Smart Money Is Betting Big In HOOD Options

Smart Money Is Betting Big In HOOD Options

High-rolling investors have positioned themselves bullish on Robinhood Markets (NASDAQ:HOOD), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in HOOD often signals that someone has privileged information.

高额投资者已将自己定位为看好罗宾汉市场(纳斯达克股票代码:HOOD),散户交易者注意这一点很重要。\ 这项活动今天通过Benzinga对公开期权数据的追踪引起了我们的注意。这些投资者的身份尚不确定,但是HOOD的如此重大的举动通常表明有人拥有特权信息。

Today, Benzinga's options scanner spotted 33 options trades for Robinhood Markets. This is not a typical pattern.

今天,Benzinga的期权扫描仪发现了Robinhood Markets的33笔期权交易。这不是典型的模式。

The sentiment among these major traders is split, with 42% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $42,500, and 32 calls, totaling $1,240,384.

这些主要交易者的情绪分歧,42%看涨,36%看跌。在我们确定的所有期权中,有一个看跌期权,金额为42,500美元,还有32个看涨期权,总额为1,240,384美元。

Expected Price Movements

预期的价格走势

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $11.5 to $35.0 for Robinhood Markets over the recent three months.

根据交易活动,看来主要投资者的目标是在最近三个月中将Robinhood Markets的价格区间从11.5美元扩大到35.0美元。

Volume & Open Interest Development

交易量和未平仓合约的发展

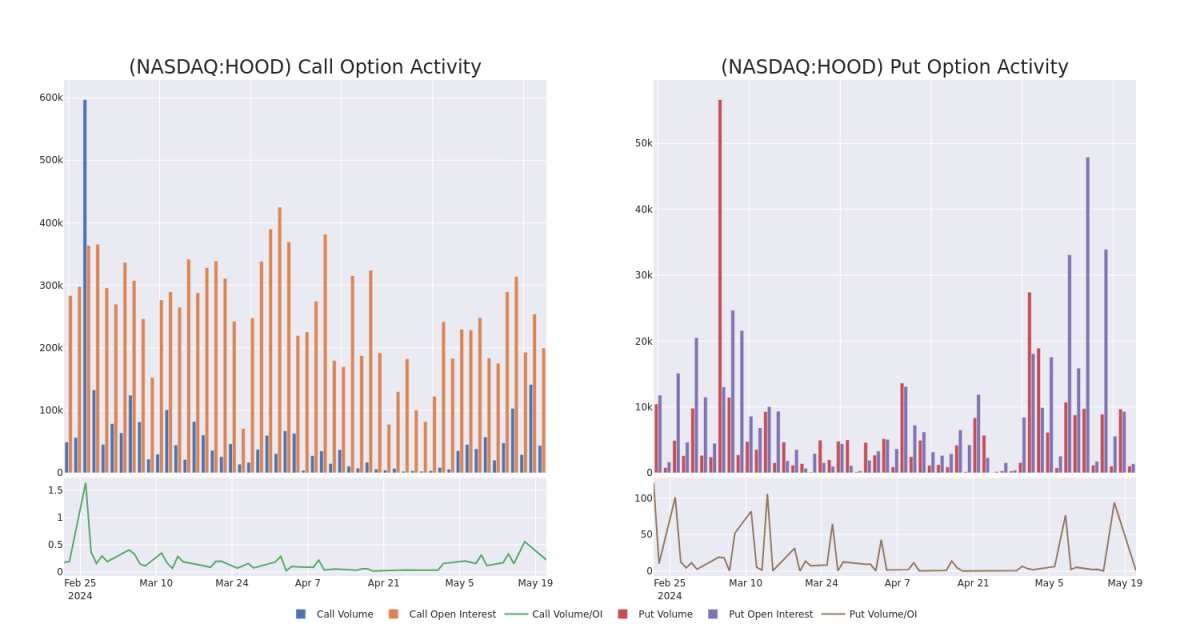

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Robinhood Markets's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Robinhood Markets's substantial trades, within a strike price spectrum from $11.5 to $35.0 over the preceding 30 days.

评估交易量和未平仓合约是期权交易的战略步骤。这些指标揭示了Robinhood Markets在指定行使价下期权的流动性和投资者对他们的兴趣。即将发布的数据可视化了与Robinhood Markets的大量交易相关的看涨期权和未平仓合约的波动,在过去30天内,行使价范围从11.5美元到35.0美元不等。

Robinhood Markets Option Activity Analysis: Last 30 Days

Robinhood Markets 期权活动分析:过去 30 天

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | NEUTRAL | 01/17/25 | $5.15 | $5.05 | $5.1 | $20.00 | $61.2K | 75.6K | 8 |

| HOOD | CALL | TRADE | BULLISH | 07/19/24 | $1.17 | $1.16 | $1.17 | $25.00 | $58.5K | 2.8K | 1.2K |

| HOOD | CALL | TRADE | BEARISH | 05/31/24 | $2.93 | $2.88 | $2.88 | $18.00 | $57.6K | 2.8K | 1.2K |

| HOOD | CALL | TRADE | BULLISH | 06/21/24 | $2.79 | $2.55 | $2.76 | $19.00 | $55.2K | 7.5K | 391 |

| HOOD | CALL | TRADE | BULLISH | 05/24/24 | $1.36 | $1.32 | $1.36 | $20.00 | $54.4K | 13.9K | 1.9K |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 引擎罩 | 打电话 | 贸易 | 中立 | 01/17/25 | 5.15 美元 | 5.05 美元 | 5.1 美元 | 20.00 美元 | 61.2 万美元 | 75.6K | 8 |

| 引擎罩 | 打电话 | 贸易 | 看涨 | 07/19/24 | 1.17 | 1.16 美元 | 1.17 | 25.00 美元 | 58.5 万美元 | 2.8K | 1.2K |

| 引擎罩 | 打电话 | 贸易 | 粗鲁的 | 05/31/24 | 2.93 美元 | 2.88 美元 | 2.88 美元 | 18.00 美元 | 57.6 万美元 | 2.8K | 1.2K |

| 引擎罩 | 打电话 | 贸易 | 看涨 | 06/21/24 | 2.79 美元 | 2.55 美元 | 2.76 美元 | 19.00 美元 | 55.2 万美元 | 7.5K | 391 |

| 引擎罩 | 打电话 | 贸易 | 看涨 | 05/24/24 | 1.36 | 1.32 | 1.36 | 20.00 美元 | 54.4 万美元 | 13.9K | 1.9K |

About Robinhood Markets

关于罗宾汉市场

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

Robinhood Markets Inc正在创建一个现代金融服务平台。它设计自己的产品和服务,并通过专有技术支持的基于应用程序的单一云平台交付。其垂直整合平台使新产品和服务的引入成为可能,例如加密货币交易、股息再投资、部分股票、经常性投资和IPO Access。它通过在执行传送的订单时将用户对期权、股票和加密货币的订单传送给做市商来获得基于交易的收入。

In light of the recent options history for Robinhood Markets, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于Robinhood Markets最近的期权历史,现在应该将重点放在公司本身上。我们的目标是探索其目前的表现。

Present Market Standing of Robinhood Markets

罗宾汉市场目前的市场地位

- With a volume of 8,884,900, the price of HOOD is down -0.62% at $20.71.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 71 days.

- HOOD的交易量为8,884,900美元,价格下跌了0.62%,至20.71美元。

- RSI指标暗示标的股票可能接近超买。

- 下一份财报预计将在71天后公布。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $11.5 to $35.0 for Robinhood Markets over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $11.5 to $35.0 for Robinhood Markets over the recent three months.