AEM, UMS, NetLink and Baker Tech Directors Acquire Stock

AEM, UMS, NetLink and Baker Tech Directors Acquire Stock

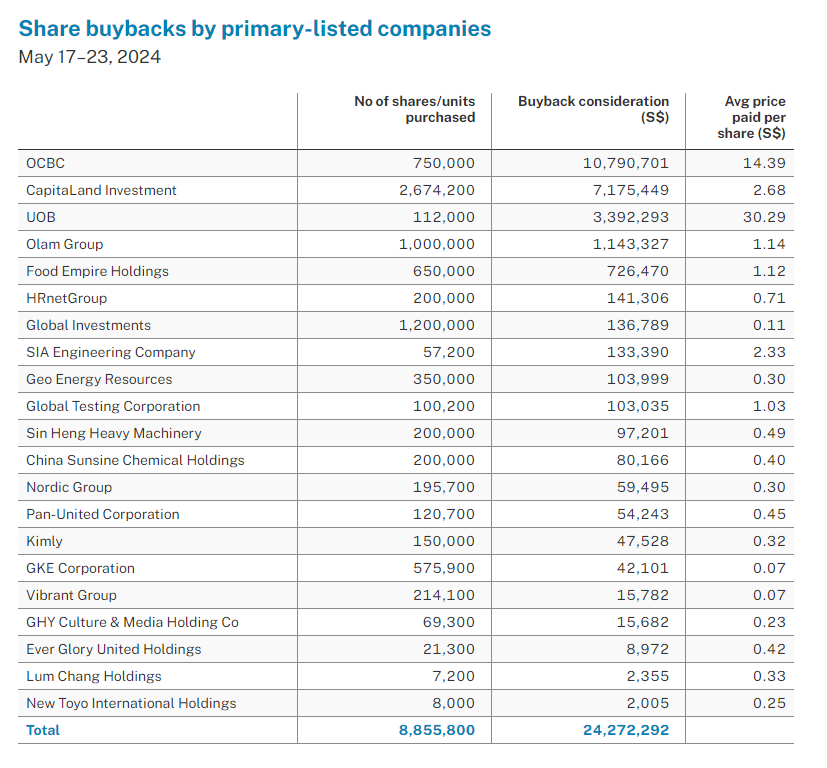

Institutions were net buyers of Singapore stocks over the four trading sessions till May 23, with S$58.5 million of net institutional inflow, as 21 primary-listed companies conducted buybacks with a total consideration of S$24.3 million.

在截至5月23日的四个交易日中,机构是新加坡股票的净买家,机构净流入量为5,850万新元,21家主要上市公司进行了回购,总对价为2430万新元。

On May 20, OUE announced a proposed off-market purchase of up to 84,038,036 shares representing 10 per cent of the total number of shares in issue. This is in accordance with an equal access scheme following the share purchase mandate approved at the Apr 26 annual general meeting.

5月20日,OUE宣布拟在场外收购多达84,038,036股股票,占已发行股票总数的10%。这符合4月26日年度股东大会批准的股票购买授权之后的平等准入计划。

Priced at S$1.25 per share, this represents a premium of 20 per cent over the average of the last dealt prices of OUE shares for the five consecutive market days immediately preceding the date of the offer, excluding transaction costs.

定价为每股1.25新元,比OUE股票在要约之日前连续五个交易日(不包括交易成本)的平均交易价格高出20%。

OUE chief executive officer Brian Riady noted that in addition to rewarding shareholders, this offer allows OUE to enhance shareholder value in the long term as it is accretive to the company's earnings per share and net asset value per share.

OUE首席执行官布莱恩·里亚迪指出,除了奖励股东外,该提议还使OUE能够长期提高股东价值,因为它可以增加公司的每股收益和每股净资产价值。

Leading the net institutional inflow over the four sessions were UOB, DBS, OCBC, Singapore Exchange, Yangzijiang Shipbuilding Holdings, Thai Beverage, Capitaland Integrated Comm Trust, City Developments, Great Eastern Holdings and Keppel DC Reit.

在这四个交易日中,引领净流入的机构是大华银行、星展银行、华侨银行、新加坡交易所、扬子江造船控股公司、泰国饮料、凯德综合信托、城市发展、大东方控股和吉宝华盛顿房地产投资信托基金。

This brings the net institutional inflow in the 2024 year to May 23 for the three banks to S$500 million.

这使三家银行在截至5月23日的2024年度的机构净流入量达到5亿新元。

Singtel, Seatrium, Singapore Airlines, Jardine Matheson Holdings, Jardine Cycle & Carriage, Wilmar International, Golden Agri-Resources, Keppel, Sats and Sembcorp Industries led the net institutional outflow over the four sessions.

新加坡电信、Seatrium、新加坡航空、怡和控股、怡和运输、丰益国际、金农资源、吉宝、Sats和胜科工业在这四个交易日中引领机构净流出。

The four trading sessions had close to 60 changes to director interests, with substantial shareholdings filed for close to 30 primary-listed stocks. Directors or CEOs filed 18 acquisitions and four disposals, while substantial shareholders filed 10 acquisitions and two disposals.

这四个交易日对董事权益进行了近60次变动,近30只主要上市股票申请了大量股权。董事或首席执行官提交了18项收购和4项出售,而大股东提交了10项收购和两项出售。

Wilmar International

丰益国际

Between May 17 and 20, Wilmar International chairman and CEO Kuok Khoon Hong increased his deemed interest in the global agri-business by 4,058,300 shares at an average price of S$3.13 per share. This increased his total interest from 13.91 per cent to 13.98 per cent.

5月17日至20日期间,丰益国际董事长兼首席执行官郭昆洪将其对全球农业综合企业的认定权益增加了4,058,300股,平均价格为每股3.13新元。这使他的总利息从13.91%增加到13.98%。

Kuok has been gradually increasing his total interest in Wilmar from 12.94 per cent in October 2022.

郭一直在逐步增加对丰益的总兴趣,从2022年10月的12.94%逐渐增加。

On May 20, Wilmar executive and non-independent director Teo La-Mei also acquired 10,000 shares at S$3.12 per share. This increased her direct interest to 1.74 million shares, which represents 0.03 per cent of the company. Teo is the group legal counsel and company secretary.

5月20日,丰益执行兼非独立董事张拉梅也以每股3.12新元的价格收购了1万股股票。这使她的直接权益增加到174万股,占该公司的0.03%。Teo是集团法律顾问兼公司秘书。

Raffles Medical Group

莱佛士医疗集团

Between May 16 and 20, Raffles Medical Group executive chairman Loo Choon Yong bought 2.1 million shares at an average price of S$1.02 per share. This increased his total interest from 54.09 per cent to 54.20 per cent.

5月16日至20日期间,莱佛士医疗集团执行董事长卢春勇以每股1.02新元的平均价格购买了210万股股票。这使他的总利息从54.09%增加到54.20%。

Since late February, Dr Loo has been gradually increasing his total interest in the stock from 53.02 per cent.

自2月下旬以来,卢博士一直在逐步增加对该股的总权益,从53.02%逐步增加。

AEM Holdings

AEM 控股公司

On May 20, AEM Holdings independent director Andre Andonian bought 207,000 shares at S$1.87 per share. With a consideration of S$504,911, this acquisition took his direct interest in the provider of global semiconductor and electronics test solutions to 0.09 per cent.

5月20日,AEM Holdings独立董事安德烈·安多尼安以每股1.87新元的价格购买了20.7万股股票。以504,911新元的对价,此次收购使他对全球半导体和电子测试解决方案提供商的直接权益达到0.09%。

This is Andonian's first acquisition of AEM Holdings shares since he joined the board in July 2022. He has over 30 years of experience in consulting companies across the semiconductor, industrial and electronics, automotive and assembly, and aerospace and defence industries on strategic, operational and organisational topics.

这是安多尼亚自2022年7月加入董事会以来首次收购AEM Holdings的股票。他在半导体、工业和电子、汽车和装配以及航空航天和国防行业的战略、运营和组织主题咨询公司拥有超过30年的经验。

He also has extensive experience in transforming companies into global leaders and in the assessment and development of talent.

他在将公司转变为全球领导者以及评估和培养人才方面也拥有丰富的经验。

He has held multiple executive leadership roles across Europe, the US and Asia during his 34 years at McKinsey & Company.

在麦肯锡公司任职的34年中,他在欧洲、美国和亚洲担任过多个行政领导职务。

These include managing partner of McKinsey Japan, Global and Americas leader of McKinsey's advanced industries sector, and most recently, the managing partner of McKinsey Korea. He currently supports McKinsey & Company as special adviser/senior partner emeritus in North Asia.

其中包括日本麦肯锡的管理合伙人、麦肯锡先进工业领域的全球和美洲负责人,以及最近的麦肯锡韩国管理合伙人。他目前以北亚特别顾问/高级名誉合伙人的身份支持麦肯锡公司。

AEM Holdings maintains its revenue guidance for H1FY24 (ending Jun 30) of S$170 million to S$200 million, and will provide H2FY24 guidance in its H1FY24 earnings press release.

AEM Holdings维持其 H1FY24(截至6月30日)的1.7亿至2亿新元的收入预期,并将在其 H1FY24 财报新闻稿中提供 H2FY24 指导。

UMS Holdings

UMS 控股公司

Between May 16 and 17, UMS Holdings chairman and CEO Andy Luong acquired 1,833,600 shares at an average price of S$1.07 per share. This increased his deemed interest in the precision engineering group from 14.99 per cent to 15.25 per cent.

5月16日至17日期间,UMS控股董事长兼首席执行官安迪·梁以每股1.07新元的平均价格收购了1,833,600股股票。这使他在精密工程集团的认定权益从14.99%增加到15.25%。

The core business of UMS Holdings is the manufacture of precision machining components, assembly and integration of equipment modules for semiconductor equipment manufacturers. This segment accounted of 87 per cent of group revenue in FY23 (ended Dec 31), and 85 per cent of group revenue in Q1FY24. Its overall Q1FY24 revenue declined 33 per cent from Q1FY23, and fell 27 per cent from Q4FY23.

UMS Holdings的核心业务是为半导体设备制造商制造精密加工组件、组装和集成设备模块。该细分市场占23财年(截至12月31日)集团收入的87%,占集团收入的85%(截至12月31日),占集团收入的85%。Q1FY24其 Q1FY24 总收入比 Q1FY23 下降了33%,比 Q4FY23 下降了27%。

During Q1FY24, the group took firm action to drive revenue, new customer acquisitions and working capital improvements to enhance its ability to capture new growth opportunities.

在 Q1FY24 期间,该集团采取了坚定行动来推动收入、新客户收购和营运资本改善,以增强其抓住新增长机会的能力。

The group noted that this is in line with global production resources continuing to shift their focus towards South-east Asia, particularly Malaysia, where UMS Holdings has grown its presence with the successful completion of its 300,000 square foot factory in Penang.

该集团指出,这符合全球生产资源继续将重点转移到东南亚,尤其是马来西亚,UMS Holdings在槟城的30万平方英尺工厂成功建成,从而扩大了其影响力。

LHT Holdings

LHT 控股公司

Between May 20 and 23, LHT Holdings managing director, Yap Mui Kee, acquired 221,700 shares at an average price of S$1.075 per share. With a consideration of S$238,230, this took her direct interest in the home-grown pallet manufacturer from 17.37 to 17.79 per cent.

5月20日至23日期间,LHT Holdings董事总经理叶梅记以每股1.075新元的平均价格收购了221,700股股票。以238,230新元的对价,这使她对这家本土托盘制造商的直接兴趣从17.37%上升到17.79%。

Yap has gradually increased her direct interest in LHT Holdings from 14.12 per cent in August 2021.

Yap已从2021年8月的14.12%逐渐增加了对LHT Holdings的直接权益。

NetLink NBN Trust

NetLink NBN 信托

On May 23, NetLink NBN Management executive director and CEO, Tong Yew Heng, acquired 100,000 units of NetLink NBN Trust at S$0.865 per unit. This increased his direct interest in the business trust from 850,000 units to 950,000 units.

5月23日,NetLink NBN管理执行董事兼首席执行官Tong Yew Heng以每单位0.865新元的价格收购了NetLink NBN信托的10万个单位。这使他在商业信托中的直接兴趣从85万个单位增加到95万个单位。

His preceding acquisition was in February, with 100,000 units acquired at S$0.845 per unit.

他的上一次收购是在2月,以每单位0.845新元的价格收购了10万套。

Baker Technology

贝克科技

On May 20, Baker Technology executive director Benety Chang acquired 114,000 shares at an average price of S$0.58 per share. With a consideration of S$66,046, this increased his total interest in the company from 55.79 per cent to 55.85 per cent.

5月20日,贝克科技执行董事Benety Chang以每股0.58新元的平均价格收购了11.4万股股票。对价为66,046新元,这使他在该公司的总权益从55.79%增加到55.85%。

His preceding acquisition was in January 2024, with 50,200 shares purchased at S$0.52 per share; and in September 2023, with 67,700 shares bought at S$0.55 per share.

他之前的收购是在2024年1月,以每股0.52新元的价格购买了50,200股股票;2023年9月,以每股0.55新元的价格购买了67,700股股票。

Baker Technology, together with its subsidiaries, is a leading manufacturer and provider of specialised marine offshore equipment and services, focused on the oil and gas and renewables sectors.

Baker Technology及其子公司是专业海洋近海设备和服务的领先制造商和提供商,专注于石油和天然气以及可再生能源领域。

The group reported a decrease of 7 per cent in revenue for FY23 (ended Dec 31) primarily due to lower fabrication revenue that was partially offset by higher chartering revenue in H2FY23.

该集团报告称,23财年(截至12月31日)的收入下降了7%,这主要是由于制造收入的减少被H2FY23 租赁收入的增加部分抵消了。

About 69 per cent (41 per cent in FY22) of group revenue was from Asia-Pacific (excluding China and Singapore) as the group's liftboat, Blue Titanium, as well as vessels belonging to CHO, a subsidiary of Baker Tech, were mainly deployed in this region.

集团收入中约有69%(22财年为41%)来自亚太地区(不包括中国和新加坡),因为该集团的救生艇蓝钛以及属于贝克科技子公司CHO的船只主要部署在该地区。

During the year, the group's revenue from Europe was reduced from S$24.2 million in FY2022 to S$3.9 million in FY2023 due to lower fabrication revenue. Cash and cash equivalents increased from S$71.5 million as at Dec 31, 2022 to S$87.5 million as at Dec 31, 2023, mainly due to better operating cash flows during FY23.

在这一年中,由于制造收入减少,该集团在欧洲的收入从 FY2022 的2420万新元减少到 FY2023 的390万新元。现金及现金等价物从截至2022年12月31日的7,150万新元增加到2023年12月31日的8,750万新元,这主要是由于23财年的运营现金流有所改善。

Dr Chang was director and CEO of Baker Tech since May 5, 2000, and stepped down as CEO in December 2018. He remains an executive director of the company and is its major shareholder. He is also the CEO and executive director of CHO.

张博士自 2000 年 5 月 5 日起担任贝克科技的董事兼首席执行官,并于 2018 年 12 月辞去首席执行官一职。他仍然是公司的执行董事,也是该公司的主要股东。他还是CHO的首席执行官兼执行董事。

He has extensive experience in the offshore oil and gas industry, and was the major founding shareholder and CEO of PPL Shipyard until his resignation in July 2012.

他在海上石油和天然气行业拥有丰富的经验,在2012年7月辞职之前一直是PPL Shipyard的主要创始股东兼首席执行官。

The current CEO of Baker Technology is his daughter, Jeanette Chang.

贝克科技现任首席执行官是他的女儿珍妮特·张。

She was the winner of the Best Chief Executive Officer award at the Singapore Corporate Awards in September 2023, while Baker Technology was the winner of Most Transparent Company Award (Energy) at the Sias Investors' Choice Awards in 2023.

在2023年9月的新加坡企业奖中,她获得了最佳首席执行官奖,而贝克科技则在2023年西亚斯投资者选择奖中获得了最透明公司奖(能源)。

JB Foods

JB Foods

On May 17, JB Foods executive director Goh Lee Beng bought 10,000 shares at S$0.495 per share, with a consideration of S$4,950. This followed her acquisition of 108,000 shares at S$0.50 per share between May 10 and 14.

5月17日,JB Foods执行董事吴利明以每股0.495新元的价格购买了1万股股票,对价为4,950新元。在此之前,她在5月10日至14日期间以每股0.50新元的价格收购了10.8万股股票。

Goh maintains a 47.66 per cent total interest in the provider of premium cocoa ingredient products, and has gradually raised her total interest in JB Foods from 47.37 per cent in mid-December.

吴继续持有这家优质可可原料产品供应商47.66%的总权益,并已逐步将对JB Foods的总权益从12月中旬的47.37%上调。