Investors Shouldn't Be Too Comfortable With Bruker's (NASDAQ:BRKR) Earnings

Investors Shouldn't Be Too Comfortable With Bruker's (NASDAQ:BRKR) Earnings

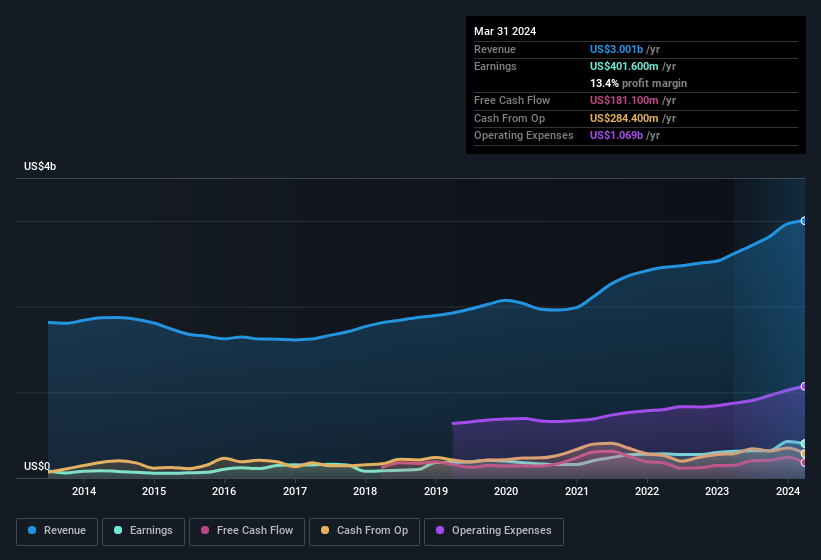

Last week's profit announcement from Bruker Corporation (NASDAQ:BRKR) was underwhelming for investors, despite headline numbers being robust. We did some digging and found some worrying underlying problems.

尽管总体数据强劲,但布鲁克公司(纳斯达克股票代码:BRKR)上周的盈利公告令投资者难以置信。我们进行了一些挖掘,发现了一些令人担忧的潜在问题。

How Do Unusual Items Influence Profit?

不寻常的物品如何影响利润?

For anyone who wants to understand Bruker's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from US$82m worth of unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. If Bruker doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

对于任何想了解布鲁克在法定数字之外的利润的人来说,值得注意的是,在过去的十二个月中,从价值8200万美元的不寻常物品中获得了法定利润。虽然我们希望看到利润增加,但当不寻常的物品做出重大贡献时,我们往往会更加谨慎一些。当我们计算数千家上市公司的数字时,我们发现,特定年份中不寻常的项目所带来的提振通常不会在第二年重演。这正如你所预料的那样,因为这些增强被描述为 “不寻常”。如果布鲁克认为这种捐款不会重演,那么在其他条件相同的情况下,我们预计其本年度的利润将下降。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

这可能会让你想知道分析师对未来盈利能力的预测。幸运的是,您可以单击此处查看根据他们的估计描绘未来盈利能力的交互式图表。

Our Take On Bruker's Profit Performance

我们对布鲁克利润表现的看法

Arguably, Bruker's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Bruker's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Bruker, you'd also look into what risks it is currently facing. Case in point: We've spotted 2 warning signs for Bruker you should be aware of.

可以说,布鲁克的法定收益被提高利润的不寻常项目所扭曲。因此,我们认为布鲁克的法定利润可能好于其基础盈利能力。但好消息是,其在过去三年中的每股收益增长非常令人印象深刻。当然,我们只是在分析其收益时才浮出水面;人们还可以考虑利润率、预测增长和投资回报率等因素。如果你想更深入地了解布鲁克,你还需要研究它目前面临的风险。一个很好的例子:我们发现了布鲁克的两个警告信号,你应该注意了。

This note has only looked at a single factor that sheds light on the nature of Bruker's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

本报告仅研究了揭示布鲁克利润性质的单一因素。但是,还有很多其他方法可以让你对公司的看法。例如,许多人认为高股本回报率是有利的商业经济的标志,而另一些人则喜欢 “关注资金”,寻找内部人士正在买入的股票。因此,你可能希望看到这份拥有高股本回报率的公司的免费集合,或者这份内部所有权高的股票清单。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

Arguably, Bruker's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Bruker's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Bruker, you'd also look into what risks it is currently facing. Case in point: We've spotted 2 warning signs for Bruker you should be aware of.

Arguably, Bruker's statutory earnings have been distorted by unusual items boosting profit. Because of this, we think that it may be that Bruker's statutory profits are better than its underlying earnings power. But the good news is that its EPS growth over the last three years has been very impressive. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Bruker, you'd also look into what risks it is currently facing. Case in point: We've spotted 2 warning signs for Bruker you should be aware of.