We Discuss Whether Newpark Resources, Inc.'s (NYSE:NR) CEO Is Due For A Pay Rise

We Discuss Whether Newpark Resources, Inc.'s (NYSE:NR) CEO Is Due For A Pay Rise

Key Insights

关键见解

- Newpark Resources to hold its Annual General Meeting on 16th of May

- Salary of US$725.0k is part of CEO Matthew Lanigan's total remuneration

- Total compensation is 42% below industry average

- Newpark Resources' total shareholder return over the past three years was 138% while its EPS grew by 94% over the past three years

- Newpark Resources将于5月16日举行年度股东大会

- 725.0万美元的薪水是首席执行官马修·拉尼根总薪酬的一部分

- 总薪酬比行业平均水平低42%

- 在过去三年中,Newpark Resources的股东总回报率为138%,而其每股收益在过去三年中增长了94%

The solid performance at Newpark Resources, Inc. (NYSE:NR) has been impressive and shareholders will probably be pleased to know that CEO Matthew Lanigan has delivered. At the upcoming AGM on 16th of May, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

纽帕克资源公司(纽约证券交易所代码:NR)的稳健表现令人印象深刻,得知首席执行官马修·拉尼根的表现,股东们可能会很高兴。在即将于5月16日举行的股东周年大会上,他们将有兴趣了解公司未来的战略,并有机会就高管薪酬和其他公司事务等决议进行投票。让我们来看看为什么我们认为首席执行官做得很好,我们将介绍提高薪酬的理由。

How Does Total Compensation For Matthew Lanigan Compare With Other Companies In The Industry?

与业内其他公司相比,马修·拉尼根的总薪酬如何?

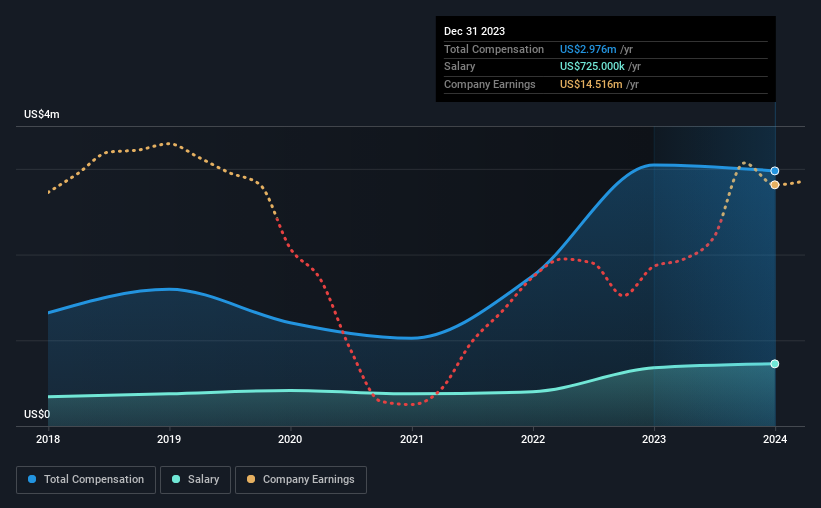

According to our data, Newpark Resources, Inc. has a market capitalization of US$626m, and paid its CEO total annual compensation worth US$3.0m over the year to December 2023. That is, the compensation was roughly the same as last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$725k.

根据我们的数据,纽帕克资源公司的市值为6.26亿美元,在截至2023年12月的一年中,向其首席执行官支付的年薪总额为300万美元。也就是说,薪酬与去年大致相同。尽管该分析侧重于总薪酬,但值得承认的是,工资部分较低,为72.5万美元。

On examining similar-sized companies in the American Energy Services industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$5.1m. This suggests that Matthew Lanigan is paid below the industry median. Furthermore, Matthew Lanigan directly owns US$3.4m worth of shares in the company, implying that they are deeply invested in the company's success.

在研究美国能源服务行业中市值在4亿美元至16亿美元之间的类似规模公司时,我们发现该集团首席执行官的总薪酬中位数为510万美元。这表明马修·拉尼根的薪水低于行业中位数。此外,马修·拉尼根直接拥有该公司价值340万美元的股份,这意味着他们对公司的成功进行了大量投资。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$725k | US$679k | 24% |

| Other | US$2.3m | US$2.4m | 76% |

| Total Compensation | US$3.0m | US$3.0m | 100% |

| 组件 | 2023 | 2022 | 比例 (2023) |

| 工资 | 72.5 万美元 | 679 万美元 | 24% |

| 其他 | 2.3 万美元 | 2.4 万美元 | 76% |

| 总薪酬 | 300 万美元 | 300 万美元 | 100% |

Speaking on an industry level, nearly 15% of total compensation represents salary, while the remainder of 85% is other remuneration. According to our research, Newpark Resources has allocated a higher percentage of pay to salary in comparison to the wider industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

从行业层面来看,总薪酬的近15%代表工资,其余的85%是其他薪酬。根据我们的研究,与整个行业相比,Newpark Resources在工资中所占的比例更高。如果非工资薪酬在总薪酬中占主导地位,则表明高管的薪水与公司业绩息息相关。

A Look at Newpark Resources, Inc.'s Growth Numbers

来看看 Newpark Resources, Inc.”s 增长数字

Newpark Resources, Inc.'s earnings per share (EPS) grew 94% per year over the last three years. It saw its revenue drop 14% over the last year.

Newpark Resources, Inc.在过去三年中,每股收益(EPS)每年增长94%。它的收入比去年下降了14%。

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

这表明该公司最近一直在改善,对股东来说是个好消息。收入增长不足并不理想,但这是业务中最重要的底线。暂时偏离目前的形式,查看这份对分析师未来预期的免费可视化描述可能很重要。

Has Newpark Resources, Inc. Been A Good Investment?

Newpark Resources, Inc. 是一项不错的投资吗?

We think that the total shareholder return of 138%, over three years, would leave most Newpark Resources, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

我们认为,三年内138%的股东总回报率将使大多数Newpark Resources, Inc.的股东微笑。因此,他们可能根本不担心首席执行官的薪水是否会超过相同规模的公司的正常水平。

In Summary...

总而言之...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

鉴于公司最近表现良好,一些股东可能会认为首席执行官薪酬可能不是即将举行的股东大会的最大焦点。鉴于收益增长和股价表现似乎走上了正确的道路,股东在股东周年大会上更紧迫的关注点可能是董事会和管理层计划如何将公司转变为可持续盈利的公司。

Shareholders may want to check for free if Newpark Resources insiders are buying or selling shares.

股东们可能想免费查看Newpark Resources的内部人士是否在买入或卖出股票。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以说,业务质量比首席执行官的薪酬水平重要得多。因此,请查看这份免费清单,列出了股本回报率高、负债率低的有趣公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。