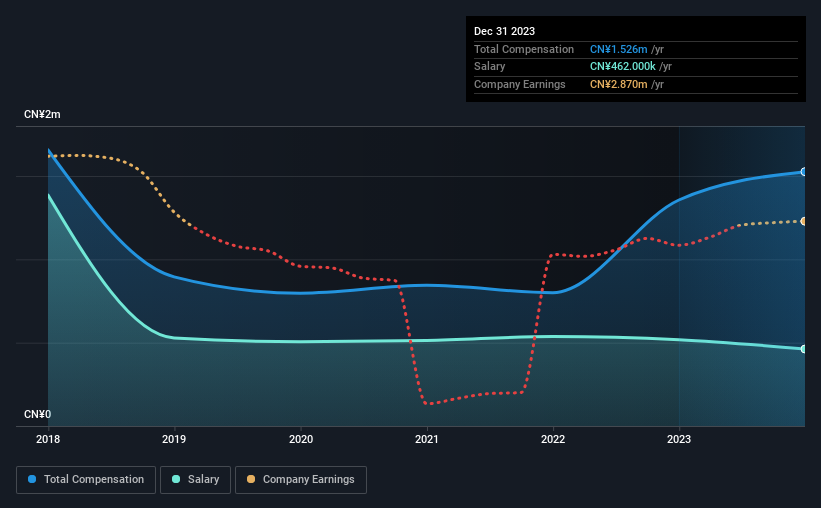

Our data indicates that Futian Holdings Limited has a market capitalization of HK$111m, and total annual CEO compensation was reported as CN¥1.5m for the year to December 2023. Notably, that's an increase of 13% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥462k.

我们的数据显示,福田控股有限公司的市值为1.11亿港元,截至2023年12月的一年中,首席执行官的年薪酬总额为150万元人民币。值得注意的是,这比上年增长了13%。虽然我们总是首先考虑薪酬总额,但我们的分析显示薪资部分较低,为46.2万元人民币。

For comparison, other companies in the Hong Kong Trade Distributors industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥1.9m. This suggests that Futian Holdings remunerates its CEO largely in line with the industry average. Furthermore, Yang Xie directly owns HK$34m worth of shares in the company, implying that they are deeply invested in the company's success.

相比之下,香港贸易分销商行业中市值低于16亿港元的其他公司报告称,首席执行官的总薪酬中位数为190万元人民币。这表明福田控股首席执行官的薪酬基本与行业平均水平一致。此外,谢阳直接拥有该公司价值3400万港元的股份,这意味着他们对公司的成功进行了大量投资。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥462k | CN¥518k | 30% |

| Other | CN¥1.1m | CN¥838k | 70% |

| Total Compensation | CN¥1.5m | CN¥1.4m | 100% |

| 组件 | 2023 | 2022 | 比例 (2023) |

| 工资 | 462k 人民币 | 518k 人民币 | 30% |

| 其他 | 110 万元人民币 | 838k 人民币 | 70% |

| 总薪酬 | 150 万元人民币 | 140 万元人民币 | 100% |

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. In Futian Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

在行业层面上,总薪酬的大约85%代表工资,15%是其他薪酬。就福田控股而言,与整个行业相比,非工资薪酬在总薪酬中所占的比例更大。值得注意的是,对非工资薪酬的倾向表明,总薪酬与公司的业绩挂钩。

Futian Holdings Limited's Growth

福田控股有限公司的成长

Futian Holdings Limited's earnings per share (EPS) grew 110% per year over the last three years. In the last year, its revenue is down 58%.

在过去三年中,福田控股有限公司的每股收益(EPS)每年增长110%。去年,其收入下降了58%。

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

总体而言,这对股东来说是一个积极的结果,表明公司近年来有所改善。虽然收入增长是件好事,但最终利润更重要。虽然我们没有分析师对公司的预测,但股东们可能需要查看这张详细的收益、收入和现金流历史图表。

Has Futian Holdings Limited Been A Good Investment?

福田控股有限公司是一项不错的投资吗?

Futian Holdings Limited has served shareholders reasonably well, with a total return of 16% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

福田控股有限公司为股东提供了相当不错的服务,三年来的总回报率为16%。但他们可能不希望看到首席执行官的薪酬远远超过中位数。

In Summary...

总而言之...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

鉴于公司的表现不错,只有少数股东(如果有的话)可能会在即将到来的股东周年大会上对首席执行官的薪酬有疑问。尽管结果令人满意,但我们仍然认为,任何增加首席执行官薪酬的提议都将根据具体情况进行审查,并与业绩结果挂钩。

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Futian Holdings that investors should look into moving forward.

首席执行官薪酬是你关注的关键方面,但投资者也需要睁大眼睛关注与业务绩效相关的其他问题。我们进行了研究,发现了福田控股的两个警告信号,投资者应该考虑向前迈进。

Important note: Futian Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:福田控股是一只令人兴奋的股票,但我们知道投资者可能正在寻找未支配的资产负债表和丰厚的回报。你可能会在这份投资回报率高、负债低的有趣公司清单中找到更好的东西。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. In Futian Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. In Futian Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.